GST issues registers

Primary production industry partnership4 Invoices

4.1.1 - Agents issuing recipient created tax invoices

Question

Can an agent for a recipient (buyer) issue recipient created tax invoices (RCTI's)?

For the source of the ATO view, refer to:

- •

- paragraph 73 of GSTR 2000/37 - Goods and services tax: agency relationships and the application of the law

- •

- GSTR 2000/10 - Goods and services tax: recipient created tax invoices

Answer

Yes. An agent for the recipient (buyer) of the supply may issue a RCTI provided all the requirements in the Commissioner's determination (Determination) are met and applied to the supplier in question.

Explanation

The position at common law is that a supply or acquisition your agent makes on your behalf is no different from one that you make yourself. An agent may act on behalf of his principal and this may include preparation and issuing of a document such as a tax invoice. Nothing contained in the GST legislation or in any GST rulings precludes this principle from applying to agents preparing and issuing RCTI's on behalf of their principal's. In addition subsection 29-70(3) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) makes it clear that a RCTI is a tax invoice.

It should be noted that stock and station agents acting on behalf of suppliers of primary produce would not be able to produce RCTI's on behalf of the recipients (buyers) of the supplies. Only an agent for the recipient (buyer) of a supply is able to produce a RCTI on behalf of the recipient (buyer).

Goods and Services Tax Ruling - Goods and services tax: recipient created tax invoices explains the determination that the Commissioner has made under subsection 29-70(3) of the GST Act.

The Determination is about the three broad classes of tax invoices that a recipient of a taxable supply may issue. The Ruling sets out certain requirements a recipient must follow when issuing an RCTI and also describes the information that an RCTI must contain. Therefore, if the recipient of a supply satisfies the criteria outlined in the ruling then the recipient may issue RCTI's.

4.1.3 - Dealing through agents

Question

Which entity is the entity making a taxable supply of sugar cane in the following situation: the sugar cane assignment holder (A) provides the land and sugar assignment to a related business entity (B) by virtue of a written agreement, lease or contract and that related entity then produces and sells cane to the mill. The related business entity is neither subcontracted by the assignment holder nor acts as agent of the holder.

Non-interpretative - straight application of the law

Answer

In this situation, it is considered that it is the business entity (B) which sells the cane to the mill that is making the taxable supply to the mill (as unprocessed cane is not food), not the assignment holder (A).

Explanation

Only the entity that is entitled to the proceeds or legally incurs the expenses is liable for GST and can claim input tax credits for creditable acquisitions. The business entity (B) will need to apply for an ABN and register for GST if required to do so. It may also be possible for the cane assignment holder (A) to register for an ABN, provided that they meet the necessary requirements.

If the cane assignment holder (A) is registered or required to be registered for GST and provides the land and cane assignment to the business entity (B) by way of a lease or contract, the normal GST rules will apply, provided that the consideration is based on commercial rates. The cane assignment holder (A) will make a taxable supply to the business entity (B) and will be liable for GST on that transaction. The business entity (B) will be entitled to claim input tax credits for any creditable acquisitions that it makes.

Where the cane assignment holder (A) is registered or required to be registered for GST and there is a written agreement, lease or contract under which there is no consideration payable or where the consideration is not based on commercial rates, it will be necessary to consider the application of Division 72 of A New Tax System (Goods and Services Tax) Act 1999 (the GST Act).

This Division ensures that supplies to, and acquisitions from, your associates without consideration are brought within the GST system, and that supplies to your associates for inadequate consideration are properly valued for GST purposes. Associate is a defined term in section 195-1 of the GST Act. It has the meaning given by section 318 of the Income Tax Assessment Act 1936.

It is important to note that Division 72 of the GST Act will only apply if the recipient of the supply is not entitled to a full input tax credit. The recipient will not be entitled to a full input tax credit where they are not registered or required to be registered or if the acquisition was not solely for a creditable purpose.

Additional Information on this Issue can be viewed at issue 2.6.4.

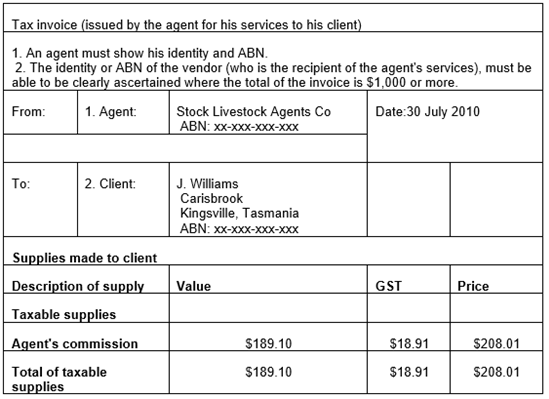

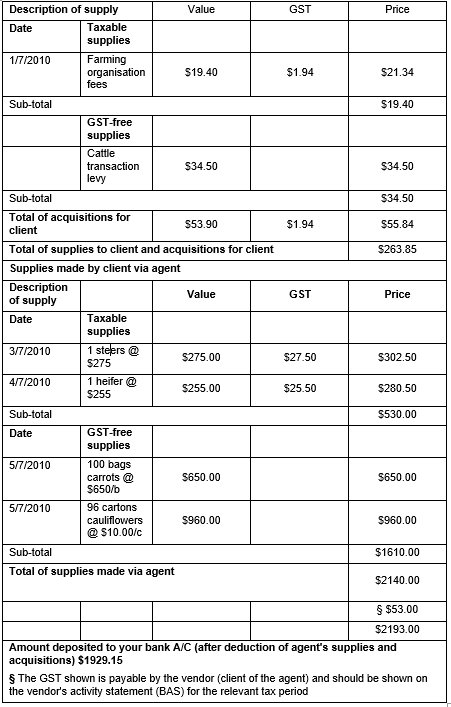

4.1.4 - Model tax invoices (issued by the agent)

