Draft Practical Compliance Guideline

PCG 2024/D3 (Finalised)

Restructures and the thin capitalisation and debt deduction creation rules - ATO compliance approach

-

This document has been finalised by PCG 2025/2, with the exception of Schedule 3 of this Guideline, which remains in draft form and will be finalised at the same time as TR 2024/D3 Income tax: aspects of the third party debt test in Subdivision 820-EAB of the Income Tax Assessment Act 1997.This document incorporates revisions made since original publication. View its history and amending notices, if applicable.There are Compendiums for this document: PCG 2025/2EC1 and PCG 2025/2EC .This document has been finalised.

| Table of Contents | Paragraph |

|---|---|

| What this draft Guideline is about | |

| Structure of this Guideline | |

| Brief summary of changes in the Act | |

| Thin capitalisation changes | |

| Debt deduction creation rules | |

| Type 1 – acquisition case | |

| Type 2 – payment or distribution case | |

| Third party debt test choice | |

| Indirect Type 1 and Type 2 arrangements | |

| Associate pairs | |

| Section 820-37 does not apply to the debt deduction creation rules | |

| Application of the debt deduction creation rules | |

| Specific anti-avoidance rule in section 820-423D | |

| Date of effect | |

| Compliance approach | |

| Risk assessment framework | |

| White zone | |

| Yellow zone | |

| Green zone | |

| Red zone | |

| Reporting your self-assessment | |

| SCHEDULE 1 – Debt deduction creation rules | |

| SCHEDULE 2 – Restructures in response to the debt deduction creation rules | |

| SCHEDULE 3 – Third party debt test compliance approach | |

| SCHEDULE 4 – Restructures in response to the thin capitalisation changes | |

| Your comments |

|

Relying on this draft Guideline

This Practical Compliance Guideline is a draft for consultation purposes only. When the final Guideline issues, it will have the following preamble: This Practical Compliance Guideline sets out a practical administration approach to assist taxpayers in complying with relevant tax laws. Provided you follow this Guideline in good faith, the Commissioner will administer the law in accordance with this approach. |

What this draft Guideline is about

1. This draft Guideline[1] has been prepared following the enactment of the Treasury Laws Amendment (Making Multinationals Pay Their Fair Share—Integrity and Transparency) Act 2024 (Act) on 8 April 2024. The Act introduces thin capitalisation rules in Division 820 of the Income Tax Assessment Act 1997 (ITAA 1997) and the debt deduction creation rules (DDCR) in Subdivision 820-EAA of the ITAA 1997.

2. This Guideline primarily sets out our compliance approach to the restructures[2] carried out in response to the Act.

3. This Guideline provides a risk assessment framework rating on the application of certain anti-avoidance provisions to restructuring in response to the Act.[3]

4. The risk assessment framework sets out matters that we will take into account in deciding whether or not we will have cause to devote our compliance resources to further examine your restructures. It does not mean that any anti-avoidance provision necessarily applies.

5. This Guideline does not replace, alter or affect our interpretation of the law in any way.

6. All legislative references in this Guideline are to the ITAA 1997, unless otherwise indicated.

7. This Guideline is structured as follows:

- •

- the main body – which sets out the general principles of our risk approach and application of compliance resources and includes

- -

- a brief summary of relevant changes to the income tax laws in the Act

- -

- our compliance approach

- -

- our risk assessment framework

- •

- schedules – which expand on the general principles in respect of specific examples.

8. The DDCR schedules to this Guideline are:

- •

- Schedule 1 – which covers examples where the DDCR may need to be considered.

- •

- Schedule 2 – which covers the compliance risks arising from restructures in response to the DDCR. Some restructures in Schedule 2 to this Guideline build on examples in Schedule 1 to this Guideline and Schedules 1 and 2 should be read as complementary in considering whether to restructure your arrangements.

9. The thin capitalisation schedules to this Guideline are:

- •

- Schedule 3 – which covers a targeted compliance approach for taxpayers seeking to comply with certain aspects of the third party debt test (TPDT).

- •

- Schedule 4 – which covers the compliance risks arising from restructures in response to the thin capitalisation rules.

10. Schedules 3 and 4 to this Guideline should be read in conjunction with draft Taxation Ruling 2024/D3 Income tax: aspects of the third party debt test in Subdivision 820-EAB of the Income Tax Assessment Act 1997.

11. You will need to read and apply the schedules in conjunction with the general principles set out in this Guideline.

Brief summary of changes in the Act

12. The Act introduced 3 thin capitalisation tests in Subdivision 820-AA for general class investors. These tests limit the amount of debt deductions of general class investors for an income year. The TPDT also applies to financial entities that are not an authorised deposit-taking institution (ADI)[4] in Subdivisions 820-B and 820-C.

13. The 'fixed ratio test' (FRT) disallows debt deductions where net debt deductions exceed 30% of the entity's 'tax EBITDA'. The FRT is the default test unless a choice to apply one of the other tests is made or is deemed to apply.

14. The 'group ratio test' can be used as an alternative to the FRT. This test limits net debt deductions using a ratio of the net interest expense and EBITDA of the worldwide group (of which the entity is a member) based on the worldwide group's audited financial statements.

15. The TPDT limits an entity's gross debt deductions to its 'third party earnings limit'. The third party earnings limit is broadly the sum of each debt deduction attributable to a debt interest issued by the entity that satisfies the third party debt conditions in subsection 820-427A(3). Debt deductions attributable to any other debt interests (such as related party debt) do not count towards the third party earnings limit.[5]

16. Debt deductions disallowed under the FRT over the previous 15 years may be utilised in a later year in certain circumstances, provided the entity continues to apply the FRT.[6] If an entity chooses to use the group ratio test or TPDT in a future year, the balance of any debt deductions that may be so utilised is reduced to nil.

17. The Act introduced the DDCR in Subdivision 820-EAA. The DDCR operates to disallow debt deductions arising on certain related party arrangements.

18. The DDCR applies to 2 types of arrangements.

19. For Type 1 arrangements, the DDCR may disallow debt deductions where an entity (acquirer) acquires a CGT asset or a legal or equitable obligation from one or more associate pairs (each an associate disposer).

20. Type 1 rules apply to debt deductions of a 'relevant entity', which may be:

- •

- the acquirer

- •

- an associate pair of the acquirer (including an associate disposer)

- •

- an associate pair of an associate disposer.[7]

21. The debt deductions must be:

- •

- wholly or partly in relation to the acquisition or holding of the CGT asset, or legal or equitable obligation[8]

- •

- referable to an amount paid or payable (directly or indirectly) to an associate pair of the relevant entity, acquirer or an associate disposer.[9]

22. Type 1 rules apply to all acquisitions except acquisitions of:

- •

- membership interests in an Australian entity or foreign company that have not previously been held by any entity[10]

- •

- a depreciating asset (other than an intangible asset) that the acquirer holds immediately after its acquisition and at the time of the acquisition

- -

- it is reasonable to conclude that the acquirer expects to use the CGT asset for a taxable purpose within Australia within 12 months

- -

- the CGT asset has not been installed ready for use, or previously used for a taxable purpose, by the acquirer, an associate disposer or an associate pair of the acquirer[11]

- •

- debt interests issued by an associate pair of the acquirer that have not previously been held by any entity.[12]

23. Debt deductions are disallowed to the extent that they are incurred in relation to the acquisition or holding of the CGT asset or legal or equitable obligation.[13]

Type 2 – payment or distribution case

24. For Type 2 arrangements, the DDCR may disallow debt deductions where an entity (payer) uses a financial arrangement to fund, or facilitate the funding of, one or more relevant payments or distributions.

25. Type 2 rules apply to one or more payments or distributions that are:

- •

- made to any entity (an associate recipient) that is an associate pair of the payer

- •

- prescribed payments or distributions.[14]

26. The prescribed payments or distributions are:

- •

- a dividend, distribution or non-share distribution

- •

- a distribution by a trustee or partnership

- •

- a return of capital, including a return of capital made by a distribution or payment made by a trustee or partnership

- •

- a payment or distribution in respect of the cancellation or redemption of a membership interest in an entity

- •

- a royalty, or a similar payment or distribution for the use of, or right to use, an asset

- •

- a payment or distribution that is wholly or partly referable to the repayment of principal under a debt interest if both of the following apply

- -

- the debt interest is issued by the payer, and

- -

- the debt interest is a financial arrangement that satisfies paragraphs 820-423A(5)(a), (b) and (c)

- •

- a payment or distribution of a kind similar to a payment or distribution mentioned in the list points in this paragraph.

