Draft Taxation Ruling

TR 2004/18DC

Income tax: capital gains: application of CGT event K6 (about pre-CGT shares and pre-CGT trust interests) in section 104-230 of the Income Tax Assessment Act 1997

-

Please note that the PDF version is the authorised version of this draft ruling.This is a draft version of the updated ruling – issued for public comment. A version which has the changes from the original version tracked is available in the PDF version of this document.

For information about the status of this draft ruling, see item 4172 on our Advice under development program.

| Contents | Para |

|---|---|

| What this draft Ruling is about | |

| Date of effect | |

| Ruling | |

| Explanation | |

| Definitions | |

| Your comments | |

| Detailed contents list |

| This is a draft consolidation outlining proposed changes to Taxation Ruling TR 2004/18 Income tax: capital gains: application of CGT event K6 (about pre-CGT shares and pre-CGT trust interests) in section 104-230 of the Income Tax Assessment Act 1997. These changes reflect the view that only one capital gain may arise in circumstances where paragraphs 104-230(2)(a) and 104-230(2)(b) are both satisfied, and clarify which property is taken into account in calculating the capital gain under subsection 104-230(6).

The Addendum which makes these changes, when finalised, will be a public ruling for the purposes of the Taxation Administration Act 1953.

This publication is a draft for public comment. It represents the Commissioner's preliminary view on how a relevant provision could apply. If this draft Ruling applies to you and you rely on it reasonably and in good faith, you will not have to pay any interest or penalties in respect of the matters covered, if this draft Ruling turns out to be incorrect and you underpay your tax as a result. However, you may still have to pay the correct amount of tax. |

What this draft Ruling is about

1. This draft Ruling[A1] considers the application of CGT event K6 in section 104-230 of the Income Tax Assessment Act 1997 (ITAA 1997).

2. CGT event K6 can result in capital gains (but not capital losses) if certain CGT events happen to pre-CGT shares in a 'private' company or pre-CGT interests in a 'private' trust where the market value of its post-CGT property is at least 75% of its net value ('the 75% test').

3. The Ruling deals with issues under the following topics:

- •

- what is meant by property, including what is meant by property acquired on or after 20 September 1985;

- •

- application of the 75% test;

- •

- calculation of the capital gain; and

- •

- interactions with other provisions of the ITAA 1997.

4. Whilst this Ruling considers the application of CGT event K6, the views expressed in the Ruling also apply, adapted as necessary, to the application of former section 160ZZT of the Income Tax Assessment Act 1936 (ITAA 1936).

5. This Ruling considers the application of CGT event K6 in the context of structures that comprise one or more companies. However, the views expressed in the Ruling also apply, adapted as necessary, to structures that comprise one or more trusts or a combination of companies and trusts.

6. A reference in this Ruling to a legislative provision is a reference to a provision in the ITAA 1997 unless otherwise indicated.

7. Key terms in this Ruling are defined in paragraph 196 of this Ruling. For ease of identification, those terms are in bold and italicised the first time they appear in this Ruling.

Class of person or arrangement

8. This Ruling is about how section 104-230 (CGT event K6) applies to persons who own pre-CGT shares in a company or pre-CGT interests in a trust if one of the CGT events in paragraph 104-230(1)(b) happens in relation to the shares or interests.

Date of effect

9. When finalised, it is proposed that this Ruling will apply to income years commencing both before and after its date of issue. However, the Ruling does not apply to taxpayers to the extent that it conflicts with the terms of settlement of a dispute agreed to before the date of issue of the Ruling (see paragraphs 75 to 76 of Taxation Ruling TR 2006/10 Public Rulings).

10. When finalised, it is proposed that the Ruling will note the following:

- •

- Changes made to this Ruling by the addendum which have published have been incorporated into this version of the Ruling. Refer to the addendum for details of how the addendum amended the Ruling, including the date of effect of the amendments.

- •

- Where the addendum applies before and after its date of issue, both the pre-addendum wording of the Ruling and the revised wording in the addendum apply prior to the issue date of the addendum. In these circumstances, entities can choose to rely on either version.

Ruling

What is meant by the term 'property' for CGT event K6 purposes?

12. The term 'property' has its ordinary legal meaning. It does not mean 'asset' or 'CGT asset'.

If a single item of property is treated as two or more CGT assets under Subdivision 108-D, how is the item treated for CGT event K6 purposes?

13. A single item of property that constitutes two or more CGT assets under Subdivision 108-D is treated as a single item of property.

When is an item of property that is a CGT asset acquired for CGT event K6 purposes?

14. The item of property is acquired, for the purposes of CGT event K6, at the time the ITAA 1936 or ITAA 1997 treats the CGT asset as having been acquired.

15. An exception applies where the CGT asset is treated as having been acquired post-CGT because of the operation of Division 149 of the ITAA 1997. In this case, the item of property continues to be treated as having been acquired pre-CGT for the purposes of CGT event K6.

16. The 75% test is satisfied only if one or both of the following tests are met:

- •

- the market value of property referred to in paragraph 104-230(2)(a) equals or exceeds 75% of the net value of the company;

- •

- the market value of property referred to in paragraph 104-230(2)(b) equals or exceeds 75% of the net value of the company.

17. Property, for the purposes of paragraph 104-230(2)(a), can include post-CGT shares in, or loans to, lower tier companies. The market value of property referred to in paragraph 104-230(2)(a) cannot be added to the market value of property referred to in paragraph 104-230(2)(b) to determine if the 75% test is satisfied.

What property is taken into account under paragraph 104-230(2)(b)?

18. The property taken into account under paragraph 104-230(2)(b) is post-CGT property that is owned by lower tier companies in which the company referred to in paragraph 104-230(2)(a) has a direct or indirect interest. If the company referred to in paragraph 104-230(2)(a) has a less than 100% interest in a lower tier company, only that percentage interest in the underlying post-CGT property is counted. It does not matter, for that purpose, whether the shares in the lower tier company giving rise to the interest were acquired pre-CGT or post-CGT.

19. However, the property taken into account does not include post-CGT shares owned by one lower tier company in another. As companies that satisfy the stock exchange listing requirements in paragraph 104-230(9)(a) (including the requirement that the company be listed continuously for at least five years) do not constitute lower tier companies, the property taken into account under paragraph 104-230(2)(b) includes shares in those listed companies owned by a lower tier company.

What assets and liabilities are taken into account for the purposes of working out the net value of a company?

20. The term 'assets' in the context of the expression 'net value' in subsection 104-230(2) means the property and other economic resources owned by the company that can be turned to account.

21. The term 'liabilities' in the context of the expression 'net value' has its ordinary meaning. It extends to a legally enforceable debt which is due for payment and to a presently existing obligation to pay either a sum certain or an ascertainable sum. It does not extend to a contingent liability or to a future obligation or expectancy.

What are the consequences of satisfying the 75% test?

21A. If the 75% test is satisfied (and the other requirements of subsection 104-230(1) are met), CGT event K6 happens. Only one capital gain may arise[A2] in relation to the CGT event. This is the case even if the 75% test is separately satisfied by both the property referred to in paragraph 104-230(2)(a) and the property referred to in paragraph 104-230(2)(b).

21B. The next step is the separate task of calculating the amount of the capital gain. This involves construing and applying subsection 104-230(6), which refers to 'the property referred to in subsection (2)' without qualification.

Calculation of the capital gain for CGT event K6

What property is taken into account in calculating the capital gain for CGT event K6 purposes?

22. The phrase 'the property referred to in subsection (2)' is a reference to all property described in paragraphs 104-230(2)(a) and (b), irrespective of whether a particular item of property is essential to the conclusion that the 75% test is satisfied. The statutory text does not direct one to have regard to only a subset of the property referred to in subsection 104-230(2).

How is the capital gain calculated for CGT event K6?

24. What constitutes a reasonable attribution of the capital proceeds for the purposes of calculating the capital gain under subsection 104-230(6) will depend on the facts in each case, and is to be informed by the legislative purpose to which section 104-230 is directed.[A3] This includes the purpose of bringing to account, as a capital gain, 'that part of the disposal proceeds ... that is attributable to an increase in the value of underlying property acquired on or after 20 September 1985'.[A4] No formula or other methodology can supplant the statutory requirement which merely provides that the attribution must be reasonable.