Question

What does a tax invoice which is issued by an agent on behalf of the vendor, have to contain to satisfy the provisions of the GST legislation?

For the source of the ATO view, refer to paragraphs 95 to 98 of GSTR 2013/1 - Goods and services tax: tax invoices.

Answer

A tax invoice is a document that satisfies the relevant provisions of the GST legislation. The form of the model tax invoice document provided below satisfies the GST legislation in regard to information requirements. However, these information requirements can be met in other forms. It is the information content that is imperative and must comply with GST legislation and not the particular format.

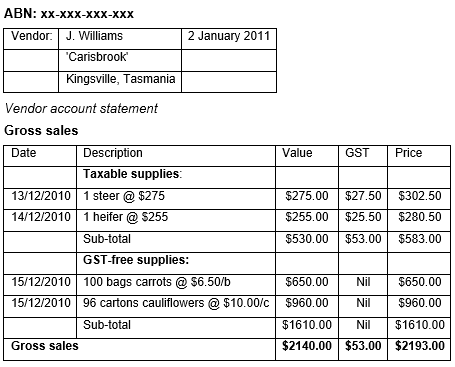

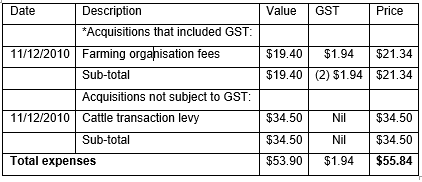

The attached model tax invoice has an account statement for client convenience contained on the same page. This account statement does not form part of the tax invoice being issued by the agent.

Explanation

Provided all the requirements of the GST legislation are met there is no objection to additional information being provided on tax invoices. For example an agent may wish to provide an 'account statement' for their client's convenience in addition to the tax invoice being provided for taxable supplies that the agent has made. The attached model tax invoice has an account statement for client convenience contained on the same page. This account statement does not form part of the tax invoice being issued by the agent.

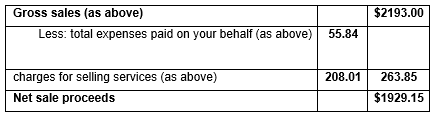

Account statement (for client's convenience)

This section does not constitute a 'tax invoice' in itself. Your agent may hold a tax invoice in relation to any or all of these supplies.

Acquisitions for client arranged by agent

Note When completing your BAS, you should ensure that only supplies made in the relevant tax period are included on it. You may need to consider whether you account on a 'cash' or 'non-cash' basis

4.1.5 - Tax invoices when acting as an agent for farmers and the agent for the carriers.

Question

Where you are the agent for two parties (for example a farmer and a livestock carrier) who transact with each other through you and you charge each party a commission for your services, what are the tax invoice requirements?

For the source of the ATO view, refer to paragraphs 61 - 66 of - Goods and services tax: agency relationships and the application of the law.

Answer

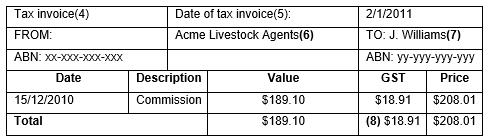

An agent can issue a document that is a tax invoice for supplies made as an agent as well as supplies made on his own account.

Explanation

Example:

A farmer sells livestock via his agent Acme Livestock Agents. The farmer is supplied with cartage services by Bob's Transport Company. Acme Livestock Agents arrange the transport in the capacity as agent for Bob's Transport Company. Acme Livestock Agents charge both the farmer and Bob's Transport Company for agency services.

Question: Can both the supply of transport services and the supply of agency services be included on the one tax invoice issued by Acme Livestock Agents to the farmer?

Answer: Yes.

Division 153 has special rules about tax invoices and agents. It reflects the position at common law that a supply or acquisition an agent makes on behalf of a principal is no different from one that the principal makes themselves. Accordingly, if a principal makes a taxable supply through an agent, the agent can issue a tax invoice for the principal. Similarly, a principal may claim an input tax credit for a creditable acquisition they make through their agent if their agent holds the tax invoice.

A 'dual agency' situation may occur where an agent's 'principal' is making creditable acquisitions from a 'third party' through the agent. This should be distinguished from an agent merely making a disbursement to another party on behalf of their principal.

The agent may also be in an agency relationship with the 'third party' (that is the 'third party' is also a principal of the agent) who is supplying services through the agent to the 'principal'.