- •

- a payment or distribution prescribed by the regulations.[15]

27. Type 2 rules apply to debt deductions of a 'relevant entity', which may be:

- •

- the payer

- •

- an associate pair of the payer (including an associate recipient)

- •

- an associate pair of an associate recipient.[16]

28. The debt deductions must be:

- •

- wholly or partly in relation to the financial arrangement[17]

- •

- referable to an amount paid or payable (directly or indirectly) to an associate pair of the relevant entity, payer or an associate recipient.[18]

29. Debt deductions are disallowed to the same extent that the financial arrangement was used to fund, or facilitate the funding of, one or more prescribed payments or distributions made to an associate recipient.[19]

30. Both Type 1 and Type 2 cases do not apply if the relevant entity has made a choice under subsection 820-46(4) to use the TPDT for the income year.[20]

Indirect Type 1 and Type 2 arrangements

31. Type 1 and Type 2 cases also apply to indirect arrangements.[21]

32. In the case of Type 1 arrangements, the DDCR may apply in relation to an indirect acquisition by an entity through one or more interposed entities.[22] In determining whether an acquisition occurs indirectly through one or more interposed entities, it is sufficient if acquisitions exist between each entity and it is not necessary that these occur in series.

33. A Type 1 indirect acquisition through one or more interposed entities may occur even if an acquisition in the series is covered by the exceptions in section 820-423AA.

34. In the case of Type 2 arrangements, the relevant prescribed payments of distributions may be made directly, or indirectly through one or more interposed entities before, at, or after the time the relevant payer enters into or has the financial arrangement which funds or facilitated the funding of those payments or distributions. The recipient may be the entity that the payer has the financial arrangement with, or another entity.[23]

35. In determining whether a payment or distribution is made indirectly through one or more interposed entities, it is sufficient if payments exist between each interposed entity, and it is not necessary to demonstrate that each payment in a series of payments funds the next payment or is made after the previous payment.[24]

36. An entity is an associate pair of another entity if either or both of the following conditions are met:

- •

- the entity is an associate of the other entity, or

- •

- the other entity is an associate of the entity.[25]

Section 820-37 does not apply to the debt deduction creation rules

37. An entity that satisfies section 820-37 will still need to apply the DDCR.

38. Section 820-37 generally operates so that the thin capitalisation rules will not apply to an entity for an income year if that entity meets the assets threshold (known as the 90% Australian assets threshold).

39. Section 820-37 only applies to:

- •

- outward investing financial entities (non-ADI) and outward investing entities (ADI) that are not also an inward investing financial entity (non-ADI) or inward investing entity (ADI).

- •

- general class investors that would meet the above condition (if they were financial entities).

Application of the debt deduction creation rules

40. The DDCR applies to assessments for income years that commence on or after 1 July 2024.

41. Accordingly, the DDCR applies in relation to:

- •

- arrangements entered into before 1 July 2024 if debt deductions continue to arise from the historical arrangements in income years commencing on or after 1 July 2024

- •

- new arrangements entered into on or after 1 July 2024.

Specific anti-avoidance rule in section 820-423D

42. Section 820-423D contains the DDCR specific anti-avoidance rule (SAAR) which directly targets schemes entered into to avoid the operation of the DDCR. For the DDCR SAAR to apply, the following criteria must be satisfied:

- •

- it is reasonable to conclude that one or more entities entered into or carried out a scheme for the principal purpose of, or for more than one principal purpose that included the purpose of, achieving any of the following results

- -

- subsection 820-423A(2) does not apply in relation to a debt deduction

- -

- subsection 820-423A(5) does not apply in relation to a debt deduction

- (whether or not the debt deduction is a debt deduction of any of the participants and whether or not any of them carried out the scheme or any part of the scheme), and

- •

- the scheme has achieved, or apart from this section would achieve, that purpose.

43. Paragraphs 1.43 and 1.44 of the Supplementary Explanatory Memorandum to the Treasury Laws Amendment (Making Multinationals Pay Their Fair Share—Integrity and Transparency) Bill 2023 relevantly state the following regarding the intended operation of section 820-423D:

1.43 Schemes that seek to exploit the related party debt deduction condition to artificially locate or 'debt-dump' third-party debt in Australia will be subject to the anti-avoidance rules in section 820-423D and Part IVA of the [Income Tax Assessment Act 1936] (ITAA 1936). For example, such schemes may involve third-party debt (and the associated debt deductions) being located in Australia, whilst the proceeds of the debt are ultimately used for business activities outside Australia. Such schemes may have a sophisticated commercial guise or may be embedded into genuine commercial activity.

1.44 The anti-avoidance rules in section 820-423D may also apply to any avoidance schemes relating to the debt deduction creation rules. However, these rules are not intended to apply to schemes where a taxpayer is merely restructuring, without any associated artificiality or contrivance, out of an arrangement that would otherwise be caught by the debt deduction creation rules. The application of section 820-423D will ultimately depend on the facts and circumstances of each case.

44. When finalised, this Guideline applies to restructures entered into on or after 22 June 2023 (the date the Act was introduced into parliament).

45. It is recognised that the Act will result in different tax outcomes as compared to the previous thin capitalisation rules. We expect taxpayers will need to consider the impact of these changes on their affairs and whether it is appropriate to restructure their arrangements that give rise to debt deductions.

46. This Guideline sets out our compliance approach to restructures by providing a risk assessment framework. You can assess the risks associated with restructuring in response to the DDCR in accordance with this Guideline.

47. By following this Guideline, you can understand the compliance risks associated with restructures being contemplated or already undertaken. If your restructures are low risk, you can have confidence that we will not have cause to allocate resources to intensive examinations beyond verifying your self-assessment. Similarly, it provides certainty on areas of higher compliance risk that are likely to result in further and more intensive examinations.

48. As our engagement with affected taxpayers and our compliance activity increases throughout the implementation of the Act, this Guideline may be updated. We will consult on any proposed material changes.

49. Where taxpayers restructure in response to the Act, we will also consider the application of the DDCR SAAR or Part IVA of the ITAA 1936 (concurrently with other provisions of the income tax law).

50. This risk assessment framework is designed to explain how to assess the compliance risks of your restructuring with respect to the Act. This risk assessment framework applies as follows:

- •

- If you have undertaken a restructure in response to the DDCR, apply this risk assessment framework in conjunction with Schedule 2 to this Guideline.

- •

- If you have undertaken a restructure in response to the thin capitalisation rules, apply this risk assessment framework in conjunction with Schedule 4 to this Guideline.

- •

- If you have not undertaken a restructure in response to the Act in an income year, this risk assessment framework does not apply to you.

51. Your risk rating will influence our engagements with you, including the intensity of assurance activities or whether we are likely to engage with you to review your restructure. We generally prioritise our resources and undertake more intensive investigations to address higher risk restructuring.

| Risk zone | Risk level |

|---|---|

| White | Further risk assessment not required |

| Yellow | Compliance risk not assessed |

| Green | Low risk |

| Red | High risk |

52. As we continue to implement the Act, we expect to revisit these zones to ensure that they continue to be an accurate reflection of our understanding of the risks associated with such restructures. We will consult on any proposed material changes.

53. You are in the white zone if all of your restructures in response to the Act are in the following categories.

- •

- There is a settlement agreement between you and the ATO entered into since enactment of the Act on 8 April 2024, where the terms of the settlement cover the Australian tax outcomes, including under the Act, related to the arrangement for the current year, and you have met the conditions of the agreement.

- •

- There is a court decision in relation to the Australian tax outcomes of the arrangement, including under the Act, where you were a party to the proceeding.

54. Your restructure will be in the white zone as long as there has not been a material change in the arrangement since the time of the agreement or decision.

55. If your restructure is in the white zone, you do not need to apply the risk assessment framework. We will not have cause to apply compliance resources beyond verifying that you can substantiate that the conditions for white zone have been met.

56. It is not anticipated that many taxpayers will have restructures in the white zone early in the implementation of the Act.

57. You are in the yellow zone if you have undertaken one or more restructures (including any part of a restructure) in response to the Act in the income year that are not in the green or red zones. That is, restructures that are not covered by examples in Schedules 2 and 4 to this Guideline.

58. If your restructure is in the yellow zone, we may engage with you to understand the compliance risks of your restructure.

59. You are in the green zone if all of your restructures in response to the Act are in the following categories.

- •

- Your restructure in response to the Act in the income year is:

- -

- covered by low-risk examples in Schedules 2 or 4 to this Guideline, and

- -

- exhibit the features set out in paragraph 166 of this Guideline.

- •

- We have conducted a review or audit of your restructure and:

- -

- provided you with a 'low-risk' rating (or 'high assurance' under a Justified Trust review), and

- -

- there has not been a material change in the arrangement which informed the basis of our risk or assurance rating in the review or audit.

60. If your restructure is in the green zone, we will generally only have cause to devote our compliance resources to tax risks in scope of this Guideline to obtain comfort and verify your self-assessment.

61. You are in the red zone if any of your restructures in response to the Act are in the following categories.

- •

- Your restructure (including any part of a restructure) in response to the Act in the income year is covered by a high-risk example in Schedules 2 and 4 to this Guideline.

- •

- We have conducted a review or audit of your restructure and provided you with a 'high risk' rating (or 'low assurance' under a Justified Trust review).