25. In most cases involving a single tier structure, the Tax Office considers that a reasonable attribution of the capital proceeds is achieved by applying the two-step approach outlined in paragraphs 27 to 33 though it is recognised this approach may not give the only reasonable attribution.

26. In the case of a single tier structure, the Tax Office will generally accept as reasonable, a CGT event K6 capital gain calculated under the two-step approach. However, what constitutes a reasonable attribution in any given case remains dependent on the facts of the case. In some cases the two-step approach may result in an attribution that is not reasonable, and therefore it would not be accepted. Such an outcome would arise where, for instance, the entity acquires a substantial asset fully funded by liabilities just prior to CGT event K6 being triggered with the intention of accessing a significantly reduced CGT event K6 capital gain under this approach.

Step 1 – determine how much of the capital proceeds actually relates to the post-CGT property

27. This step requires assumptions to be made about:

- •

- the extent to which the post-CGT property and the remaining property of the company, such as its pre-CGT property and trading stock, is reflected in the capital proceeds; and

- •

- how the liabilities in existence relate to the post-CGT property and the remaining property of the company.

28. The Tax Office will accept that:

- •

- the post-CGT property and the remaining property of the company is reflected in the capital proceeds on a proportional market value basis; and

- •

- the liabilities relate to the post-CGT property and the remaining property of the company on a proportional market value basis.

29. As a result, the capital proceeds relating to the post-CGT property could be determined as:

Step 1 amount = capital proceeds × market value of post-CGT property ÷ market value of all property

Where:

- •

- market value of post-CGT property is the sum of the market value of the post-CGT property taken into account under paragraph 104-230(2)(a); and

- •

- market value of all property is the sum of the market value of all property (including pre-CGT acquired property and trading stock) owned by the company.

30. It would be open to taxpayers to do a more refined analysis of either the extent to which the company's property is reflected in the capital proceeds or how the liabilities relate to the property of the company for the purposes of this step.

Step 2 – determine how much of the step 1 amount relates to the amount by which the market value of the post-CGT property exceeds the costs bases of that property

31. The Tax Office considers that the capital proceeds relating to the post-CGT property should be allocated on a reasonable basis between the original investment in the property and the overall unrealised gain on the property. It is considered that a reasonable allocation of the proceeds to the unrealised gain would be achieved by determining the proportion of gain on the post-CGT property to its market value, then applying that same proportion to the amount of proceeds attributable to the post-CGT property.

32. As a result, the amount of the CGT event K6 capital gain is determined under step 2 as:

Step 1 amount × market value excess ÷ market value of post-CGT property

Where:

- •

- market value excess is the excess of the market value of property taken into account under subsection 104-230(6) over the sum of the cost bases of that property.

33. If a capital gain calculated under step 2 exceeds the market value excess, the capital gain would be limited to the market value excess.

34. The principles underlying the approach for single tier structures would also be helpful in determining what constitutes a reasonable attribution of the capital proceeds in the case of a multi-tier structure.

35. In multi-tier structures, the process of reasonable attribution is complicated by having both the interests in lower tier entities and the property of lower tier entities (the underlying property) in the pool of property taken into account in calculating the capital gain. It is important to approach this process in a way that avoids attributing capital proceeds to both the interests and the underlying property. What constitutes a reasonable attribution in a multi-tier structure will depend on the facts in each case.

35A. In most situations, it would be reasonable to attribute the capital proceeds to the value of the underlying property, rather than to the value of interests in the lower tier entity. This approach ensures that consistent with the purpose of section 104-230, the pre- and post-CGT status of the underlying property is properly reflected in the calculation of the capital gain.

35B. However, there will be limited situations where it is reasonable to attribute the capital proceeds on the basis of interests in the lower tier entity, rather than the underlying property. For example, if a lower tier company holds post-CGT property that has increased in value but the shares in the lower tier company itself have no (or much lower) value for other reasons, it might not be reasonable to look through the lower tier company to attribute any part of the capital proceeds to the increased value of the underlying post-CGT property.[A5] This is because the increased value of that underlying property may have had no impact on the capital proceeds due to the counteracting effect of the other factors that have caused the lower tier company to have no value.

What company must satisfy the stock exchange listing requirements in paragraph 104-230(9)(a) for CGT event K6 not to happen?

36. The company referred to in paragraph 104-230(2)(a) must satisfy the stock exchange listing requirements for CGT event K6 not to happen under paragraph 104-230(9)(a).

37. If the company referred to in paragraph 104-230(2)(a), or a lower tier company, holds shares in a company that satisfies the stock exchange listing requirements in paragraph 104-230(9)(a) (including the requirement that the company be listed continuously for at least five years), the property owned by that listed company, along with the property owned by other companies in which it has a direct or indirect interest, does not constitute property which is taken into account under paragraph 104-230(2)(b). The post-CGT shares in the listed company will, however, constitute property which is taken into account either under paragraph 104-230(2)(a) or paragraph 104-230(2)(b).

Can section 116-30 substitute market value proceeds?

38. Yes. The market value substitution rule in section 116-30 can apply (see section 116-25).

Do depreciating assets have cost bases for the purpose of calculating the capital gain?

41. Yes. Depreciating assets have a cost base for this purpose.

Can subsection 110-45(2) apply to reduce the cost bases of depreciating assets for amounts deducted for their decline in value?

42. Yes. Subsection 110-45(2) can apply to reduce the cost base for amounts deducted for the decline in value.

Is the CGT discount in Division 115 potentially available for a capital gain made under CGT event K6?

43. Yes. The CGT discount is potentially available where:

- •

- CGT event K6 happened to a pre-CGT share owned by an individual, a complying superannuation entity, a trust or, in the circumstances set out in paragraph 115-10(d), a life insurance company: section 115-10;

- •

- the CGT event happened after 11.45 am (by legal time in the Australian Capital Territory) on 21 September 1999: section 115-15;

- •

- the cost base of property was not indexed for the purposes of calculating the capital gain under subsection 104-230(6): section 115-20;

- •

- the pre-CGT share in the company was acquired at least 12 months prior to the time of the CGT event: section 115-25; and

- •

- the CGT discount would have been available in relation to the majority of CGT assets (by cost and by value) owned by the company referred to in paragraph 104-230(2)(a) had those assets been owned by the shareholder for the same time they were owned by the company and been disposed of at the time CGT event K6 happened: sections 115-45 and 115-50 of the ITAA 1997.

Can small business CGT relief in Division 152 apply to a CGT event K6 capital gain?

44. Yes. Provided the pre-CGT shares referred to in paragraph 104-230(1)(a) are active assets within the meaning of section 152-40 and the other requirements of Division 152 are satisfied.

Interactions with other provisions

Can a choice be made to avoid the disregarding of a capital gain under subsection 104-230(10) in circumstances where a choice for scrip for scrip rollover would have been available had the shares been acquired post-CGT?

45. No. Subsection 104-230(10) operates automatically and the disregarding cannot be avoided.

If a capital gain is disregarded under subsection 104-230(10), what is the amount of the reduction required to the cost base and reduced cost base of the replacement share under subsection 124-800(2)?

46. The amount of the reduction is the amount of the CGT event K6 capital gain disregarded under subsection 104-230(10).

If the cost base and reduced cost base of a post-CGT replacement share is reduced under subsection 124-800(2) as a result of a capital gain being disregarded under subsection 104-230(10), is the CGT discount available if a CGT event happens to the share within 12 months of its acquisition?

47. No. The CGT discount is not available in these circumstances. A post-CGT replacement share, acquired in exchange for a pre-CGT original share, must be owned for at least 12 months to qualify for the CGT discount.

Can CGT event K6 happen when pre-CGT shares end under CGT event C2 on deregistration of a company in liquidation following its winding up?

48. Although CGT event K6 is theoretically capable of happening, it is most unlikely that the company would have any property of the kind referred to in subsection 104-230(2) just before the time CGT event C2 happens. That is, the company is highly likely to be a 'shell' at that stage.