Where an agent acting in this dual capacity supplies services to his principal (that is commission), the principal will require a tax invoice. The tax invoice may also include acquisitions made by the principal through the agent (in his agency capacity for the 'third party').

Therefore, an agent may provide a tax invoice to his principal, which includes supplies made under an agency relationship as well as supplies made on his own account.

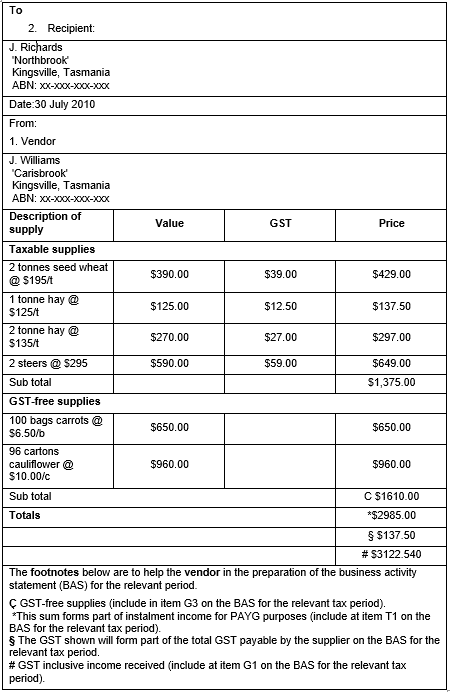

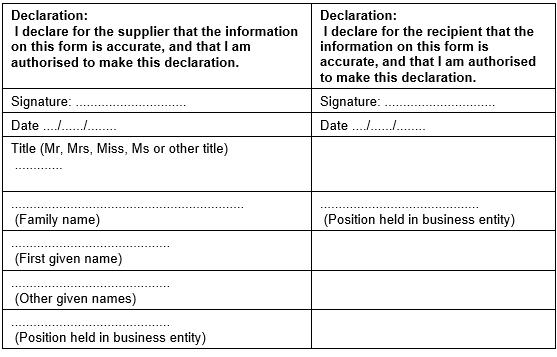

4.3 Model tax invoice (issued by the supplier)

4.3.1 - Model tax invoice requirements

Question

What does a tax invoice have to contain to satisfy the provisions of the GST legislation?

Non-interpretative - other references (see - Goods and services tax: tax invoices).

Answer

A tax invoice is document that satisfies the relevant provisions of the GST legislation. The form of the model tax invoice document provided below satisfies the GST legislation in regard to information requirements. However, these information requirements can be met in other forms. It is the information content that is imperative and must comply with GST legislation and not the particular format.

Explanation

The information required in a tax invoice is set down in subsection 29-70(1) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act). Paragraph 29-70(1)(b) of the GST Act also requires that the invoice be in an 'approved form'.

Supplier (vendor) created tax invoice

- 1.

- The vendor's identity and ABN must be shown.

- 2.

- Where the total of the invoice is $1,000 or more, the identity or ABN of the recipient must be able to be clearly ascertained on the invoice.

4.4 Recipient created tax invoices (RCTI)

4.4.1 Can recipients of supplies of wild game issue recipient created tax invoices (RCTI)?

Non-interpretative - other references (see GSTR 2000/10 - Goods and services tax: recipient created tax invoices).

Answer

Yes, subject to the recipient and the supplier meeting certain requirements. It is necessary to consider A New Tax System (Goods and Services Tax) Act 1999 Classes of Recipient Created Tax Invoice Determination (No. 1) 2000 and attached to Goods and Services Tax Ruling GSTR 2000/10 Goods and Services Tax: recipient created tax invoices. Where all of the requirements are satisfied the recipient may issue a RCTI. One of the main requirements is that there must be a written agreement between the recipient and supplier (see below for details).

Explanation

There are a number of requirements that must be satisfied by a recipient (processor) of a taxable supply to issue a valid RCTI. These are contained in GSTR 2000/10.

The requirements are:

- •

- the recipient (processor) must be registered for GST

- •

- the recipient must set out in the tax invoice the ABN of the supplier

- •

- the recipient must issue the original or a copy of the tax invoice to the supplier within 28 days of making, or determining, the value of a taxable supply and must retain the original or the copy

- •

- the recipient must issue the original or a copy of an adjustment note to the supplier within 28 days of the adjustment and must retain the original or the copy

- •

- the recipient must reasonably comply with its obligations under the taxation laws

- •

- the recipient and the supplier must have a written agreement specifying the supplies to which it relates, that is current and effective when the RCTI is issued agreeing that

- (i)

- the recipient may issue tax invoices in respect of the supplies

- (i)

- the supplier will not issue tax invoices in respect of those supplies

- (iii)

- the supplier is registered for GST when it enters the agreement and it will notify the recipient if it ceases to be registered

- (iv)

- the recipient is registered for GST and that it will notify the supplier if it ceases to be registered for GST or if it ceases to satisfy any of the requirements of the determination

- •

- the recipient must not issue a document that would otherwise be an RCTI, on or after the date when the recipient or the supplier has failed to comply with any of the requirements of this determination.

A RCTI must also satisfy the tax invoice requirements as specified in section 29-70 of the GST Act.