62. If your restructure is in the red zone, we will prioritise our resources to review your arrangement. This may involve commencing a review or audit. The red zone is a reflection of the features that we consider indicate greater risk; however, it is not a presumption that the DDCR SAAR or Part IVA of the ITAA 1936 necessarily apply.

63. We will generally tell you if we intend to commence an examination involving the DDCR SAAR or Part IVA of the ITAA 1936. As part of our examination, we will consider information available to us and may request further information from you. We will have regard to the relevant facts and circumstances, including evidence in relation to contended commercial or non-tax rationales, when we review your restructure.

Reporting your self-assessment

64. It is generally voluntary to apply this Guideline to assess your restructures, although doing so is best practice. If you do not apply this Guideline, we may apply resources to understand your arrangements consistent with the red zone.

65. You may be required to report your risk rating. For example, you may have disclosure requirements if you are required to complete a reportable tax position schedule.

Commissioner of Taxation

4 December 2024

SCHEDULE 1 – Debt deduction creation rules

| Table of Contents | Paragraph |

| Scope of this Schedule | 66 |

| Examples where the debt deduction creation rules may need to be considered | 70 |

| Example 1 – timing and the 'associate pairs' conditions | 72 |

| Example 2 – funding capital expenditure only with related party debt | 77 |

| Example 3 – funding working capital and dividends with related party debt | 85 |

| Example 4 – cash pooling | 90 |

| Example 5 – bridging finance | 99 |

| Example 6 – related party financing of related party acquisition | 103 |

| Example 7 – related party transactions to recharge outcomes arising from swaps | 106 |

| Example 8 – debt deductions in relation to an acquisition from an associate pair | 111 |

| Example 9 – acquisition from a related trust | 116 |

| Example 10 – loan funding distribution by trustee | 125 |

| Example 11 – related party lending between multinational subsidiaries | 133 |

| Debt deduction creation rules records and evidence | 138 |

| Historical transactions | 140 |

| Transactions since enactment | 148 |

| Tracing of funds and apportionment | 151 |

| Tracing of funds | 152 |

| Apportionment | 153 |

66. The DDCR applies to debt deductions arising in income years starting on or after 1 July 2024, regardless of whether those debt deductions are connected to arrangements arising prior to, or after, the start of such an income year.

67. This Schedule provides you with guidance on:

- •

- examples where the DDCR may need to be considered

- •

- records and evidence relevant to such considerations, including tracing and apportionment of funds.

68. The examples in this Schedule provide guidance to assist taxpayers considering whether to restructure. The examples do not consider the DDCR SAAR or any other provision.

69. Schedule 2 to this Guideline provides examples of restructures in response to the DDCR, some of which build on the examples in this Schedule.

Examples where the debt deduction creation rules may need to be considered

70. The DDCR may need to be considered in the following examples. In each example, information and documentation would need to be obtained where the taxpayer wants to determine if the DDCR (and whether an exception in section 820-423AA) applies to the arrangement.

71. If the DDCR needs to be considered, in the course of compliance activity we would ordinarily expect to have cause to allocate resources to ensure that the correct amount of debt deductions were disallowed.

Example 1 – timing and the 'associate pairs' conditions

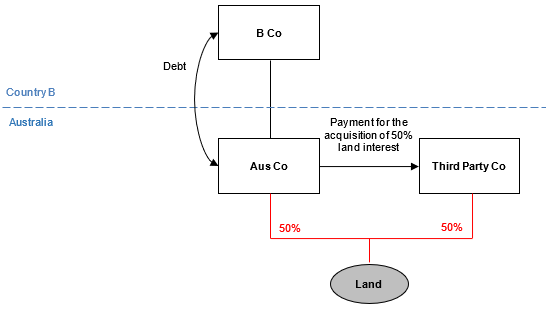

Diagram 1: Timing and the 'associate pairs' conditions

72. Aus Co is an Australian tax resident and general class investor wholly owned by B Co, which is a tax resident of Country B.

73. Aus Co acquires a 50% interest in land from Third Party Co, an unrelated Australian company. Aus Co borrows from B Co to fund the acquisition of its 50% interest in the land.

74. Aus Co and Third Party Co hold their respective shares in the land as tenants in common.

75. Aus Co and Third Party Co subsequently enter into a joint venture arrangement to develop the land for residential purposes. Aus Co and Third Party Co become associate pairs.

76. Aus Co will not need to consider the application of the DDCR for this arrangement as Aus Co and Third Party Co were not associate pairs at the time Aus Co acquired its interest in the land from Third Party Co. We are unlikely to apply compliance resources in this example.

Example 2 – funding capital expenditure only with related party debt

Diagram 2: Funding capital expenditure only with related party debt

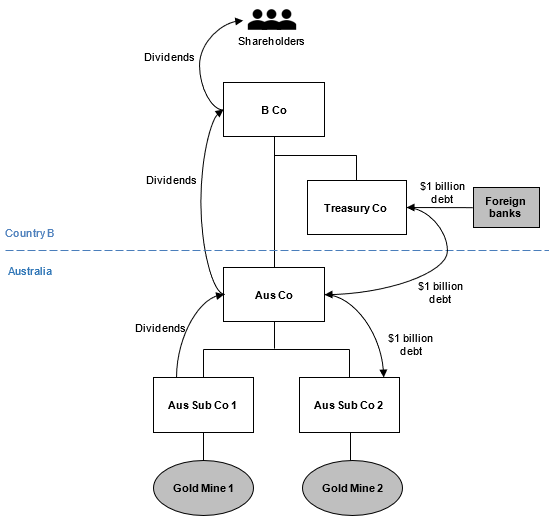

77. Aus Co is an Australian tax resident and general class investor that is a holding company with 2 Australian subsidiaries (Aus Sub Co 1 and Aus Sub Co 2).

78. Aus Co is a subsidiary of B Co, a multinational enterprise which is tax resident in Country B.

79. Aus Sub Co 1 owns and operates a gold mine in Australia (Gold Mine 1). It does not have any borrowings and regularly pays dividends to Aus Co from its retained earnings. In turn, Aus Co regularly pays dividends to B Co.

80. The board of B Co resolves to use Aus Sub Co 2 to mine gold in Australia from a separate mining lease (Gold Mine 2) recently acquired from an unrelated third party.

81. Aus Sub Co 2 does not carry on any other business.

82. B Co's subsidiary, Treasury Co, which is resident in Country B, issues $1 billion of interest-bearing debt interests to foreign banks for the specific purpose of funding Gold Mine 2's development. The borrowed funds are lent through Aus Co to Aus Sub Co 2 on back-to-back terms. Aus Co has no other borrowings.

83. While Gold Mine 2 is in development:

- •

- Aus Sub Co 2 does not pay dividends to Aus Co.

- •

- Aus Sub Co 1 continues to pay regular dividends to Aus Co from its retained earnings and in turn Aus Co continues to pay regular dividends of a similar amount to B Co.

84. Aus Co would not need to consider the application of the DDCR while Gold Mine 2 is in development, as Aus Co's borrowings are not used to fund or facilitate the funding of any dividends. We are unlikely to apply compliance resources while Gold Mine 2 is in development to determine the application of the DDCR.

Example 3 – funding working capital and dividends with related party debt

Diagram 3: Funding working capital and dividends with related party debt

85. Aus Co is an Australian tax resident and a subsidiary of B Co, a multinational enterprise which is tax resident in Country B. B Co runs a global motor vehicle sales business.

86. Aus Co carries on the multinational enterprise's business operations in Australia. It regularly pays dividends to B Co out of profits generated from the sales of motor vehicles to Australian customers.

87. In a particular year, Australian profits are not sufficient for Aus Co to fund dividends and its continuing operations.

88. Aus Co issues a $100 million debt interest to B Sub Co, a subsidiary of B Co which is tax resident in Country B. The funds raised under the debt interest are used by Aus Co to pay a dividend to B Co and to fund its commercial operations.

89. Aus Co will need to consider the application of the DDCR for the extent to which the financial arrangement funded or facilitated the funding of the dividends to B Co. We are likely to consider applying compliance resources to determine the correct application of the DDCR.

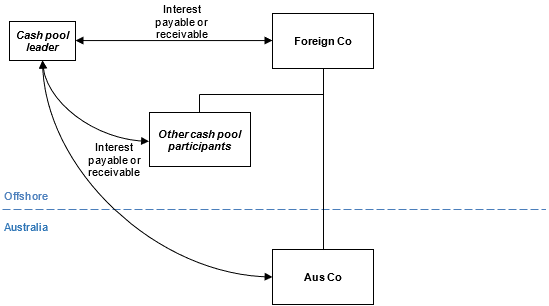

90. Aus Co is an Australian company with a foreign parent, Foreign Co.

91. Foreign Co operates a global cash pooling arrangement with numerous offshore cash pool participants and an offshore cash pool leader. The arrangement requires all accounts to be nil, with positive balances transferred (or 'swept') to the cash pool leader and negative balances replenished by the cash pool leader daily.