49. In the unlikely event that CGT event K6 is attracted, section 118-20 of the ITAA 1997 reduces any capital gain under subsection 104-230(6) by the amount (if any) of the liquidator's distribution that is assessed as a dividend.

Explanation

This Explanation is provided as information to help you understand how the Commissioner's preliminary view has been reached. It does not form part of the proposed binding public ruling.

This Explanation is provided as information to help you understand how the Commissioner's preliminary view has been reached. It does not form part of the proposed binding public ruling.

50. The remaining paragraphs explain in turn each of the issues dealt with in the Ruling and, where relevant, outline alternative views on the application of CGT event K6.

What is meant by the term 'property' for CGT event K6 purposes?

51. The term 'property' is not defined for the purposes of CGT event K6 although trading stock is specifically excluded. Property in section 104-230 has its ordinary legal meaning (see ICI Australia Ltd v. Commissioner of Taxation;[1] Hepples v. Commissioner of Taxation;[2] R v. Toohey; Ex parte Meneling Station Pty Ltd;[3] Naval, Military and Airforce Club of South Australia Inc v. Commissioner of Taxation).[4]

52. The Macquarie Dictionary (3rd revised edn) defines 'property' to mean 'that which one owns; the possession or possessions of a particular owner'. The term 'property' in its context in section 104-230 is property owned by either the company referred to in paragraph 104-230(2)(a) or by lower tier companies.

53. It extends to any kind of property. It covers most CGT assets, including pre-CGT assets, but does not include a CGT asset that is not property. It can include such things as land and buildings, shares in a company, units in a unit trust, options, debts owed to the company, interests in assets and goodwill. Motor vehicles, in relation to which capital gains or capital losses are disregarded for CGT purposes, also constitute 'property'.

54. On the other hand the ordinary meaning of 'property' excludes personal rights such as a contractual right revocable at will by the other party: Austell Pty Ltd v. Commr of State Taxation (WA)[5] and, possibly, non assignable rights under an employment contract: Hepples v. Commissioner of Taxation.[6] It is judicially established that mining, quarrying or prospecting information is not property: Pancontinental Mining Ltd v. Commissioner of Stamp Duties,[7] and items such as future income tax benefits, whilst within the accounting definition of asset, are not property.

Alternative view: property should be construed as meaning the same as 'assets'

55. An alternative view is that property should be construed as meaning the same as 'assets', being property that can be applied to repay debts. The meaning of 'asset' does not correspond with the ordinary legal meaning of 'property'. Some things may constitute property, but not be an asset, and vice versa.

56. Proponents of the view that property means 'assets' argue that it achieves a 'like for like' comparison between 'property' and 'assets', as used in the net value calculation, in subsection 104-230(2), thereby reducing compliance costs for taxpayers.

57. The Tax Office does not accept this view because the legislature used the word property, not asset, which is a well understood term and is therefore preferred in the context of CGT event K6.

Alternative view: property means 'CGT assets'

58. Another alternative view is that property should be construed as meaning 'CGT assets'. The ordinary legal meaning of 'property' does not correspond with the definition of 'CGT asset', which extends to non-proprietary rights. Australian currency notes and coins ('cash') is a chattel and therefore 'property'.

59. Proponents of the view that property should be construed as meaning 'CGT assets' contend that this appropriately mirrors the capital gain that would arise if a CGT event had happened to the underlying property of the company. It is also argued that the use of the defined CGT terms 'acquired' and 'cost base' recognises the very close correspondence between 'property' and 'asset' as defined in section 160A of the ITAA 1936 when CGT was introduced in 1986.

60. The Tax Office does not accept this view because:

- •

- the legislature could easily have used, in former section 160ZZT of the ITAA 1936, the term 'asset', as defined in section 160A of that Act if this had been its intention;

- •

- when the concept of 'asset' for CGT purposes clearly diverged away from 'property', there were no changes made for former section 160ZZT or CGT event K6 purposes – for example, there was no change to section 160ZZT when the definition of 'asset' in section 160A was widened to include non-proprietary rights[8] nor was there any change when motor vehicles were included as 'CGT assets' in the 1997 Act CGT provisions; and

- •

- the use of defined CGT terms 'acquired' and 'cost base' does not necessarily signify that property is intended to refer to 'CGT assets' – the use of those terms merely indicates that they should be used in calculating the capital gain on underlying post-CGT property under subsection 104-230(6).

If a single item of property is treated as two or more CGT assets under Subdivision 108-D, how is the item treated for CGT event K6 purposes?

61. Subdivision 108-D treats a single asset as constituting two or more separate CGT assets in certain cases. For example, subsection 108-55(2) treats a building constructed on or after 20 September 1985 on land acquired before that date as being a separate CGT asset from the land even though, at common law, the building forms part of a single asset being the land.

62. An item of property that constitutes two or more CGT assets under Subdivision 108-D is nevertheless treated as a single item of property in section 104-230. This is because the term 'property' in section 104-230 takes its ordinary legal meaning and does not mean 'CGT assets'.

63. Patricia holds 100% of the pre-CGT shares in Y Co. Y Co owns a block of land which it acquired prior to 20 September 1985. It constructed a building on the land in 1995. The land and building are separate CGT assets under Subdivision 108-D. However the land and building are a single item of property acquired prior to 20 September 1985 for CGT event K6 purposes.

When is an item of property that is a CGT asset acquired for CGT event K6 purposes?

64. For CGT event K6 purposes, the item of property is taken to have been acquired at the time the ITAA 1936 or ITAA 1997 treats the CGT asset as having been acquired. Thus, for example, if a CGT asset is taken to have been acquired before 20 September 1985 under a roll-over provision within Parts 3-1 and 3-3, the item of property will also be taken to have been acquired before that date for CGT event K6 purposes.

65. An exception applies where the CGT asset is treated as having been acquired post-CGT because of the operation of Division 149. In this case, the item of property continues to be treated as having been acquired pre-CGT for the purposes of CGT event K6.

66. Continuing to treat the item of property as acquired pre-CGT is consistent with the objective of CGT event K6. As an anti-avoidance or transitional provision, it is designed to capture the accumulation of post-CGT acquired property in a company with pre-CGT shareholders. CGT event K6 is not targeted at the accumulation of property which is only deemed post-CGT acquired because of the operation of another anti-avoidance or transitional provision in Division 149.

67. Extending the context of the deeming in Division 149 to the operation of CGT event K6 could lead to one deemed result from an anti-avoidance provision adversely interacting with another deemed result from another anti-avoidance provision.

68. The 75% test is satisfied only if one or both of the following tests are met:

- •

- the market value of property referred to in paragraph 104-230(2)(a) equals or exceeds 75% of the net value of the company;

- •

- the market value of property referred to in paragraph 104-230(2)(b) equals or exceeds 75% of the net value of the company.

69. The use of the word 'or' between paragraphs 104-230(2)(a) and 104-230(2)(b) suggests that each of the requirements in those paragraphs must be tested independently. Ordinarily, the word 'or' is used disjunctively and invites consideration of two alternatives.

70. The Tax Office observes that such an interpretation may result in the 75% test being avoided by the placement of post-CGT property in a lower tier company rather than in the company in which the shares are held. The general anti-avoidance provisions in Part IVA of the ITAA 1936 may apply where this is done predominantly for the purpose of gaining a tax benefit. Also, any CGT assets acquired, or any liabilities discharged or released, may be disregarded under subsection 104-230(8) in working out the net value of the company in which the shares are held if the acquisition, or the discharge or release, was done for a purpose that included ensuring the 75% test was not satisfied.

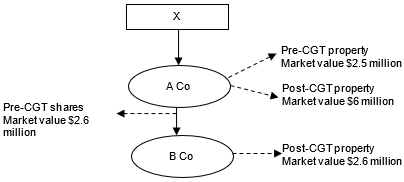

71. X acquired all of the shares of A Co (a private company manufacturer) before 20 September 1985. X sold those shares on 1 July 2001. Just before the time of disposal, A Co owned pre-CGT property and post-CGT property, including pre-CGT issued shares in B Co, another private company. The only property of B Co is post-CGT property. The market value of the property of both A Co and B Co at the date of sale is shown diagrammatically in Diagram 1 of this Ruling.