The following points should also be noted:

- •

- GSTR 2000/10 also states at paragraph 43 that to ensure compliance with the GST law (and for the protection of the supplier) permission to issue RCTIs is available only to taxpayers who reasonably comply with the taxation laws.

- •

- If you fail to satisfy all of the requirements when issuing a RCTI, it will not be treated as being within the class of invoices determined as RCTIs (GSTR 2000/10 paragraph 48).

- •

- If this happens, you cannot attribute an input tax credit for the supply to a tax period (even though it may be for a creditable acquisition) until you hold a valid tax invoice issued by your supplier. To obtain the input tax credits, you can request a tax invoice for the supply from your supplier, who must give it to you within 28 days after your request (GSTR 2000/10 paragraph 49).

4.4.2 - Recipient created tax invoice (RCTI) agreement

Question

What form should an agreement to issue a recipient created tax invoice (RCTI) take?

Non-interpretative - other references (see - Goods and services tax: recipient created tax invoices).

Answer

The A New Tax System (Goods and Services Tax) 1999 (GST Act) does not prescribe any particular format for RCTI agreements. The information that must be contained in a RCTI is listed in subsection 29-70(1) of the GST Act and Goods and Services Tax Ruling GSTR 2000/10 - Goods and services tax: recipient created tax invoices.

However, it should be noted that a particular industry RCTI determination may contain other pre-conditions.

Subject to the above, a format that may be suitable to adopt is attached.

If you make supplies to which GST will apply, and you enter into the RCTI agreement, the recipient, (identity of recipient) will be able to issue tax invoices on your behalf, saving you considerable paperwork.

To allow us, (print identity of recipient) to issue a tax invoice (called a RCTI), we require there to be a written RCTI agreement between you, the supplier and the recipient.

Parties to the agreement:

The name of the recipient is:

..........(print full identity of recipient)..........

The name of the business entity making taxable supplies to the recipient is:

..........(identity of supplier recorded here)..........

(hereafter referred to as 'the supplier')

ABN of the supplier

Agreement:

The supplies to which this agreement relates are:

.............................................................................................................

The

supplier

agrees that:

- •

- it is registered for GST when it enters into this agreement

- •

- it will notify the recipient if the supplier ceases to be registered for the GST

- •

- the recipient may issue tax invoices in respect of the above mentioned supplies

- •

- it will not issue tax invoices to the recipient for supplies made to the recipient.

The recipient agrees that:

- •

- it is registered for the GST when it enters into this agreement

- •

- it will notify the supplier if the recipient ceases to be registered for the GST

- •

- it will not issue a document that would otherwise be an RCTI, on or after the date when recipient or the supplier has failed to comply with any of the requirements of the determination attached to Tax Ruling GSTR2000/10.

Question

What does a recipient created tax invoice have to contain to satisfy the provisions of the GST legislation?

Non-interpretative - other references (GSTR 2000/10 - Goods and services tax: recipient created tax invoices).

Answer

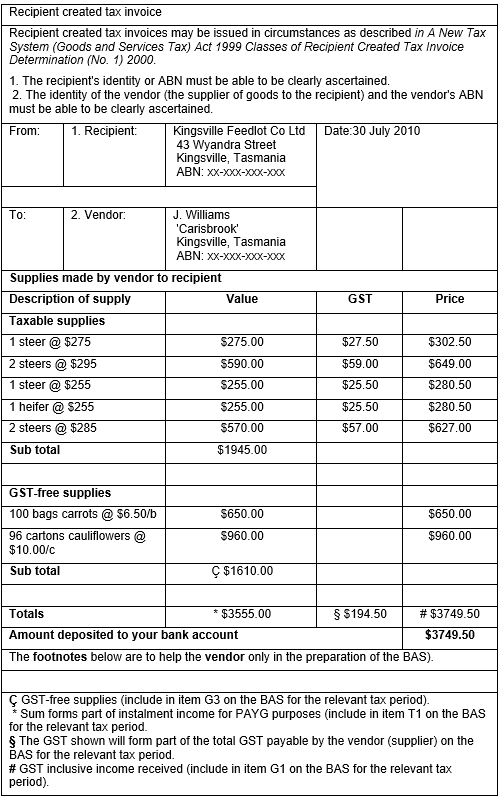

A recipient created tax invoice (RCTI) is a class of tax invoice that may be issued by a recipient of a taxable supply, where it falls into a category designated in A New Tax System (Goods and Services Tax) Act 1999 Classes of Recipient Created Tax Invoice Determination (No. 1) 2000.

The form of the model RCTI document provided below satisfies the relevant provisions of the GST legislation in regard to information requirements. However, these information requirements can be met in other forms. It is the information content that is imperative and must comply with GST legislation and not the particular format.

Explanation

Under subsection 29-70(3) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act), a RCTI is a tax invoice belonging to a class of tax invoices that we have determined in writing may be issued by the recipient of a taxable supply.