92. If a participant has its cash swept to the offshore cash pool leader, the leader pays interest on the balance owed to the participant at a rate determined under the arrangement.

93. If a participant is transferred an amount from the offshore cash pool leader in order to make its account balance nil, unless any amount is owed by the leader, the participant pays interest on the balance owed to the leader.

94. Aus Co has no other borrowings.

95. Aus Co uses its cash pool account to acquire CGT assets from associate pairs and to fund dividends, royalties and returns of capital to associate pairs.

96. Throughout the 2023–24 income year, Aus Co's cash pool balance always remains positive. In the 2024–25 income year, Aus Co's balance fluctuates between negative and positive.

97. Aus Co does not need to consider the application of the DDCR in relation to the 2023–24 income year as Aus Co's cash pooling account did not give rise to debt deductions and we are unlikely to apply compliance resources in this example.

98. However, Aus Co does need to consider the application of the DDCR to the debt deductions arising in the 2024–25 income year and we are likely to consider applying compliance resources to verify the correct application of the DDCR for this year.

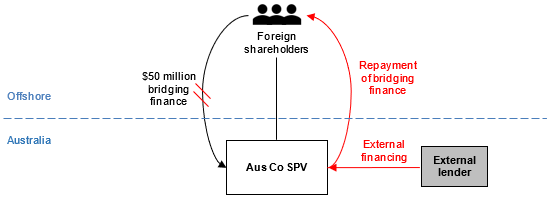

99. Aus Co SPV is an Australian-incorporated entity and general class investor. It is commencing a new project in Australia for which capital expenditure is forecast to be approximately $300 million.

100. Due to commercial issues causing delays in external funding, $50 million bridging finance is obtained from the SPV's shareholders to make initial capital acquisitions. None of the initial capital acquisitions are covered by subsection 820-423A(2).

101. Once external finance is obtained, Aus Co SPV repays the $50 million shareholder bridging finance with the proceeds of the external financing.

102. Aus Co will not need to consider the DDCR as no related party debt deductions arise in relation to acquisitions from associate pairs. We are unlikely to apply compliance resources in this example to determine the application of the DDCR.

Example 6 – related party financing of related party acquisition

Diagram 6: Related party financing of related party acquisition

103. Aus Co SPV is an Australian-incorporated entity and general class investor. It commences a new property project in Australia and acquires real property from an associate pair for approximately $300 million.

104. Debt interests of $50 million in total were issued by Aus Co SPV to SPV's shareholders which are an associate pair in relation to Aus Co SPV.

105. Aus Co SPV will need to consider the application of the DDCR to debt deductions arising in relation to the $50 million associate pair financing. We are likely to consider applying compliance resources to determine the correct application of the DDCR.

Example 7 – related party transactions to recharge outcomes arising from swaps

Diagram 7: Related party transactions to recharge outcomes arising from swaps

106. Aus Co is a general class investor and the head company of an Australian tax consolidated group. The group raises debt financing by issuing debt interests to third-party banks to fund its commercial activities (which does not include any acquisitions from associate pairs or payments to associate pairs).

107. The bank debt is denominated in various currencies at fixed rates. To manage the associated interest rate and exchange rate risks, the group enters into interest rate swaps (IRS) and cross currency interest rate swaps when it issues the debt interests to the third-party banks in order to convert the group's fixed interest rate exposure under the debt to floating United States dollar interest rate exposure.

108. A related party (not within the tax consolidated group), Finance Co, undertakes all swap transactions for the group. It executes the swaps under International Swaps and Derivates Association agreements with third-party banks.

109. When entering into these swaps, Finance Co and Aus Co also enter into internal arrangements which recharge or pass through the actual costs and payments of the external bank swaps to Aus Co which effectively hedge the bank debt. The recharge costs are debt deductions.

110. Aus Co will not need to consider the DDCR for this arrangement as the debt deductions in relation to the recharge arrangement are not in relation to a transaction with an associate pair. We are unlikely to apply compliance resources in this example to determine the application of the DDCR.

Example 8 – debt deductions in relation to an acquisition from an associate pair

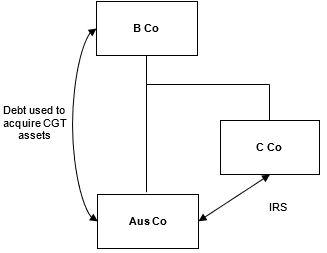

Diagram 8: Debt deductions in relation to an acquisition from an associate pair

111. Aus Co is an Australian tax resident and general class investor.

112. Aus Co acquires a CGT asset directly from B Co (an associate pair). The acquisition is not covered by section 820-423AA.

113. Aus Co finances the acquisition with an interest-bearing loan from B Co of $100 million.

114. In order to swap its exposure to interest rate risk in relation to the loan, Aus Co enters into an IRS with another associate pair, C Co.

115. Aus Co would need to consider the application of the DDCR to the debt deductions in relation to the loan and the interest rate swap. We are likely to consider applying compliance resources to determine the correct application of the DDCR.

Example 9 – acquisition from a related trust

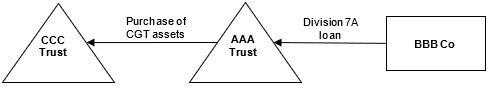

Diagram 9: Acquisition from a related trust

116. AAA Trust is a general class investor. AAA Trust is carrying on a business and, together with its associates, has more than $2 million in debt deductions.

117. BBB Co is a private company that holds a significant amount of funds in the group.

118. CCC Trust is a trust that holds a CGT asset.

119. AAA Trust, BBB Co and CCC Trust are part of a privately owned group and are associate pairs of each other.

120. In the 2024–25 income year, the trustee of the AAA Trust acquired the CGT asset held by CCC Trust to be used in its business.

121. AAA Trust did not have sufficient working capital to both acquire the CGT asset and fund its business operations.

122. The trustee of AAA Trust and BBB Co entered into a Division 7A (of the ITAA 1936) complying loan agreement[26] under which the trustee borrowed an amount from BBB Co equal to the amount of the CGT asset's purchase price (Division 7A complying loan). The loan agreement stipulates that the trustee of AAA Trust must make minimum yearly repayments to BBB Co, and the rate of interest payable on the loan is equal to the benchmark interest rate for each year.

123. The trustee of AAA trust pays the CCC Trust the purchase price for the CGT asset using the funds provided under the Division 7A complying loan for the CGT asset acquired.

124. The trustee of AAA trust will need to consider the application of the DDCR to the debt deductions arising in relation to the acquisition from CCC Trust. We are likely to consider applying compliance resources to determine the correct application of the DDCR.

Example 10 – loan funding distribution by trustee

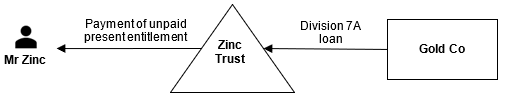

Diagram 10: Loan funding distribution by trustee

125. Zinc Trust is a discretionary trust and a general class investor that, together with its associates, has more than $2 million in debt deductions.

126. Mr Zinc is the appointor and primary beneficiary of Zinc Trust.

127. Gold Co is a private company of which Mr Zinc is the sole director and shareholder.

128. The 2 entities are part of a privately owned group and are associate pairs of each other.

129. In the 2021–22 income year, the trustee of Zinc Trust made Mr Zinc presently entitled to 100% of the trust income. Mr Zinc agreed for the trustee to retain the amount to which his present entitlement relates in Zinc Trust as working capital.

130. On 30 June 2023, Mr Zinc called for payment of his unpaid present entitlement (UPE). After reviewing the financial affairs of the Zinc Trust, the trustee decided to refinance the amount contributed by Mr Zinc by borrowing the same amount from Gold Co rather than reducing the working capital of the business. The loan was structured in accordance with Division 7A of the ITAA 1936 complying terms. The rate of interest payable on the loan from Gold Co is equal to the benchmark interest rate for each year.

131. The trustee used the amount borrowed from Gold Co to pay off Mr Zinc's UPE.

132. The trustee will need to consider the application of the DDCR to Zinc Trust's debt deductions arising in relation to the borrowing from Gold Co used to fund or facilitate the funding of the payment of Mr Zinc's UPE. We are likely to consider applying compliance resources to determine the correct application of the DDCR.

Example 11 – related party lending between multinational subsidiaries

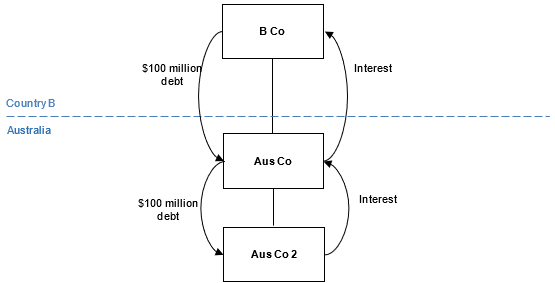

Diagram 11: Related party lending between multinational subsidiaries

133. Aus Co is an Australian tax resident and general class investor, wholly owned by B Co, a tax resident of Country B. Aus Co issued a $100 million debt interest to B Co.