Diagram 1: Ownership of shares and property outlined in Example 2

72. The property referred to in paragraph 104-230(2)(a) does not satisfy the 75% test because the market value of post-CGT property in A Co does not equal or exceed 75% of the net value of A Co ($6 million ÷ $11.1 million = 54.05%). The property referred to in paragraph 104-230(2)(b) also does not satisfy the 75% test because the market value of the interest which A Co owns in post-CGT property through B Co does not equal or exceed 75% of the net value of A Co ($2.6 million ÷ $11.1 million = 23.42%).

73. The 75% test would have been satisfied if the property referred to in paragraph 104-230(2)(a) was counted with the property referred to in paragraph 104-230(2)(b) – that is, 54.05% + 23.42% = 77.47%.

74. Had the post-CGT property held by B Co instead been held by A Co, the post-CGT property held by A Co would have satisfied the 75% test.

Alternative view: 'or' should be construed conjunctively

75. An alternative view is that the word 'or' should be construed conjunctively, that is to mean 'and'. This is either because the draftsman made an error that would give a wholly unreasonable result as could not have been intended by the legislature (see R v. Oakes[9] cited with approval Ex parte Melvin)[10] or, in its context, the word 'or' should be given a conjunctive interpretation (see Gillespie v. Ford;[11] Minister for Immigration and Ethnic Affairs v. Baker;[12] Unity APA Ltd v. Humes Ltd (No. 2);[13] Ormerod v. Blaslov;[14] The Electricity Trust of South Australia v. Krone (Australia) Technique Pty Ltd).[15]

76. The Tax Office does not accept this view because:

- •

- the ordinary meaning of 'or' is a disjunctive interpretation and this does not produce a wholly unreasonable result, even if it does result in certain potentially anomalous outcomes; and

- •

- literally, the conjunctive interpretation would result in inappropriate double counting of post-CGT shares in lower tier companies and post-CGT property of those companies – while this might be avoided by implicitly disregarding the shares, such an approach has not been drafted and arguably cannot be read in.

Alternative view: single test for multi-tier structures

77. Another alternative view is that the 75% test is satisfied in a multi-tier structure only if the property referred to in paragraph 104-230(2)(b) equals or exceeds 75% of the net value of the company.

78. Proponents of this view argue that the reference in paragraph 104-230(1)(d) to 'the applicable requirement in subsection (2)' being satisfied indicates an intention on the part of the legislature for the paragraph 104-230(2)(a) requirement to apply only to single tier structures and the paragraph 104-230(2)(b) requirement to apply to multi-tier structures.

79. The Tax Office does not accept this view because:

- •

- it would produce absurd results – a shareholder in a single tier structure could minimise or eliminate their CGT event K6 liability by having the company referred to in paragraph 104-230(2)(a) create a lower tier company prior to the event happening; and

- •

- it is inconsistent with the interpretation that applied under former section 160ZZT of the ITAA 1936 and section 1-3 ensures the use of different words in section 104-230 are not taken to result in a different meaning.

What property is taken into account under paragraph 104-230(2)(b)?

80. The property to which paragraph 104-230(2)(b) refers is the post-CGT property in lower tier companies in which the company referred to in paragraph 104-230(2)(a) has a direct or indirect interest, other than property that consists of post-CGT shares held by a lower tier company in another lower tier company. This 'look through' approach effectively ignores the post-CGT shares in lower tier companies and looks to the underlying post-CGT property owned by those companies.

81. The Tax Office considers that the reference in paragraph 104-230(2)(b) to 'interests the company owned through interposed companies in property' directs attention to the proportionate interest which the company referred to in paragraph 104-230(2)(a) owns in the underlying post-CGT property of the lower tier companies. Whether the shareholdings representing those interests were acquired pre-CGT or post-CGT is irrelevant.

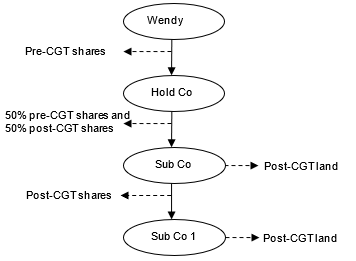

82. Wendy owns all of the shares, being pre-CGT shares, in Hold Co. Hold Co owns all of the shares in Sub Co, with 50% of the shares being pre-CGT shares and the remaining 50% being post-CGT shares. Sub Co owns property consisting of post-CGT land and all of the shares in Sub Co 1, those shares also being post-CGT shares. Sub Co 1 in turn also owns property consisting of post-CGT land.

Diagram 2: Ownership of shares and property outlined in Example 3

83. If Wendy were to sell her pre-CGT shares in Hold Co, the property that would be taken into account under paragraph 104-230(2)(b) would be the post-CGT land in Sub Co and the post-CGT land in Sub Co 1 (assuming the post-CGT land was not trading stock in the hands of Sub Co and Sub Co 1).

84. The post-CGT shares that Sub Co owns in Sub Co 1 would not be taken into account under paragraph 104-230(2)(b). This is because those shares are 'looked through' to the underlying post-CGT property owned by Sub Co 1.

85. If Hold Co instead owned 70% of the shares in Sub Co, with five-sevenths of those shares being post-CGT shares and the remaining two-sevenths being pre-CGT shares, the property taken into account under paragraph 104-230(2)(b) would be the proportionate interest that Hold Co has in the underlying property owned by Sub Co and Sub Co 1 – that is, 70% of the market value of both the post-CGT land in Sub Co and the post-CGT land in Sub Co 1 would be taken into account under paragraph 104-230(2)(b). The fact that two-sevenths of the shares owned by Hold Co were pre-CGT shares is irrelevant.

86. Alternative views relating to what property is taken into account under paragraph 104-230(2)(b) are:

- •

- only the post-CGT interests which the company referred to in paragraph 104-230(2)(a) owns in post-CGT property of lower tier companies;

- •

- where a company referred to in paragraph 104-230(2)(a) has post-CGT shares in a lower tier company, all post-CGT property in that lower tier company, as well as in tiers of lower tier companies below that particular lower tier company, is disregarded; or

- •

- post-CGT shares in a lower tier company are not disregarded to the extent that the property owned by that company is pre-CGT property or trading stock.

87. Under the first alternative view, the property taken into account under paragraph 104-230(2)(b) in Example 3 of this Ruling, using the first set of facts, would be 50% of the market value of both the post-CGT land in Sub Co and the post-CGT land in Sub Co 1. This is because Hold Co has a 50% post-CGT interest in the post-CGT property of Sub Co and a 50% post-CGT interest (50% × 100%) in the post-CGT property of Sub Co 1.

88. Under the second alternative view, no property would be taken into account under paragraph 104-230(2)(b) using the first set of facts in Example 3 of this Ruling. The post-CGT land owned in Sub Co and Sub Co 1, as well as the post-CGT shares that Sub Co owned in Sub Co 1, would not constitute post-CGT property that is taken into account under paragraph 104-230(2)(b). However, the post-CGT shares held by Hold Co in Sub Co would be taken into account under paragraph 104-230(2)(a).

89. The third alternative view ignores the post-CGT shares in lower tier companies but not if the property held by the company is pre-CGT property or trading stock, as there can be no 'double counting' in that regard. Using the first set of facts in Example 3 of this Ruling, this would mean Sub Co's post-CGT shareholding in Sub Co 1 would be taken into account under paragraph 104-230(2)(b) if the land held by Sub Co 1 was pre-CGT rather than post-CGT, or was trading stock.

90. These alternative views are not accepted because, as a matter of grammatical construction, the word 'were' would have been used in paragraph 104-230(2)(b) instead of the word 'was' if a reference to post-CGT interests in property of a lower tier company, or the post CGT interests in a lower tier company, had been intended. More generally, the view of the Tax Office is that the proposed 'look through' approach to underlying post-CGT property (not being shares in lower tier companies where there is the potential for the property of such companies to be counted), directly fulfils the legislative purpose of section 104-230.[16]

What assets and liabilities are taken into account for the purposes of working out the net value of a company?