A determination has been made by us in A New Tax System (Goods and Services Tax) Act 1999 Classes of Recipient Created Tax Invoice Determination (No.1) 2000 (Determination) issued in Schedule 1 to Goods and Services Tax Ruling GSTR 2000/10 Goods and services tax: recipient created tax invoices, concerning the three classes of tax invoices that may be issued by a recipient of a taxable supply. These classes are contained in Clause 3 of the determination, part of which is reproduced below:

'Classes of tax invoices that may be issued by the recipient of a taxable supply

1. A recipient of a taxable supply may issue a tax invoice that belongs to a class of tax invoices specified in each of the following paragraphs:

- (a)

- a tax invoice for a taxable supply of agricultural products where the recipient:

- (i)

- determines the value of those products after the supply is made using a qualitative or quantitative process; and

- (ii)

- satisfies the requirements set out in Clause 4;

- (b)

- .....................

- (c)

- .....................

- (d)

- .....................

Requirements that must be satisfied by a recipient of a taxable supply

2. A recipient must satisfy the following requirements:

- (a)

- the recipient must be registered for GST;

- (b)

- the recipient must set out in the tax invoice the ABN of the supplier;

- (c)

- the recipient must issue the original or a copy of the tax invoice to the supplier within 28 days of making, or determining, the value of a taxable supply and must retain the original or the copy;

- (d)

- the recipient must issue the original or a copy of an adjustment note to the supplier within 28 days of the adjustment and must retain the original or the copy;

- (e)

- the recipient must reasonably comply with its obligations under the taxation laws;

- (f)

- the recipient must issue the tax invoice pursuant to a written agreement that the recipient has with the supplier which specifies the supplies to which it relates and contains the following terms:

- -

- the recipient may issue tax invoices in respect of the specified supplies;

- -

- the supplier will not issue tax invoices in respect of those supplies;

- -

- the supplier acknowledges that it is registered when it enters the agreement and that it will notify the recipient if it ceases to be registered;

- -

- the recipient acknowledges that it is registered when it enters into the agreement and that it will notify the supplier if it ceases to be registered;

- (g)

- the recipient must not issue a document that would otherwise be a recipient created tax invoice, on or after the date when the recipient or the supplier has failed to comply with any of the requirements of this determination.'

The information required in a RCTI is set down in subsection 29-70(1) of the GST Act. Paragraph 29-70(1)(b) also requires that the invoice be in an 'approved form'.

4.4.5 - RCTIs and co-ops and marketing boards.

Question

Where an organisation (for example, a cooperative or a marketing board) issues a recipient created tax invoice (RCTI), is the organisation also able to include in that document charges for taxable supplies made by the organisation to the grower?

For the source of the ATO view, refer to:

- •

- GSTR2000/10 - Goods and services tax: recipient created tax invoices

- •

- GSTR 2000/37 - Goods and services tax: agency relationships and the application of the law.

Answer

An organisation can only issue an RCTI when it takes ownership of the produce and the supply by the grower is subject to GST and falls within the written RCTI agreement between the organisation and the grower. That is, a valid RCTI may only be generated as long as the supply by the grower to the organisation is taxable.

For practical convenience, where an organisation makes a taxable supply to a grower to whom it is issuing an RCTI, the organisation can include on the same page as the RCTI a separate tax invoice recording the taxable supply to the grower (for example, sales of fertiliser to the grower).

In doing so, no set-off of the consideration of one supply against the consideration of the other supply is allowable in the calculation of the GST liability as the GST legislation does not allow the price of one supply to be reduced by the price of another supply.

Explanation:

RCTIs are discussed in Goods and Services Tax Ruling GSTR 2000/10. An RCTI must contain all the information required for a tax invoice by subsection 29-70(1) of A New Tax System (Goods and Services Tax) Act 1999 (GST Act).

It should also be noted that an RCTI is a tax invoice belonging to a class of tax invoices that we have determined in writing may be issued by the recipient of a taxable supply. Typically, this occurs in the agricultural industry where the value of agricultural produce is determined by the recipient and is dependent upon by a quantitative or qualitative analysis of the supply.

Where the organisation takes ownership of the produce which is subject to GST

Where a registered grower sells their produce to an organisation, the organisation may supply an RCTI in accordance with a written agreement entered into with the registered grower.

It is common for the organisation to make supplies to the registered grower. For example, sales of fertiliser and pesticides, packaging for produce etc may be supplied by the organisation.

When invoicing the grower for these taxable supplies, the organisation may want to put both documents (RCTI and tax invoice) on the one page for convenience.

As long as both the RCTI and tax invoice that are on the one page contain the appropriate details as required by the GST Act then this will be acceptable for GST purposes.

However, even though there is a close connection between the supply to the organisation and the supply made by the organisation, each is a separate supply and the GST law does not allow the price for one supply to be reduced by the price of another.

Where the organisation is not taking ownership of the produce (that is acting as agent)

Different arrangements are required when the organisation does not take ownership of the produce. In such a case the actual buyer (recipient) is a third party and the agent organisation sells to that third party on behalf of the grower. Unless there is a written RCTI agreement in place between the grower and the third party, no RCTI could be issued and the grower (or grower's agent) would need to issue an ordinary 'tax invoice' for a taxable supply of produce.