134. Using the proceeds of the debt interest, Aus Co acquires a $100 million debt interest from Aus Co 2, another wholly owned subsidiary of B Co and Australian tax resident. No other entity has previously held the debt interest.

135. Aus Co 2 uses the proceeds to acquire CGT assets from unrelated entities in the ordinary course of its commercial operations.

136. Aus Co and Aus Co 2 will not need to consider the application of the DDCR for this arrangement as no related party debt deductions arise in relation to transactions with associate pairs other than the debt interests that are covered by the exception in subsection 820-423AA(3). We are unlikely to apply compliance resources in this example.

137. Aus Co and Aus Co 2 will need to consider the application of the to their respective debt deductions in relation to any other transactions Aus Co 2 enters with associate pairs, including whether those transactions were indirectly made by Aus Co. Where such transactions occur, we are likely to consider applying compliance resources to determine the correct application of the DDCR.

Debt deduction creation rules records and evidence

138. The DDCR requires taxpayers to trace the use of debt funding transactions that are covered by subsections 820-423A(2) and (5), including both direct and indirect transactions.

139. In order to determine whether the DDCR has application to your arrangements, you and your associate pairs will need to obtain sufficient information to trace the use of related party debt and whether it funds transactions that are covered by subsections 820-423A(2) and (5), including both direct and indirect transactions. For example, the information should be sufficient to establish whether an arrangement has the characteristics of the examples in Schedules 1 and 2 to this Guideline.

140. Stakeholders have raised practical concerns when seeking to comply with the DDCR where business records about historical transactions and related party debt may be limited.

141. We recognise that it can be challenging to obtain relevant documents and information to evidence or substantiate use of related party debt funding for historical transactions.

142. We anticipate that the following documents and information may assist taxpayers to demonstrate whether the DDCR applies to debt deductions in relation to your historical transactions:

- •

- copies of loan documentation prepared when the related party debt was entered into or dealt with (for example, intercompany loan agreements or other documents setting out the purpose of the loan and key terms)

- •

- copies of the taxpayer's and relevant associate pair's financial accounts for the relevant years, prepared in accordance with accounting principles, and any records or working papers prepared by the taxpayer or their professional advisers, for example, accounting or tax working papers

- •

- copies of cash flow statements, general ledger, journals or other records or working papers with identifiable entries relating to historical transactions and related party debt

- •

- copies of bank statements or payment records

- •

- copies of board minutes, resolutions and papers, or any other contemporaneous documentation relating to the decisions to undertake historical transactions or enter into related party debt.

143. However, the onus is on the taxpayer to prove that the DDCR does not apply and you can prove this through the provision of information and documentation to us.

144. Stakeholders have requested that we not allocate compliance resources to ongoing related party funding of historical transactions that occurred before a certain period (for example, more than 5 years before enactment). We do not consider such an approach is available and appropriate. We will assist taxpayers seeking to comply with the DDCR.

145. All information and documentation provided to us should be in English or be accompanied with an English translation.

146. In the course of our compliance activities, we may request these documents or similar information from you as evidence of relevant tracing.

147. Where the onus to prove that the DDCR does not apply to you is not discharged, we may have cause to apply compliance resources to determine whether the correct amount of debt deductions have been disallowed under subsection 820-423A(1).

148. Since the enactment of the DDCR, best practice record-keeping practices have changed. We would expect taxpayers to keep contemporaneous documentation and associated analysis on the operation of the DDCR (including evidentiary support for tracing the use of funds).

149. We also expect associate pairs to provide taxpayers with full disclosure of all relevant information to work out whether the DDCR applies to debt deductions in relation to transactions covered by subsections 820-423A(2) and (5), including for indirect arrangements.

150. A deduction should not be claimed unless sufficient information is available to support a conclusion that the DDCR does not apply.

Tracing of funds and apportionment

151. Stakeholders have requested guidance on methodologies to trace and apportion the disallowance of debt deductions under subsection 820-423A(1).

152. We consider that tracing is a factual exercise and should be the method used to determine the disallowed debt deduction under subsection 820-423A(1) wherever possible.

153. Apportionment does not replace tracing. However, apportionment may be appropriate where it is not possible to trace, such as where funds from various sources that were used for different purposes are combined into a single debt interest.

154. Whether an apportionment methodology is appropriate will depend on whether it is fair and reasonable in the relevant facts and circumstances.

155. An example of fair and reasonable apportionment is where the debt deductions under a facility are disallowed in the same proportion of the 'DDCR debt' to total debt in circumstances where related party debt that funded transactions covered by subsections 820-423A(2) or (5) is refinanced into a single related party debt facility that also includes debt in relation to other purposes. This includes any repayments of principal and capitalisation of interest.

156. We are aware of potential methodologies, including:

- •

- methodologies that rely on a hypothesis of what may instead have occurred had the DDCR been in operation at the time

- •

- methodologies that allocate historical principal repayments (including those made prior to the enactment of the DDCR) to any debt or part of a debt that may give rise to disallowance under the DDCR, and allocating principal repayments to other debt after the DDCR debt portion has first been treated as repaid without contemporaneous documentation to support that allocation.

157. We do not consider such approaches are designed to provide a fair and reasonable apportionment as they do not reflect the facts and circumstances of taxpayers' affairs. We would apply compliance resources to investigate any such apportionment approach.

SCHEDULE 2 – Restructures in response to the debt deduction creation rules

| Table of Contents | Paragraph |

| Scope of this Schedule | 158 |

| Low-risk restructures | 163 |

| Example 12 – repaying debt interest | 168 |

| Example 13 – repaying bridging finance | 173 |

| Example 14 – disposing of foreign assets | 179 |

| Example 15 – repaying debt interest, terminating swaps, recapitalising subsidiary | 185 |

| Example 16 – repaying debt interest | 192 |

| Example 17 – cash pooling | 197 |

| High-risk restructures | 203 |

| Example 18 – contending to change the character of costs incurred | 206 |

| Example 19 – replacing related party debt with third party debt | 212 |

158. The Schedule provides our view on the compliance risks associated with restructures in response to the DDCR.

159. The risk assessment framework in this Guideline applies to the restructuring examples in this Schedule.

160. Concerns have been raised about the potential for us to apply the DDCR or Part IVA of the ITAA 1936 to cancel all or part of a tax benefit where a taxpayer restructures to avoid the application of the DDCR but preserves tax benefits going forward, such as debt deductions arising in relation to transactions covered by subsections 820-423A(2) or (5).

161. For example, replacing a debt interest to an associate pair with a debt interest to an unrelated entity to eliminate related party debt deductions with other debt deductions.

162. This Schedule provides examples of restructures that we consider to be low-risk restructures and high-risk restructures. Many of these examples build on examples in Schedule 1 to this Guideline and the 2 schedules should be read as complementary.

163. We expect the lowest-risk restructures to involve the repayment of all related party debt in relation to transactions covered by subsections 820-423A(2) or (5) without any additional debt being issued or acquired. That is, by eliminating all debt deductions that would otherwise be disallowed under subsection 820-423A(1).

164. Some of the following examples involve the repayment of related party debt without additional debt being introduced. Others involve the introduction of new debt.

165. Where a restructure is low risk, we will generally have cause to allocate compliance resources only to obtain comfort and verify your self-assessment.

166. Restructures are only low risk where the arrangements are otherwise commercial. The following features must be present for a restructure to be low risk:

- •

- Debt deductions disallowed by the DDCR prior to the restructure have been accurately calculated.

- •

- Prior to the restructure, the arrangements would not have attracted the application of Part IVA of the ITAA 1936.

- •

- The restructure occurs in a straightforward manner having regard to the circumstances, without any associated contrivance or artificiality and is on arm's length terms.

- •

- The arrangement following the restructure will not attract the application of Part IVA of the ITAA 1936.

167. If all of these features are present, the restructure will be regarded as a low-risk restructure. If any of these features are not present, the restructure will not be regarded as a low-risk restructure.

Example 12 – repaying debt interest

168. Aus Co is an Australian tax resident and general class investor, with a wholly owned subsidiary B Co which is a tax resident of Country B.

169. Aus Co identifies debt deductions which are expected to be incurred in the 2024–25 income year that are in relation to acquisitions of CGT assets from an associate pair and financial arrangements used to fund dividends paid to associate pairs that occurred in prior income years.

170. Aus Co repays all of the debt interests under which the debt deductions arise from retained earnings and dividends received from B Co.

171. There are no debt deductions arising from its restructured arrangements.

172. This is a low-risk restructure.

Example 13 – repaying bridging finance

Diagram 12: Repaying bridging finance

173. Assume the facts in Example 6 of this Guideline.

174. Aus Co SPV determines that the DDCR will apply to debt deductions in relation to the acquisition of real property from an associate pair arising from the $50 million debt interests that Aus Co SPV issued to its shareholders (shareholder debt).