91. In determining whether the post-CGT value in a company is sufficient such that a CGT event happening to pre-CGT shares in that company should give rise to tax consequences, the legislature has chosen to compare the value of post-CGT property with the 'net value' of the company. The expression 'net value' used in subsection 104-230(2) is defined in subsection 995-1(1) to mean, for an entity, 'the amount by which the sum of the market values of the assets of the entity exceeds the sum of its liabilities'.

92. It can easily be appreciated that a company which is very highly geared may have a net value (say $10 million) which is very small compared to the value of its assets (say $200 million). As such, it may have post-CGT property (say $8 million) with a value in excess of 75% of the net value of the company, and so pre-CGT shares in that company may be subject to CGT event K6. This is so even though the post-CGT property represents only a small proportion (4%) of the company's total assets.

93. 'Assets' is not defined for the net value definition. Accordingly, the term has its ordinary meaning in the context in which it is used.

94. In the context of section 104-230, the term means property according to ordinary concepts as well as the other economic resources of the company that it is capable of turning to account, even if they are not property.

Alternative view: accounting meaning of 'assets'

95. An alternative view is that in the context of section 104-230, 'assets' has its accounting meaning. For the purpose of preparing general purpose financial statements Statement of Accounting Concepts 4 (SAC 4) defines 'assets' at paragraph 14 as 'future economic benefits controlled by an entity as a result of past transactions or other past events'.

96. There are insufficient contextual factors in the legislation to warrant adopting that meaning. This contrasts with the views expressed in Taxation Ruling TR 2002/20 Income tax: Thin Capitalisation – Definitions of assets and liabilities for the purposes of Division 820 where it was stated that the term 'assets', when used in the thin capitalisation provisions in Division 820, is to have its accounting meaning. However, the broad and specific contextual factors present in Division 820 collectively support the conclusion that the accounting definition was intended to apply throughout that Division. These factors are not present in section 104-230.

97. 'Liabilities' is also not defined for the net value definition. Accordingly, the term has its ordinary meaning in context.

98. The Macquarie Dictionary (3rd revised edn) defines liability to mean: 'an obligation, especially for payment; debt or pecuniary obligations (opposed to asset)'.

99. In the context of section 104-230, the term 'liabilities' extends to legally enforceable debts due for payment and to presently existing obligations to pay either a sum certain or ascertainable sums. It does not extend to contingent liabilities, future obligations or expectancies.

Alternative view: accounting meaning of 'liabilities'

100. An alternative view is that in the context of section 104-230, 'liabilities' has its accounting meaning. SAC 4 defines liabilities as 'future sacrifices of economic benefits that the entity is presently obliged to make to other entities as a result of past transactions or other past events'.

101. In the context of CGT event K6, it is considered that the term 'liabilities' should not have its accounting meaning as, unlike the thin capitalisation provisions in Division 820 where the term has its accounting meaning, there are insufficient contextual factors for that interpretation in CGT event K6.

What are the consequences of satisfying the 75% test?

101A. Once the 75% test is satisfied (and the other requirements of section 104-230(1) are met), CGT event K6 happens. Only one capital gain may arise[17], even if the 75% test is separately satisfied by both the property referred to in paragraphs 104-230(2)(a) and the property referred to in paragraph 104-230(2)(b). This conclusion is consistent with both the wording used in subsection 104-230(6) (which provides that an entity 'makes a capital gain') and the general scheme of the CGT provisions.

Calculation of the capital gain for CGT event K6

What property is taken into account in calculating the capital gain for CGT event K6 purposes?

102. The property taken into account under subsection 104-230(6) is the property referred to in paragraph 104-230(2)(a) and the property referred to in paragraph 104-230(2)(b). This is irrespective of whether the 75% test is satisfied by the property referred to in only one of those paragraphs, or separately satisfied by the property referred to in both of those paragraphs.

103. The 75% test is a threshold test which determines whether the provision has application. As a result, the property taken into account under subsection 104-230(6) is not governed by what property satisfied the 75% test.

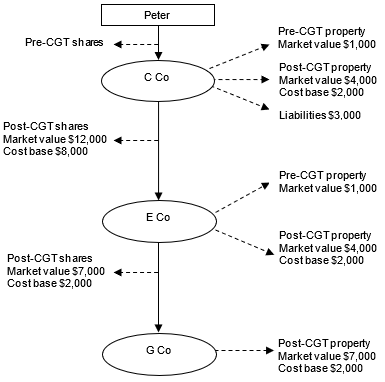

106. Peter owns all of the shares, being pre-CGT shares, in C Co. C Co owns pre-CGT and post-CGT property, including post-CGT shares in the lower tier company E Co. E Co owns pre-CGT and post-CGT property, including post-CGT shares in the lower tier company G Co. G Co owns only post-CGT property.

Diagram 3: Ownership of shares and property outlined in Example 4

107. If Peter were to sell his pre-CGT shares in C Co, both the property referred to in paragraph 104-230(2)(a) [($4,000 + $12,000) ÷ $14,000 = 114.29%] and the property referred to in paragraph 104-230(2)(b) [($4,000 + $7,000) ÷ $14,000 = 78.57%] would each separately satisfy the 75% test. The post-CGT property in paragraph 104-230(2)(b) consists only of the underlying property in E Co and G Co. The post-CGT shares which E Co owns in G Co are not treated as property for the purposes of paragraph 104-230(2)(b).

108. As the 75% test (and other preconditions under subsection 104-230(1)) are satisfied, CGT event K6 happens. In calculating the capital gain under subsection 104-230(6), Peter must take into account all of the property referred to in subsection 104-230(2). See paragraphs 116 to 130 of this Ruling for an explanation concerning the calculation of the capital gain under subsection 104-230(6).

109. Assume now that the underlying post-CGT property in G Co consists mostly of trading stock which is specifically excluded from property in paragraph 104-230(2)(b). The property referred to in paragraph 104-230(2)(a) still satisfies the 75% test but assume that the property referred to in paragraph 104-230(2)(b) now does not. Peter still takes into account all the property referred to in subsection 104-230(2) (including the property referred to in paragraph 104-230(2)(b)) in calculating his capital gain under subsection 104-230(6).

Alternative view: property that satisfied the 75% test

110. An alternative view is that if the property referred to in either paragraph 104-230(2)(a) or 104-230(2)(b) (but not both) satisfies the 75% test, the property taken into account is that referred to in the paragraph for which the 75% test is satisfied.

110A. If the property referred to in each of paragraphs 104-230(2)(a) and 104-230 (2)(b) separately satisfies the 75% test, the property in each paragraph is separately taken into account under subsection 104-230(6) with the result that two capital gains may arise under that subsection. In these circumstances, proponents of this view argue that the lesser capital gain be disregarded to avoid a double application of the provision.

112. The Tax Office considers that:

- •

- The context of section 104-230 does not indicate a link between the property which satisfies the 75% test in paragraph 104-230(2) and the property which is taken into account in calculating the capital gain for subsection 104-230(6) purposes. The wider purpose of section 104-230 supports the proposition that regard should be had to all 'property referred to in subsection 104-230(2)' (that is, all post-CGT property whether held directly or through interposed companies or trusts).

- •

- The function of the word 'or' in subsection 104-230(2) is to make it sufficient that either the property referred to in 104-230(2)(a) or the interests referred to in 104-230(2)(b) have an aggregate market value of at least 75% of the net value of the relevant company or trust. Subsection 104-230(6) simply refers to what is 'the property referred to in subsection (2)'. Subsection 104-230(6)'s wording does not direct attention to whether the property referred to has caused the 75% test to be satisfied.

Alternative view: more specific test for multi-tier structures

113. Another alternative view is that the property referred to in paragraph 104-230(2)(b) is the more relevant and more specific test to be applied in the case of a multi-tiered structure. As a result, it is argued that only the property referred to in paragraph 104-230(2)(b) should be taken into account in calculating the capital gain in cases where the property in each paragraph separately satisfies the 75% test.

114. Proponents of this view argue that adopting this approach ensures that gains relating to trading stock and pre-CGT assets held in lower tier companies are not indirectly taxed as a result of taking into account as property the shares in lower tier companies under paragraph 104-230(2)(a).