However it may be that the grower will enter into a written RCTI agreement with the third party buyer in respect of taxable produce being sold through the agent organisation. The third party buyer can then issue an RCTI. (The grower's agent may choose to forward this on to the grower or retain it in the agent's records on behalf of the grower and merely pass on information in an 'account sales' document to the grower.) In any 'account sales' documentation the agent organisation may choose to issue to the grower, care should be taken to devote a separate section to any 'tax invoice' the agent wishes to issue for selling services (commission) or other taxable supplies the agent makes to the grower (for example, fertiliser).

As yet a further possibility, the grower's agent may also be acting as agent for the third party buyer. If this is the case and a written RCTI agreement is in place between the grower and the third party, the agent organisation may be authorised to create an RCTI as agent for the buyer. This RCTI will still satisfy the requirements of the GST legislation where the agent organisation chooses to use its own identity or ABN on the RCTI, instead of the buyer's identity or ABN (GSTR 2000/37 paragraph 73).

Model tax invoices can be accessed at 4.3.1 (tax invoice), 4.1.4 (agent/vendor tax invoice) and 4.4.4 (recipient created tax invoice).

4.5.1 - Invoice for GST-free supplies

Question

Is it permissible to use a tax invoice when only GST-free supplies are made?

Non-interpretative - straight application of the law

Answer

Any of the following alternatives are acceptable:

- •

- the document contains a prominently displayed statement that the total amount of GST payable is NIL

- •

- the words 'tax invoice' are omitted or crossed out

- •

- the word 'tax' where it precedes the word 'invoice' is omitted or crossed out.

4.5.2 - Monthly statements as invoices

Question

Can a monthly statement from a supplier satisfy tax invoice requirements?

Non-interpretative - straight application of the law

Answer

A monthly statement that complies with the tax invoice requirements of subsection 29-70(1) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) can be used as a tax invoice for GST.

Explanation

All tax invoices require certain information as per section 29-70(1) of the GST Act. Other information may be included on the tax invoice for remittance advice.

Model tax invoices can be accessed at 4.3.1 (tax invoice), 4.1.4 (agent/vendor tax invoice) and 4.4.4 (recipient created tax invoice).

4.5.3 - Tax invoices and copies

Question

Can a tax invoice be copied?

Non-interpretative

Answer

Yes.

Explanation

Sometimes a supplier may issue a tax invoice and the recipient of the supply may request another copy. For example, the tax invoice may be lost or destroyed. If the supplier issues a copy of the tax invoice or a second tax invoice, we suggest that it be marked 'copy' or 'duplicate' to enable easier identification of the document. Where no previous amount has been claimed, you may claim an input tax credit if you hold a tax invoice that is a copy or a re-issued tax invoice.

Question

Where two or more GST registered enterprises make a creditable acquisition jointly, how does each enterprise claim their share of any input tax credit entitlement where there is only one tax invoice issued by the supplier?

Answer

See below.

Explanation

The answer will always depend upon the actual facts of each case. The entity making a creditable acquisition will be entitled to an input tax credit. Whether the entity makes taxable supplies to other entities will be a question of fact.

In order to establish entitlement to input tax credits, it must be determined whether there is a creditable acquisition and if so, by whom. In most instances, the entity that has the liability in respect of the relevant acquisition is the one entitled to claim the input tax credit.

The following scenarios provide an example of how these types of situations may be arranged.

- 1.

- Two share farmers Alan and Bob purchase a tractor jointly. The supplier issues a tax invoice that is made out to both parties. Alan and Bob will each claim their share of the input tax credit in accordance with a business arrangement that exists between them.

- 2.

- The tax invoice for the tractor is made out to sharefarmer Alan even though Bob contributed half of the purchase price of the tractor:

- (a)

- In this scenario, it may be that Alan who holds the tax invoice, was acting as an agent for Bob in the purchase of Bob's ½ share in the tractor; if so then as Bob's agent Alan may provide Bob with an account statement which would provide details of Bob's share of the tractor acquisition and the GST component that was applicable to Bob's share. This is not a requirement of the GST legislation.

- Where Alan as Bob's agent, holds the tax invoice for the tractor then both Alan & Bob will be entitled to claim an input tax credit for their share of the creditable acquisition (that is, the tractor).

- (b)

- If Alan is not acting as an agent for Bob then Alan may be making a separate taxable supply of a ½ share in the tractor to Bob.

- Alan will be required to issue a tax invoice within 28 days when Bob requests one. Bob will be entitled to claim an input tax credit as long as Bob holds a valid tax invoice from Alan for Bob's creditable acquisition (that is, The ½ share in the tractor).

4.6.1 - Account sales documents for stock and station agents

Question

Stock and station agents traditionally send account sales documentation to their vendors advising of the amounts fetched on livestock or produce sold on their behalf, and also advising of expenses. Can the ATO comment on the GST requirements for the different parts of this documentation, and also provide an example of the documentation?

Non-interpretative - straight application of the law

Answer

This is a typical situation faced by many stock and station agents needing to advise vendors of:

- •

- amounts fetched for the livestock or produce the agent has sold on behalf of the vendor

- •

- various expenses paid by the agent on behalf of the vendor such as freight or industry levies

- •

- the agent's commission and any other charges the vendor may make for their selling services.