175. Based on contemporaneous documentation and correspondence with financial institutions and intermediaries, the shareholder debt was issued in anticipation of additional external financing being secured by Aus Co SPV to fund the acquisition of the real property. Upon the provision of external financing in October 2024, the $50 million 'bridging' shareholder debt is repaid by Aux Co SPV.

176. This is a low-risk restructure.

177. The use of the shareholder debt as related party bridging finance was commercially necessary and its replacement with external financing always intended and documented.

178. Aus Co SPV will need to consider the correct amount of debt deductions disallowed under the bridging finance due to the operation of the DDCR until it is repaid.

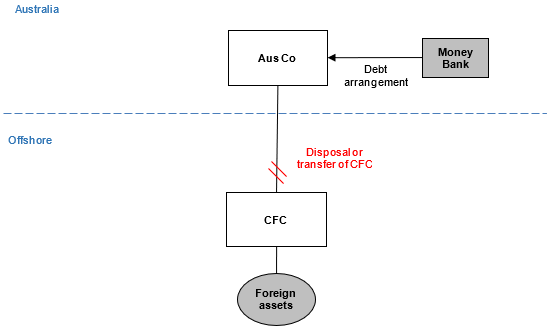

Example 14 – disposing of foreign assets

Diagram 13: Disposing of foreign assets

179. Aus Co is a general class investor that satisfies section 820-37 (known as the 90% Australian assets threshold).

180. Aus Co has a single foreign subsidiary.

181. In anticipation of the DDCR applying, Aus Co liquidates the foreign subsidiary. There is no capital gain or capital loss on the liquidation.

182. In the following income year, Aus Co will no longer be a general class investor.

183. This is a low-risk restructure.

184. Aus Co has disposed of a dormant entity and its business operations are not otherwise impacted as a result of the restructure.

Example 15 – repaying debt interest, terminating swaps, recapitalising subsidiary

Diagram 14: Repaying debt interest, terminating swaps, recapitalising subsidiary

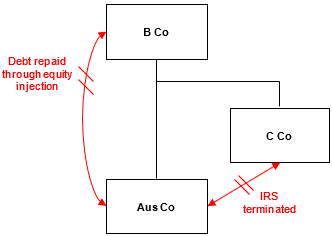

185. Assume the facts in Example 8 of this Guideline.

186. Aus Co determines that the DDCR will apply to its debt deductions in relation to its purchase of tangible assets from B Co (that is, Aus Co's debt deductions relating to its $100 million debt issued to B Co and its swap with C Co).

187. Aus Co repays its $100 million debt, funded by an injection of equity by B Co and terminates the IRS.

188. Subsequently, Aus Co and B Co reconsiders their approach to funding the acquisition of tangible assets and Aus Co is sufficiently capitalised to pay B Co in accordance with its payment terms, preventing potential further related party debt arising through the transfer of assets between the entities.

189. This is a low-risk restructure.

190. Debt deductions are no longer incurred in relation to the acquisition from an associate pair.

191. Aus Co will need to consider the correct amount of debt deductions disallowed under the arrangement due to the operation of the DDCR until the debt to B Co is repaid and the swap terminated (including any deductible costs arising on termination of the swap).

Example 16 – repaying debt interest

Diagram 15: Repaying debt interest

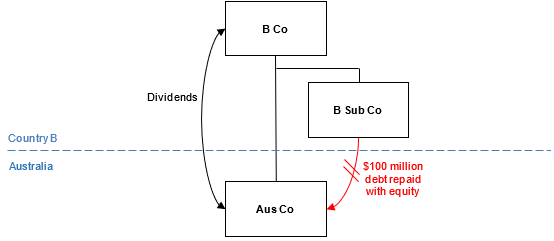

192. Assume the facts in Example 3 of this Guideline.

193. Aus Co determines that the DDCR will apply to disallow debt deductions in relation to the $100 million debt interest used to fund the dividends paid to an associate pair.

194. Aus Co repays its $100 million debt interest held by B Sub Co by issuing additional equity interests to B Co.

195. This is a low-risk restructure.

196. Aus Co will need to consider the correct amount of debt deductions disallowed under the $100 million debt interest due to the operation of the DDCR until it is repaid.

197. Assume the facts in Example 4 of this Guideline.

198. Aus Co determines that the DDCR will apply in the 2024–25 income year to disallow debt deductions for the cash pooling arrangement in relation to acquiring CGT assets from associate pairs or funding dividends, royalties and returns of capital to associate pairs.

199. During the 2024–25 income year, Aus Co repays its cash pool to a nil balance.

200. Subsequently, Aus Co and B Co reconsider funding of Aus Co's transactions with associate pairs and:

- •

- B Co increases its capitalisation of Aus Co (through issuing additional equity interests) and annually reviews this arrangement to ensure that Aus Co is sufficiently capitalised to fund Aus Co's relevant transactions and payments with associate pairs.

- •

- Aus Co enters into relevant transactions and payments with associate pairs from a separate account or borrowing that is not interest bearing (or used to offset other accounts).

201. This is a low-risk restructure.

202. Aus Co will need to consider the correct amount of debt deductions disallowed for Foreign Co's global cash pooling arrangement due to the operation of the DDCR until Aus Co repays its negative cash pool balance.

203. We expect the highest-risk restructures would involve arrangements where debt deductions are expected to be disallowed under subsection 820-423A(1) and a similar level of debt deductions are contended to be available under restructured or recharacterised arrangements.

204. For example, higher-risk arrangements may include round robin financing, contended change in 'use' of debt under other related party arrangements, or a contrived arrangement to choose and use the TPDT under subsection 820-46(4) with the purported effect of preventing the DDCR from applying.

205. The following examples are restructures that are high risk and should be expected to attract intensive compliance action.

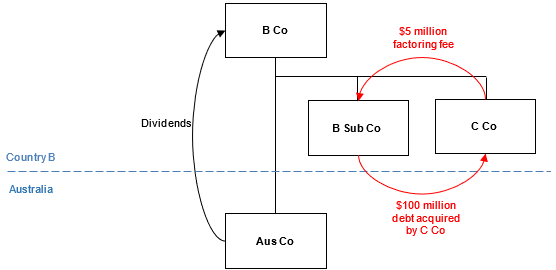

Example 18 – contending to change the character of costs incurred

Diagram 16: Contending to change the character of costs incurred

206. Assume the facts in Example 3 of this Guideline.

207. Aus Co determines that the DDCR would apply to disallow debt deductions in relation to the $100 million debt interest issued by Aus Co to B Sub Co used to fund dividends paid to B Co (an associate pair).

208. B Sub Co enters into a factoring arrangement with C Co, another subsidiary of B Co, which is also a tax resident of Country B. C Co acquires the $100 million debt interest from B Sub Co at its face value less an agreed factoring fee of 5% of face value.

209. Aus Co contends that the debt deductions for the debt factored by B Sub Co to C Co does not relate to the underlying funding of the dividends paid by A Co to B Co.

210. This restructure presents risks that the contended change in use does not reflect the underlying arrangement.

211. This is a high-risk restructure.

Example 19 – replacing related party debt with third party debt

Diagram 17: Replacing related party debt with third party debt

212. Assume the facts in Example 8 of this Guideline.

213. Aus Co determines that the DDCR will apply to its debt deductions in relation to its purchase of tangible assets from B Co (that is, Aus Co's debt deductions relating to its $100 million debt issued to B Co and its swap with C Co).

214. Aus Co repays its $100 million debt, funded by the proceeds of issuing a $100 million debt interest to Bank Co.

215. Around the same time B Co repays $100 million worth of debt owed to Bank Co.

216. This restructure presents risks that the refinancing of related party debt with third party debt merely has the effect of 'dumping' debt into Australia going forward, with an associated reduction in the third party debt issued by B Co's offshore group.

217. This is a high-risk restructure.

SCHEDULE 3 – Third party debt test compliance approach

| Table of Contents | Paragraph |

| Scope of this Schedule | 218 |

| Paragraph 820-427A(3)(c) – recourse | 223 |

| Example 20 – removing recourse to foreign assets from obligor group | 227 |

| Example 21 – removing recourse to foreign assets from obligor group | 233 |

| Example 22 – disposal of foreign asset | 235 |

| Paragraph 820-427A(3)(c) – minor or insignificant assets | 240 |

| Example 23 – compliance approach for small asset holding | 246 |

| Compliance with paragraph 820-427C(1)(d) | 249 |

| Example 24 – removing margin on project finance – back-to-back | 253 |

| Example 25 – creating separate intercompany loans | 258 |

| Example 26 – back-to-back lending facility | 261 |

218. The Act applies for income years beginning on or after 1 July 2023. As the enactment date was 8 April 2024, the income year of certain taxpayers commenced prior to the requirements of the TPDT being legislated. Accordingly, these taxpayers may not have met the TPDT requirements for the first full income year in which the Act applies.