115. The Tax Office does not accept this view because:

- •

- the property referred to in one paragraph is not considered to be any more relevant or specific than the property which is referred to in the other paragraph; and

- •

- it would produce absurd results – a shareholder could minimise or eliminate their CGT event K6 liability by arranging that lower tier companies are present, but hold only low value property having little or no unrealised gain.

How is the capital gain calculated for CGT event K6?

116. Subsection 104-230(6) provides that you make a capital gain equal to that part of the capital proceeds from the share which is reasonably attributable to the amount by which the market value of property referred to in subsection 104-230(2) exceeds the sum of the cost bases of that property.

117. The legislation provides the reasonableness requirement as the way that an amount of capital proceeds is to be attributed to the market value excess on the post-CGT property. Reasonable attribution is to be informed by the legislative purpose to which section 104-230 is directed.[18] This includes the purpose of bringing to account, as a capital gain, 'that part of the disposal proceeds ... that is attributable to an increase in the value of underlying property acquired on or after 20 September 1985'.[19]

119. What constitutes a reasonable attribution will depend on the facts of each case and no formula or other methodology can supplant the statutory requirement which merely provides that the attribution must be reasonable. It is possible that, on the facts of a given case, more than one amount might be considered 'reasonable'.

Reasonable attribution – single tier structures

120. The Tax Office considers that the principles underpinning the two-step approach outlined in paragraphs 27 to 33 are legislatively supported by the wording of subsection 104-230(6). As a result, in the case of a single tier structure, the Tax Office will normally accept as reasonable the CGT event K6 capital gain calculated under this approach.

121. This does not override the principle that what constitutes a reasonable attribution in any given case will depend on the facts of that case. In some cases, the two-step approach may not lead to a reasonable attribution.

122. Such a result may not be common but could arise where, for instance, the entity acquires a substantial asset fully funded by liabilities just prior to CGT event K6 being triggered with the intention of accessing, by a swamping effect, a significantly reduced CGT event K6 capital gain under this approach. In these circumstances, the result would be unreasonable as the acquisition of the debt funded asset would materially distort the amount of capital proceeds allocated to existing post-CGT property under step 1 without affecting the overall amount of capital proceeds received.

123. Step one of the approach requires determining how much of the capital proceeds actually relates to the post-CGT property. For the purposes of applying that step, the Tax Office will accept that:

- •

- the post-CGT property and the remaining property of the company, such as its pre-CGT property and trading stock, is reflected in the capital proceeds on a proportional market value basis; and

- •

- the liabilities relate to the post-CGT property and the remaining property of the company on a proportional market value basis.

124. However, it would be open to taxpayers to do a more refined analysis of either the extent to which the company's property is reflected in the capital proceeds or how the liabilities relate to the property of the company. Such an approach could be adopted where, for instance, a taxpayer could demonstrate that the capital proceeds were reduced to take account of potential future tax liabilities on post-CGT property or where the taxpayer could demonstrate that certain liabilities related to particular items of property.

125. Step two requires determining what part of the capital proceeds relating to the post-CGT property is attributable to the market value excess on that property. The amount attributable to the market value excess is dependent on whether the capital proceeds in relation to the post-CGT property could be considered to relate:

- •

- firstly, to the gain component of the property; or

- •

- to the total market value of the property, comprising both a cost base component and a gain component.

126. The Tax Office considers that allocating the capital proceeds firstly to the gain component of the property is inappropriate as the capital proceeds should be allocated on a reasonable basis between the original investment in the property and the overall unrealised gain on the property. It is considered that a reasonable allocation of the proceeds to the unrealised gain would be achieved by determining the proportion of gain on the post-CGT property to its market value, then applying that same proportion to the amount of proceeds attributable to the post-CGT property.

127. Where the capital proceeds received from the sale of pre-CGT shares reflects a premium that has been paid over the market value of the company's property, the capital gain calculated under step 2 may exceed the market value excess. In those cases, the capital gain is limited to the market value excess.

Reasonable attribution – multi-tier structures

128. The principles underlying the approach for single tier structures would also be helpful in determining what constitutes a reasonable attribution of the capital proceeds in the case of a multi-tier structure.

130A. In multi-tier structures, the process of reasonable attribution is complicated by having both the interests in lower tier entities and the property of lower tier entities (the underlying property) in the pool of property taken into account in calculating the capital gain. It is important to approach this process in a way that avoids attributing capital proceeds to both the interests and the underlying property.

130B. What constitutes a reasonable attribution in a multi-tier structure will depend on the facts in each case and is to be informed by legislative purpose to which section 104-230 was directed. The Tax Office considers (having regard to the reference to 'underlying property' in the Explanatory Memorandum[20] and in former section 160ZZT of the ITAA 1936, and the requirement in section 104-230 to look through 'interposed' companies or trusts) that the legislature intended to focus attention on the property from which any interests in lower tier entities derived their value rather than the interests themselves.

130C. Consistent with this intention, it would generally be reasonable to attribute the capital proceeds to the value of the underlying property, rather than to the value of interests in the lower tier entity. This approach ensures that consistent with the purpose of section 104-230, the pre and post-CGT status of the underlying property is properly reflected in the calculation of the capital gain.

130D. However, there will be limited situations where it is reasonable to attribute the capital proceeds on the basis of interests in the lower tier entity, rather than the underlying property. For example, if a lower tier company holds post-CGT property that has increased in value but the shares in the lower tier company itself have no (or much lower) value for other reasons, it might not be reasonable to look through the lower tier company to attribute any part of the capital proceeds to the increased value of the underlying post-CGT property.[21] This is because the increased value of the property may have had no impact on the capital proceeds due to the counteracting effect of the other factors that have caused the lower tier company to have no value.

131. Min Co is a privately owned mining exploration company. Its sole shareholder, John, acquired all of his shares pre-CGT. Just before John disposed of all of his shares for $810,000, Min Co held the following property all of which was post-CGT acquired except for the Mining tenement – QLD. Min Co also had liabilities of $40,000.

| Property | Market value | Cost base |

|---|---|---|

| Debtors | $20,000 | $20,000 |

| Loans | $45,000 | $45,000 |

| Cash at bank | $15,000 | $15,000 |

| Mining tenement – QLD (pre-CGT) | $240,000 | $220,000 |

| Mining tenement – SA | $260,000 | $125,000 |

| Depreciating assets | $40,000 | $50,000 |

| Land and buildings | $230,000 | $260,000 |

| Totals | $850,000 | $735,000 |

132. As Min Co is a single tier structure, John may calculate his capital gain under the two-step approach.

Step 1 – capital proceeds relating to the post-CGT property

133. John has assumed that the post-CGT property and the pre-CGT property is reflected in the capital proceeds on a proportional market value basis. As John is unaware of what property the liabilities relate to, John has assumed that the liabilities relate to the post-CGT property and the pre-CGT property on a proportional market value basis. As a result, the capital proceeds relating to the post-CGT property could be determined as:

Step 1 amount = Capital proceeds × Market value of post-CGT property ÷ Market value of all property

= $810,000 × $610,000 ÷ $850,000

= $581,294

Step 2 – allocating the step 1 amount to the market value excess

134. Step 2 involves allocating the capital proceeds relating to the post-CGT property between the cost base of that property and the market value excess of that property on a reasonable basis. This can be done by firstly determining the proportion of gain on the post-CGT property to its market value, then applying that same proportion to the amount of proceeds attributable to the post-CGT property. As a result, the amount of the CGT event K6 capital gain is determined under step 2 as:

Step 1 amount × Market value excess ÷ Market value of post-CGT property

= $581,294 × $95,000 ÷ $610,000

= $90,529

136. In working out the market value excess, both the depreciating assets and the land and buildings are taken into account even though their market value is less than their cost base. This is because the post-CGT property taken into account in calculating the capital gain is not limited to the property which would yield a capital gain relative to its market value just before the time of CGT event K6.