In the past, the agent may have advised the vendor in the following fashion:

On 1/7/1999 we sold 10 bulls on your behalf for a total price of $9.000.

We have paid freight costs on your behalf of $105.

Our commission on the above sale is 180.

Total costs and charges total $285.

Please find enclosed our cheque for the net sale proceeds of $8,715.

The advent of GST brings with it a need to issue a formal tax invoice to the vendor for sales commission, as selling services are a taxable supply the GST registered agent makes to the vendor, and the vendor (where registered for GST) will need to hold a valid tax invoice from the agent. The vendor will use this to support anclaim for an input tax credit for these selling services, in the vendor's business activity statement (BAS).

Important information the agent needs to convey to the vendor is the amount of GST the agent has charged on the vendor's behalf for the stock or produce sold. This enables the vendor to record and bring to account their GST liabilities to us.

Finally, if the agent has incurred expenses on behalf of the vendor (such as freight) and has decided to hold the tax invoice on the vendor's behalf, the vendor will expect the agent to advise of this fact. This will facilitate the making of a claim by the vendor for an input tax credit on expenses incurred by the agent on the vendor's behalf.

Bearing in mind these considerations, the basic account sales documentation can be expanded to something along the following lines:

On 1/07/2010 we sold 10 bulls on your behalf for a total price of which included GST of $920 we charged on your behalf. $10,120

We have paid freight costs on your behalf of which included GST of $10. $110*

*We hold a tax invoice on your behalf for this expense.

Our commission (see tax invoice below) on the above sale is 198.

Total costs and charges $308

Please find enclosed our cheque for the net sale proceeds of $9,812

Tax invoice

Date of issue: 02/07/2010

Supplier: Acme Livestock Agents, ABN xx xxx xxx xxx

Recipient: A & B Taxpayer, ABN yy yyy yyy yyy

Our commission payable on sale detailed above: $198 (includes GST of $18) This amount has been deducted from your gross sale proceeds, as shown above.

Agents are free to choose their own setting out and details in documentation advising the vendor of what has been sold on their behalf, and of expenses paid on behalf of the vendor. Of course the information should not be presented in a way that might mislead the vendor as to their taxation liabilities or entitlements.

On the other hand, there are specific requirements for tax invoices prescribed in the GST legislation. It should be noted that an agent's tax invoice to a vendor should only include supplies made by the agent to the vendor and not expenses merely incurred by the agent on behalf of a client. Rural stock and station agents should already be aware that the following information needs to be able to be clearly ascertained on tax invoices they issue for their selling services (commission):

- •

- that the document is intended as a tax invoice, such as showing the words 'tax invoice' prominently

- •

- identity of supplier, ABN of issuer of tax invoice

- •

- if for an invoice amount of $1,000 or more, the identity or ABN of the recipient

- •

- the price for the supply

- •

- if the tax invoice is for one or more taxable supplies only, and the amount of GST payable on the supply or supplies is exactly one-eleventh of the total price for the supply or supplies, the tax invoice must contain:

- (a)

- a statement to the effect that the total amount payable includes GST for the supply or supplies

- (b)

- the total amount of GST payable.

The matter of tax invoice requirements has been discussed more fully at 4.3.1 (tax invoice), 4.1.4 (agent/vendor tax invoice) and 4.4.4 (recipient created tax invoice), which include some examples of tax invoices. An alternative example of account sales documentation agents may choose to adopt appears below. The second part of the following account sales documentation consists of notes for agents.

**sample document** Acme Livestock Agents

Note:

In completing your BAS, the figures above may be relevant for the 'Supplies you have made' and the figures below for the 'Acquisitions you have made'. (1)

Expenses paid on your behalf

*Tax invoices are held by us for these amounts.(3)

Our charges for selling services

Net sale proceeds

Notes for agents

- •

- The GST shown as part of the gross sale proceeds is payable by your client, the vendor (unless a non-resident) and the corresponding taxable supplies need to be included in your client's BAS for the relevant tax period. Note: When completing the GST section of the BAS for a particular tax period, the vendor should ensure that supplies attributable to that tax period are included. The vendor may need to consider whether they account on a 'cash' or 'non-cash' basis, and the date on which they become aware of the supplies made on their behalf (Goods and Services Tax Ruling GSTR 2000/29, paragraphs 87 - 91).

- •

- This is the GST included in the expenses paid on behalf of the vendor. The vendor may be able to claim these input tax credits for the relevant tax period. If an acquisition exceeds $82.50, the vendor, or the agent, will need to hold a valid tax invoice. The agent may choose to retain a valid tax invoice on behalf of the vendor and inform the vendor of this fact. Alternatively the agent may choose to forward the tax invoice to the vendor.

- •

- This statement should only be included if relevant tax invoices are held.

- •

- The document must clearly show that it is intended to be a tax invoice, such as including the words 'tax invoice' prominently at the top. This tax invoice is for the supply by the agent, of selling services, to the vendor. Details shown on other parts of the document are merely for the client's information and the content and setting out of those parts is at the discretion of the agent.

- •

- The date of issue of the tax invoice needs to be able to be clearly ascertained.