219. This Schedule provides targeted compliance approaches in the following circumstances:

- •

- determining whether paragraph 820-427A(3)(c) is satisfied with respect to:

- -

- restructuring to remove recourse for payment of a debt to assets that are not Australian assets

- -

- whether assets are considered 'minor or insignificant'

- •

- restructuring to comply with paragraph 820-427C(1)(d).

220. Where applicable, we will generally not have cause to apply compliance resources other than to verify the application of the targeted compliance approaches.

221. The following requirements apply to all compliance approaches in this Schedule:

- •

- Any restructure that occurs to ensure the debt arrangement can satisfy the third party debt conditions is undertaken in a straightforward manner having regard to the circumstances, without any associated contrivance or artificiality and is on arm's-length terms.

- •

- The restructure will not attract the application of Part IVA of the ITAA 1936.

- •

- Prior to and following any restructure, the original arrangement satisfies the third party debt conditions (other than the condition to which the compliance approach applies).

- •

- The use of the financial arrangement does not change.

- •

- The quantum and rate of the financing arrangement do not materially change.

222. We will review these compliance approaches as we implement the TPDT. We will consult on any material changes.

Paragraph 820-427A(3)(c) – recourse

223. Paragraph 820-427A(3)(c) sets out requirements relating to the limitations on recourse of the holder of a debt interest to satisfy the third party debt conditions.

224. This compliance approach is intended to facilitate taxpayers determining whether to restructure their affairs to comply with the TPDT as it comes into operation.

225. It is limited to restructures undertaken between 22 June 2023 (the date the Act was introduced into parliament) and the end of the income year in which this Guideline is finalised and applies only for the purpose of considering whether paragraph 820-427A(3)(c) is satisfied in the period prior to the restructure.

226. Where restructures are consistent with examples in this section and the requirements of paragraph 221 of this Guideline are also met, we will only allocate compliance resources to you to verify that this compliance approach applies.

Example 20 – removing recourse to foreign assets from obligor group

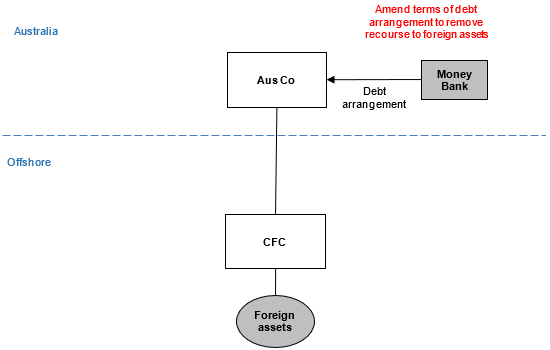

Diagram 18: Removing recourse to foreign assets from obligor group

227. Aus Co is a general class investor.

228. Aus Co has Australian assets and a wholly owned foreign subsidiary entity (CFC). Consistent with Example 14 of draft Taxation Ruling TR 2024/D3 Income tax: aspects of the third party debt test in subdivision 820-EAB of the Income Tax Assessment Act 1997, the shares in CFC are not Australian assets.

229. CFC carries on business in the foreign jurisdiction and owns foreign assets.

230. Aus Co issues a debt interest held by Money Bank, a financial institution that is not an associate entity of Aus Co.

231. Under the terms of the arrangement, Money Bank has recourse for payment of the debt to all of the assets of Aus Co, including the shares in CFC.

232. Aus Co restructures its arrangement to satisfy paragraph 820-427A(3)(c) of the third party debt conditions, by amending the terms of all arrangements so that Money Bank does not have recourse to the shares in CFC or any of its assets.

Example 21 –removing recourse to foreign assets from obligor group

Diagram 19: Removing recourse to foreign assets from obligor group

233. Assume the same facts as Example 20 of this Guideline except:

- •

- CFC carries on an active business offshore and owns foreign assets, and

- •

- Aus Co does not derive attributable income from CFC.

234. Aus Co restructures its arrangement to satisfy paragraph 820-427A(3)(c) of the third party debt conditions, by transferring its shares in CFC to an associate entity that is not in the obligor group in relation to Aus Co's debt interest.

Example 22 – disposal of foreign asset

Diagram 20: Disposal of foreign asset

235. Mining Co is a general class investor.

236. Mining Co issues a debt interest held by Globe Bank, a financial institution that is not an associate entity of Mining Co. Globe Bank has recourse to all of the assets of Mining Co.

237. Mining Co's customers include foreign entities that pay sales proceeds to a foreign bank account of Mining Co. Mining Co then transfers the proceeds to an Australian bank account.

238. During the income year, the offshore, United States dollar, bank account may have a significantly high cash balance (such as when a customer payment is deposited prior to proceeds being transferred). Consistent with paragraph 63 of TR 2024/D3, Mining Co's bank account is not a minor or insignificant asset as its value is not nominal at all times in the income year.

239. Aus Co restructures its banking arrangement to satisfy paragraph 820-427A(3)(c) of the third party debt conditions by closing the offshore bank account and requiring all customer payments to be made to the Australian bank account.

Paragraph 820-427A(3)(c) – minor or insignificant assets

240. Paragraph 820-427A(3)(c) disregards recourse to minor or insignificant assets when limiting the recourse of the holder of a debt interest in satisfying the third party debt conditions. Consistent with TR 2024/D3, an asset is minor or insignificant if it is of a minimal or nominal value.

241. This compliance approach is intended to facilitate taxpayers determining whether to restructure their affairs to comply with the TPDT as it comes into operation.

242. It is limited to income years starting on or after 1 July 2023 and ending on or before 1 January 2027.

243. It applies only for the purpose of considering whether paragraph 820-427A(3)(c) is satisfied in the period prior to the restructure.

244. Where taxpayers satisfy the following criteria, we will only apply compliance resources to verify that this compliance approach applies.

- •

- You make reasonable efforts to identify minor or insignificant assets of the obligor group that are not Australian assets and both of the following apply

- -

- The market value of those assets identified is less than 1% of all of the assets to which the holder of the debt interest has recourse for the payment of the debt.

- -

- The market value of each asset (or bundle of identical assets, such as a shareholding) does not exceed $1 million.

- •

- None of those assets are credit support rights.

Example 23 – compliance approach for small asset holding

Diagram 21: Compliance approach for small asset holding

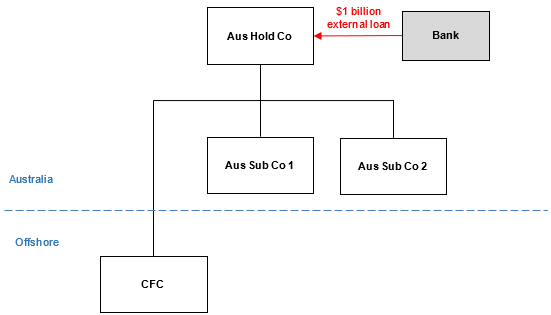

246. Aus Hold Co wholly owns 2 Australia subsidiaries, Aus Sub Co 1 and Aus Sub Co 2, and one foreign-resident subsidiary, CFC. All entities are general class investors.

247. Aus Hold Co borrows $1 billion from Bank, not an associate entity. Under the terms of the loan, Bank has recourse to all of assets of the Aus Hold Co group, including foreign assets held by CFC.

248. Aus Hold Co's shares in CFC are not Australian assets. The market value of CFC is approximately 1% of all of assets of the entities to which the lender has recourse.

Compliance with paragraph 820-427C(1)(d)

249. The conduit financing conditions modify the third party debt conditions to accommodate certain arrangements where a debt interest that satisfies the third party debt conditions is on-lent to its associate entities. Under paragraph 820-427C(1)(d), the terms of the relevant debt interest (being the on-lent amount) between the conduit financer and its associate entity to the extent that those terms relate to costs incurred by the borrower in relation to the relevant debt interest, must be the same as the corresponding terms of the ultimate debt interest.

250. This compliance approach is intended to facilitate taxpayers determining whether to restructure their affairs to comply with the TPDT as it comes into operation.

251. It is limited to restructures undertaken between 22 June 2023 (the date the Act was introduced into parliament) and the end of the income year in which this Guideline is finalised and applies only for the purpose of considering whether paragraph 820-427C(1)(d) is satisfied in the period prior to the restructure. For Examples 25 and 26 of this Guideline, this compliance approach also applies when considering whether paragraph 820-427C(1)(d) applies following the restructure for income years ending on or before 1 January 2027.

252. Where restructures are consistent with examples in this section and the requirements of paragraph 221 of this Guideline are also met, we will only allocate compliance resources to you to verify that this compliance approach applies.

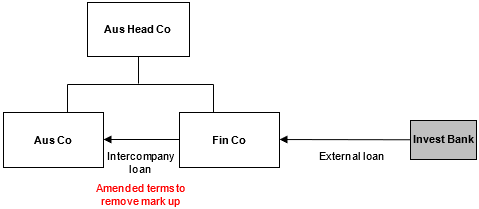

Example 24 – removing margin on project finance – back-to-back

Diagram 22: Removing margin on project finance – back-to-back

253. Aus Head Co has 2 Australian subsidiaries, Aus Co and Fin Co. These entities are not consolidated for tax purposes.

254. Fin Co borrows funds from Invest Bank, not an associate entity, entering into a loan agreement on arm's length terms (the external loan) to use the proceeds wholly to fund a project that is the creation and development of a CGT asset to be undertaken by Aus Co.