137. Brew Co is a privately owned boutique brewing company the sole shareholder in which, Mark, acquired all of his shares pre-CGT. On 1 May 2000, following an offer from a major competitor, Mark disposed of all of his shares in Brew Co for $1,020,000. Just before that time, Brew Co had post-CGT property with a market value of $800,000 and cost base of $400,000 and pre-CGT property with a market value of $200,000 and cost base of $100,000. Brew Co also had liabilities of $50,000. The capital proceeds of $1,020,000 represented a premium of $70,000 over the net value of Brew Co and reflected the premium paid by the purchaser to remove a competitor from the market.

138. As Brew Co is a single tier structure, Mark may calculate his capital gain under the two-step approach.

Step 1 – capital proceeds relating to the post-CGT property

139. Mark has assumed that the post-CGT property and the pre-CGT property is reflected in the capital proceeds on a proportional market value basis. However, as Mark is able to show that the liabilities relate solely to the post-CGT property, the capital proceeds relating to the post-CGT property could be determined as:

Step 1 amount = Gross proceeds relating to post-CGT property −Liabilities

= ($800,000 ÷ $1,000,000 × $1,070,000) −$50,000

= $806,000

Step 2 – allocating the step 1 amount to the market value excess

140. Step 2 involves allocating the capital proceeds relating to the post-CGT property between the cost base of that property and the market value excess of that property on a reasonable basis. This can be done by determining the proportion of gain on the post-CGT property to its market value, then applying that same proportion to the amount of proceeds attributable to the post-CGT property. As a result, the amount of the CGT event K6 capital gain is determined under step 2 as:

Step 1 amount × Market value excess ÷ Market value of post-CGT property

= $806,000 × $400,000 ÷ $800,000

= $403,000

141. As the capital gain exceeds the market value excess ($400,000), the capital gain is limited to $400,000.

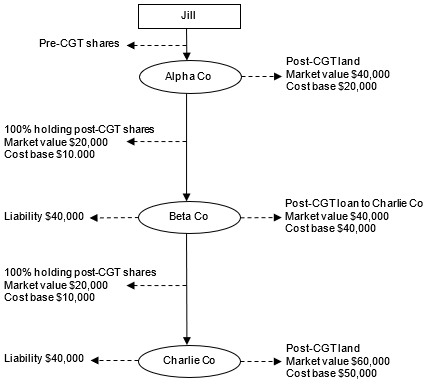

142. Jill owns all the shares in Alpha Co which she acquired pre-CGT. In March 2002, Jill sells all her shares for $60,000 under an arms length dealing with a third party purchaser. At that time, Alpha Co owned two items of property, which it acquired post-CGT, being a block of land, which had a cost base of $20,000 and a market value of $40,000, and a 100% interest in Beta Co, which had a cost base of $10,000 and a market value of $20,000.

143. Beta Co owned two items of property, both of which it acquired post-CGT, being a 100% interest in Charlie Co, which had a cost base of $10,000 and a market value of $20,000, and a loan to Charlie Co which had a cost base and market value of $40,000. Beta Co also had liabilities to external parties of $40,000.

144. Charlie Co owned one item of property, being a block of land, which it acquired post-CGT. The land had a cost base of $50,000 and a market value of $60,000. Charlie Co also had a liability of $40,000 owing to Beta Co.

Diagram 4: Ownership of shares and property outlined in Example 7

145. The property referred to in paragraph 104-230(2)(a) [($40,000 + $20,000) ÷ $60,000 = 100%] and the property referred to in paragraph 104-230(2)(b) [($40,000 + $60,000) ÷ $60,000 = 166.67%] each separately satisfies the 75% test. Accordingly, CGT event K6 happens.

146. In calculating the capital gain, Jill may undertake an attribution in any way that is reasonable. In this relatively simple multi-tier scenario, Jill may use a modified version of the two-step approach (but the application of this method will not always result in a reasonable attribution in multi-tier scenarios).

147A. Whichever method she uses, Jill should retain records which document the process she undertakes, including any assumptions she makes.

Step 1 – capital proceeds relating to the post-CGT property

148. Jill assumes that the post-CGT property is reflected in the capital proceeds on a proportional market value basis.

148A. Accordingly, the capital proceeds of $60,000 relates to:

- •

- the post-CGT land owned by Alpha Co ($40,000)

- •

- the post-CGT shares Alpha Co owns in Beta Co ($20,000).

148B. However, the $20,000 component of the capital proceeds that relates to the shares in Beta Co also relates to any underlying property owned (directly or indirectly) by Beta Co. In this case, there is only one such item, being the land held by Beta Co's subsidiary Charlie Co.

148C. In a multi-tier structure, it is generally appropriate to attribute the capital proceeds to the underlying property and not to shares in lower-tier entities. There is nothing in the facts that would suggest that a departure from this general approach is warranted in this case.

148D. Accordingly, the $60,000 capital proceeds are reasonably attributable to the following items of property:

- •

- post-CGT land owned by Alpha Co ($40,000)

- •

- post-CGT land owned by Charlie Co ($20,000).

Step 2 – allocating the step 1 amount to the market value excess

149. Step 2 involves allocating the capital proceeds relating to the post-CGT property between the cost base of that property and the market value excess of that property on a reasonable basis.

149A. Of the $40,000 in capital proceeds that is attributable to the land owned by Alpha Co:

- •

- $20,000 is attributable to the market value excess,

- •

- the remaining $20,000 is attributable to the cost base value.

149B. Of the $20,000 in capital proceeds that is attributable to the land owned by Charlie Co:

- •

- $3,333 is attributable to the market value excess [$20,000 × ($60,000 −$50,000) ÷ $60,000)],

- •

- the remaining $16,667 is attributable to the cost base value [$20,000 × $50,000 ÷ $60,000].

149C. It follows that the amount of the capital proceeds that are reasonably attributable to the market value excess of the post-CGT property is $23,333 ($20,000 + $3,333).

149D. This is the amount of the capital gain.

156. The following points are made about the reasonable attribution used in calculating the capital gain:

- (a)

- The object of the reasonable attribution is to bring to account as a capital gain that part of the disposal proceeds of shares in a company which is attributable to an increase in the value of the company's underlying property acquired on or after 20 September 1985 (page 139 of the Explanatory Memorandum to the Income Tax Assessment Amendment (Capital Gains) Bill 1986). In subsection 104-230(6) the concept of 'an increase in the value of the company's underlying property acquired on or after 20 September 1985' is expressed as the amount by which 'the market value of the property referred to in subsection [104-230](2)' is more than 'the sum of the cost bases of that property'. This is referred to in this Ruling as the 'market value excess'.

- (b)

- The reasonable attribution applies to the post-CGT property as a whole rather than to each item of post-CGT property separately. The reference to 'the sum of the cost bases of that property' in subsection 104-230(6) supports this approach.

- (c)

- In calculating the amount of any capital gain, the reasonable attribution takes into account all items of property irrespective of whether the market value of each separate item of property is greater or less than the cost base of that item.

- (d)

- For the purposes of subsection 104-230(6), the 'market value' of the property is determined just before the time of CGT event K6 and is the price at which the property could be expected to be bought and sold as between a willing but not anxious seller and a willing but not anxious buyer: Spencer v. The Commonwealth (1907) 5 CLR 418 at 441; Building and Civil Engineering Holidays Scheme Management, Ltd v. Post Office [1965] 1 All ER 163 at 169.

- (e)

- Views might differ on how much of the capital proceeds from the shares is reasonably attributable to the market value excess. If a dispute arises it is ultimately a matter for the courts to determine how much of the capital proceeds from the shares is reasonably attributable to the market value excess.

What company must satisfy the stock exchange listing requirements in paragraph 104-230(9)(a) for CGT event K6 not to happen?

160. To calculate the amount of a CGT event K6 capital gain, it is necessary to obtain information concerning the market value and pre-CGT or post-CGT status of property held in both the company referred to in paragraph 104-230(2)(a) and in lower tier companies. For this reason, CGT event K6 is limited in its application to companies that do not satisfy certain stock exchange listing requirements outlined in paragraph 104-230(9)(a). This ensures that in most cases it is not necessary to ascertain what property is held in widely held listed companies.