255. Fin Co on-lends the entire amount of the external loan funds to Aus Co (the intercompany loan) that is used in the project.

256. The intercompany loan is on the same terms as the external loan except that Fin Co charges a higher rate interest (that is, it includes a 'mark up').

257. Fin Co and Aus Co amend the terms of the intercompany loan to remove the mark up so that the interest rates on the intercompany and external loan are the same.

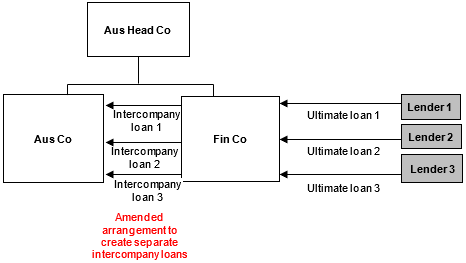

Example 25 – creating separate intercompany loans

Diagram 23: Creating separate intercompany loans

258. Assume the same facts as Example 24 of this Guideline except that Fin Co borrows from 3 separate lenders to use the proceeds wholly to fund a project that is the creation and development of a CGT asset to be undertaken by Aus Co. Fin Co on-lends the entire amount of the external loans to Aus Co that is used in the project under a single intercompany loan.

259. Fin Co and Aus Co amend the intercompany loan arrangement to create 3 separate intercompany loans, with no mark up. Each intercompany loan has the same terms as the corresponding Ultimate loan.

260. Overall, the debt deductions of Aus Co under the intercompany loans are equal to the debt deductions of Fin Co under the Ultimate loans.

Example 26 – back-to-back lending facility

Diagram 24: Back-to-back lending facility

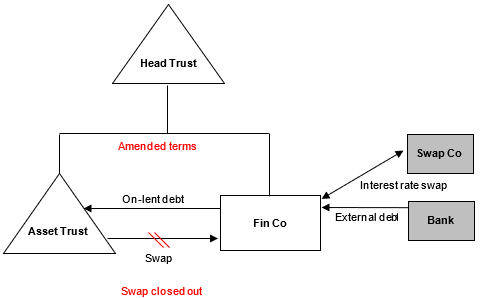

261. Head Trust is an Australian trust with a sub-trust, Asset trust and resident subsidiary, Fin Co.

262. Fin Co borrows from Bank to use the proceeds wholly to fund a project that is the creation and development of a CGT asset to be undertaken by Aus Co and on-lends to Asset Trust on the same terms.

263. Separately, Fin Co enters an interest rate swap with Swap Co to hedge the interest rate risk in respect of the loan. Fin Co and Asset Trust also enter into an interest rate swap (that is, a back-to-back swap).

264. Fin Co and Asset Trust close out the interest rate swap. Fin Co and Asset Trust amend the terms of their loan so that it is a debt interest under which interest payable by Asset Trust is the same rate as the debt interest issued by Fin Co to Bank adjusted by the amounts payable under the interest rate swap.

265. Fin Co and Asset Trust do not recognise any gain or loss for tax purposes when closing out the swap.

SCHEDULE 4 – Restructures in response to the thin capitalisation changes

| Table of Contents | Paragraph |

| Thin capitalisation (non-debt deduction creation rules) restructuring | 266 |

| Example 27 – low risk: restructuring to account for differing individual tax EBITDA of entities within a group | 270 |

| Example 28 – high risk: introducing debt to maximise debt deductions under the fixed ratio test | 276 |

| Example 29 – high risk: amending conduit financing interest rates | 286 |

Thin capitalisation (non-debt deduction creation rules) restructuring

266. This Schedule provides our view on compliance risks associated with certain restructures in response to the thin capitalisation rules.

267. The risk assessment framework in this Guideline applies to the restructuring examples in this Schedule.

268. Concerns have been raised about the potential for us to apply Part IVA of the ITAA 1936 to cancel all or part of a tax benefit where a taxpayer restructures in response to the thin capitalisation changes but preserves tax benefits going forward.

269. This Schedule provides examples of restructures that we consider to be low-risk restructures and high-risk restructures.

Example 27 – low risk: restructuring to account for differing individual tax EBITDA of entities within a group

Diagram 25: Low risk: restructuring to account for differing individual tax EBITDA

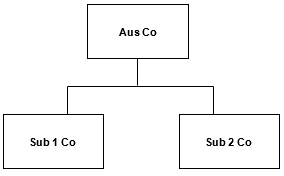

270. Aus Co, an Australian tax resident company, has 2 wholly owned subsidiaries, Sub 1 Co and Sub 2 Co, who are also Australian tax resident companies. The company has not entered into new debt financing in the current income year.

271. Under the thin capitalisation rules, Sub 2 Co's net debt deductions exceed its fixed ratio earnings limit.

272. Aus Co makes a choice to become the head company of an Australian tax consolidated group, the Aus Co Consolidated Group, with Sub 1 Co and Sub 2 Co identified as 2 subsidiary members of the consolidated group.

273. Due to the single entity rule, the Aus Co Consolidated Group's net debt deductions are below its fixed ratio earnings limit, and no debt deductions incurred with respect to any of the entities are disallowed.

274. This scenario is a low-risk restructure.

275. While consolidating has reduced the group's disallowed debt deductions, the group availed itself of a choice open to it and did not otherwise restructure its affairs to produce this result.

Example 28 – high risk: introducing debt to maximise debt deductions under the fixed ratio test

Diagram 26: High risk: introducing debt to maximise debt deductions under the fixed ratio test

276. Global Inc. is a foreign tax resident entity, and the ultimate parent entity of the International Group.

277. Aus Co, a wholly owned subsidiary company of Global Inc., is the only Australian tax resident entity of the International Group. Aus Co was an 'inward investment vehicle (general)' for the purposes of the former thin capitalisation rules, and a 'general class investor' for the purposes of the current thin capitalisation rules.

278. Finance Corp, a wholly owned foreign incorporated subsidiary entity of Global Inc., performs all treasury functions for the International Group.

279. Finance Corp provides Aus Co access to its common global group facility. Access is subject to the facility's terms of agreement, which state that interest accrues daily and is payable to Finance Corp for any outstanding drawdown of facility funds by an International Group entity, until repayment of such funds.

280. Since accessing the facility, Aus Co has, on average, annually incurred $3 million in net debt deductions. Under the former thin capitalisation rules, these amounts did not result in Aus Co having an excess debt amount.

281. Under the current thin capitalisation rules, Aus Co has a tax EBITDA of $30 million and annual net debt deductions of $3 million. No debt deductions are denied under the fixed ratio test as Aus Co's fixed ratio earnings limit is $9 million (30% × $30 million).

282. Aus Co restructures its capital in response to the current thin capitalisation rules. It undertakes a round robin financing with the result that Aus Co draws down a further $100 million from Finance Corp through the common global group facility.

283. The restructure does not result in any change to Aus Co's business operations, nor does it result in a material change in the International Group's global leverage. Aus Co's net debt deductions are still less than its fixed ratio earnings limit despite the additional interest expense incurred with respect to the further drawdowns.

284. This is a high-risk restructure.

285. The additional debt appears to have been introduced for the purpose of maximising debt deduction 'capacity' under the FRT and has no apparent commercial purpose. Aus Co may also need to consider the DDCR.

Example 29 – high risk: amending conduit financing interest rates

Diagram 27: High risk: amending conduit financing interest rates

286. Assume the same facts as Example 24 of this Guideline.

287. Two other member entities of the Group, Dev Co and Ops Co, each have separate long-term development projects underway that were financed through intercompany loans with the Group's treasury entity, Fin Co.

288. These intercompany loans are funded via external loans between Fin Co and third-party lenders. There are multiple external loans, and they comprise of a variety of interest rates and maturity dates.

289. While the entire quantum of the external loans is on-lent through the intercompany loans to Dev Co and Ops Co, none of the intercompany loans are entered into on the same terms as any of the external loan agreements. For example, none of the loans match in terms of tenor or interest rate.

290. Fin Co, Dev Co and Ops Co agree to formally amend the intercompany loan agreements. However, their terms are all changed to that of the highest interest rate of all the external loans.

291. This is a high-risk restructure.

292. The decision to adopt the highest interest rate indicates it was done to maximise debt deductions.

Your comments

293. This draft Guideline is being reissued to allow for comments on Schedule 3 and Schedule 4 only. Please read Schedule 3 and Schedule 4 of this Guideline in conjunction with Draft Taxation Ruling TR 2024/D3 Income tax: aspects of the third party debt test in Subdivision 820-EAB of the Income Tax Assessment Act 1997. You are invited to comment on Schedule 3 and Schedule 4 of this Guideline. Please forward your comments to the contact officer by the due date.