161. It has been argued that the reference in paragraph 104-230(9)(a) to 'a company referred to in subsection (2)' is not limited to the company referred to in paragraph 104-230(2)(a) but also extends to the 'interposed companies' referred to in paragraph 104-230(2)(b). As a result, it is argued CGT event K6 does not happen upon a sale of pre-CGT shares in a company which has substantial post-CGT property if the company owns as little as one share in a company that satisfies the stock exchange listing requirements.

162. The Tax Office does not accept this argument because:

- •

- it would produce absurd results; and

- •

- it is inconsistent with the interpretation that applied under former section 160ZZT of the ITAA 1936 and section 1-3 ensures the same interpretation under CGT event K6.

Property owned by listed companies

163. Where the company referred to in paragraph 104-230(2)(a), or a lower tier company, holds shares in a company that satisfies the stock exchange listing requirements in paragraph 104-230(9)(a) (including the requirement that the company be listed continuously for at least five years), the property owned by that listed company, along with the property owned by other companies in which it has a direct or indirect interest, does not constitute property which is taken into account under paragraph 104-230(2)(b).

164. The property is disregarded as the Tax Office does not consider that the listed company, as well as any companies in which it has a direct or indirect interest, constitute 'interposed companies' as that term is used in paragraph 104-230(2)(b). Having regard to the objective of CGT event K6 and the information required for a CGT event K6 calculation, it is considered that the provision does not extend to the accumulation of post-CGT acquired property in a listed company or in other companies in which the listed company has a direct or indirect interest. The post-CGT shares in the listed company will however constitute property which is taken into account either under paragraph 104-230(2)(a) or paragraph 104-230(2)(b).

Can section 116-30 substitute market value proceeds?

165. The term 'capital proceeds' is defined in subsection 995-1(1) to have the meaning given by Division 116. Division 116 contains the general rules about capital proceeds as well as the modifications to the general rules that apply for each CGT event. The table in section 116-25 states that modification 1, being the market value substitution rule, applies to CGT event K6.

Do depreciating assets have cost bases for the purpose of calculating the capital gain?

168. CGT event K6 operates by comparing the market values of certain post-CGT property with the cost bases of that property. Property includes depreciating assets.

169. Whilst gains or losses arising upon the disposal of depreciating assets are not worked out under Parts 3-1 and 3-3, depreciating assets are nevertheless CGT assets. As the term 'cost base' is defined in Subdivision 110-A in relation to a CGT asset, it follows that depreciating assets continue to have cost bases for the purposes of applying section 104-230. This is so even though balancing adjustment amounts from depreciating assets are worked out having regard to their Division 40 cost.

Can subsection 110-45(2) apply to reduce the cost bases of depreciating assets for amounts deducted for their decline in value?

170. Broadly, subsection 110-45(2) prevents expenditure from forming part of the cost base of an asset acquired after 13 May 1997 if the expenditure has been deducted or could be deducted for an income year. However, rather than the expenditure never forming part of the cost base of the asset, section 110-37 provides that the expenditure is initially to be included in the cost base and then excluded 'just before a CGT event' happens 'in relation to' the asset.

171. It has been argued that the cost bases of depreciating assets owned by the company referred to in paragraph 104-230(2)(a), or by the lower tier companies, are not required to be reduced under subsection 110-45(2) by amounts representing the decline in value of the assets that have been deducted because no CGT event happens in relation to those depreciating assets.

172. This argument is not accepted as the phrase 'in relation to', in the context of section 110-37, has a broad meaning which is capable of supporting an indirect relationship between the subject matters 'CGT event' and 'CGT asset'.

173. Support for adopting a broad meaning of 'in relation to' in section 110-37 can be found in the allowance of indexation in the cost base of a company's property when working out the amount of a capital gain from CGT event K6 under subsection 104-230(6). Under section 114-10, indexation is only available in relation to expenditure included in the cost base of a CGT asset if a CGT event happened in relation to the asset.

Is the CGT discount in Division 115 potentially available for a capital gain made under CGT event K6?

174. The CGT discount applies to a capital gain made under CGT event K6 provided the gain is made by an individual, a complying superannuation entity, a trust or, in the circumstances set out in paragraph 115-10(d), a life insurance company and the other requirements of Division 115 are satisfied.

175. One of those requirements is that the capital gain must result from a CGT event happening to a CGT asset that was acquired by the entity making the capital gain at least 12 months before the CGT event. In the case of a capital gain made from CGT event K6, item 2 in the table in subsection 115-25(2) makes it clear that the 12 month test is applied to the pre-CGT shares in the company and not to the property owned by the company.

176. Another of those requirements is that the capital gain must have been worked out using a cost base that has been calculated without reference to indexation at any time. Accordingly, a capital gain from CGT event K6 will not be a discount capital gain if the cost base of property has been indexed for the purposes of calculating the capital gain under subsection 104-230(6).

Can small business CGT relief in Division 152 apply to a CGT event K6 capital gain?

179. Small business relief in Division 152 can apply for shares that are 'active assets' in terms of section 152-40 and where the other requirements of Division 152 are met.

180. On the happening of CGT event K6 to pre-CGT shares in a company, the small business relief in Division 152 does not apply to property of that company or to any underlying property of any lower tier company as no capital gain is made on that property at that time.

Interactions with other provisions

Can a choice be made to avoid the disregarding of a capital gain under subsection 104-230(10) in circumstances where a choice for scrip for scrip rollover would have been available had the shares been acquired post-CGT?

181. Broadly, scrip for scrip rollover applies where a taxpayer exchanges a share in one company for a share in another company. The rollover does not extend to the exchange of a share that was acquired before 20 September 1985. Ordinarily, in such a case any capital gain would be disregarded.

182. The exchange of a pre-CGT share in a company for a share in another company may, however, result in a capital gain under CGT event K6. In these circumstances, subsection 104-230(10) provides that the capital gain from CGT event K6 is disregarded to the extent that scrip for scrip rollover could have been chosen had the pre-CGT share been a post-CGT share.

183. Subsection 104-230(10) applies automatically to disregard the capital gain in these circumstances. No regard is had to whether or not the taxpayer would have chosen scrip for scrip rollover if the pre-CGT share had been a post-CGT share.

If a capital gain is disregarded under subsection 104-230(10), what is the amount of the reduction required to the cost base and reduced cost base of the replacement share under subsection 124-800(2)?

184. If a capital gain from CGT event K6 is disregarded under subsection 104-230(10), subsection 124-800(2) provides that the cost base and reduced cost base of the replacement share in the other company is reduced by the amount of the capital gain that was disregarded under subsection 104-230(10).

185. It has been suggested that the capital gain disregarded under subsection 104-230(10) is the amount of the gain remaining after the application of both the CGT discount in Division 115 and the small business concessions in Division 152.

186. Such a view is not supported by the framework contained in section 102-5 for calculating a net capital gain. Under that framework only those capital gains that are not otherwise disregarded are taken into account under step 1 of the method statement. As a capital gain that is disregarded under subsection 104-230(10) is not taken into account at step 1 of the method statement, that capital gain cannot be reduced further under step 3 (about capital gains that qualify for the CGT discount) and under step 4 (about capital gains that qualify for the small business concessions) of the method statement.

187. Accordingly, the reduction required to the cost base and reduced cost base under subsection 124-800(2) is the capital gain arising under CGT event K6 that is disregarded under subsection 104-230(10).

If the cost base and reduced cost base of a post-CGT replacement share is reduced under subsection 124-800(2) as a result of a capital gain being disregarded under subsection 104-230(10), is the CGT discount available if a CGT event happens to the share within 12 months of its acquisition?

188. For a capital gain to be a discount capital gain under Division 115, the capital gain must result from a CGT event happening to a CGT asset that was acquired by the entity making the capital gain at least 12 months before the CGT event.

189. The time of acquisition of an asset for the purposes of applying the 12 month test is generally determined under Division 109. However, special rules contained in the table in subsection 115-30(1) may prescribe an earlier time of acquisition, to that determined under Division 109, for the purposes of applying the 12 month test. Broadly, subsection 115-30(1) prescribes an earlier time of acquisition for the purposes of applying the 12 month test in circumstances where a taxpayer has acquired the asset as a result of a rollover or as a result of the death of another person.