- •

- The agent's identity and ABN must be able to be clearly ascertained on the tax invoice that is issued to the client for the selling services.

- •

- Where a tax invoice is for a total price of $1 000 or more, the recipient's identity or ABN must be able to be clearly ascertained.

- •

- This is the GST included in the price charged by the agent to the client for selling services. The client may be able to claim these services as creditable acquisitions in their BAS for the relevant tax period.

4.6.2 - Account sales documents for stock and station agents

Question

Stock and station agents have been advised that for GST they must separate vendor expenses into expenses merely paid for by the agent on the vendor's behalf, and actual professional charges by the agent, such as commission. What guidance is available from the ATO on this and what will be the repercussions if an agent misclassifies a selling service item as an expense paid on behalf of the vendor, or vice versa?

For the source of the ATO view, refer to GSTR 2000/37 - Goods and services tax: agency relationships and the application of the law

Answer

Stock and station agents traditionally advise clients (either buyers or sellers) of two broad categories of expenses or costs:

- •

- various expenses paid by the agent on the client's behalf (such as freight organised by the vendor and paid for by the agent)

- •

- the agent's commission and any other professional charges the agent may make in connection with their buying or selling services.

The first category of expenses pass through the stock and station agent's books merely as amounts paid on behalf of the client and then reimbursed by the client. They typically include amounts such as industry levies, statutory charges, and freight organised or directed by the client but initially paid for by the agent. These sorts of amounts are not 'supplies' made by the agent. The agent acts merely makes a payment. The 'supply' is between the client and some third party.

The agent will not need to be involved in the GST aspects of these expenses (for resident clients) other than to ensure that where needed the agent obtains a tax invoice from the supplier if the client has not done so. If the agent chooses to hold a tax invoice on behalf of a client or clients, the client or clients may need to be advised of this fact in order for them to be able to include appropriate claims for input tax credits in their Business Activity Statements. Under section 153-5 of the A New Tax System (Goods and Services Tax Act 1999 (GST Act), either the agent or the client can hold a tax invoice for an acquisition the agent makes on behalf of the client.

The second category of expenses are supplies made by the agent to either the buyer or seller in the agent's professional role as a facilitator of purchases and sales. The predominant supply an agent makes is the selling service known as 'commission'. This will typically be calculated as a percentage of the value of the items bought on behalf of the buyer or sold on behalf of the seller. The amount charged as 'commission' may be intended to cover a myriad of minor expenses such as telephone and postage as well as the time and other resources allocated to the transaction. Sometimes the underlying expenses may be significant enough to be listed separately and to be separately charged (for example, photocopying). These charges are not in the nature of precise reimbursements but rather the professional charge the agent deems it reasonable to request the client to pay. As these amounts are part of the agent's supply of selling services, the GST registered agent needs to include GST in the price for these services and to include these supplies in the agent's own BAS.

These matters are discussed in some detail in Goods and Services Tax Ruling GSTR 2000/37 - Goods and services tax: agency relationships and the application of the law.

Most expenses are readily classified as expenses paid on a client's behalf or alternatively as professional charges, but some expenses may be difficult to classify. For example, advertising costs may generally form part of professional services but if a vendor made a specific request that an advertisement with a particular wording be placed in a particular publication and it was agreed the vendor would reimburse the actual expense, the agent may need to treat payment for that specific advertisement as a mere expenses payment on behalf of the vendor.

There are potential repercussions if an agent misclassifies an expense. These repercussions can go in two opposing directions:

Inclusion in the agent's tax invoice of a supply that is not the supply of the agent but of a third party.

This may invalidate the total price shown on the tax invoice for taxable supplies of the agent. It may cause an overstatement of the agent's GST liability and PAYG instalment income.

Inclusion of an amount that is part of the agent's professional selling services in advice given to the client about expenses paid on a client's behalf.

This may cause an overstatement of amounts a client is entitled to claim in reliance on section 153-5 of the GST Act. It may result in the overclaiming by an agent of input tax credits on behalf of a non-resident client under section 57-10 of the GST Act. It may cause an understatement of the agent's GST liability, and the agent's PAYG instalment income.

Whilst the ATO may be in a position in some cases to exercise a discretion under section 29-70 of the GST Act to treat a document as a tax invoice that is not a tax invoice, the agent cannot assume the Commissioner will exercise such a discretion. Each case would need to be treated on its merits.

The policy of the ATO in the realm of penalty taxes will evolve and this issue will not attempt to specify what that policy is currently or can be expected to be in the future in the realm of GST, PAYG instalment income, or income tax. However it is obvious that a stock and station agent who fails to classify correctly those transactions that are clearly of one kind rather than the other, or who fails to seek advice concerning doubtful or contentious transactions, is likely to be in a less favourable position than one who has established a proper system for classifying the expenses and obtaining advice.

Enquiries concerning the categorisation of expenses in relation to agency as it specifically affects GST can be directed to a GST technical area of the ATO. If a Ruling is required on whether an income or expenditure item is the assessable income or allowable income tax deduction of the agent (rather than of their client) the enquiry can be directed to an ATO income tax technical area.

4.7.1 - Can the recipient of a supply issue an adjustment note?

Question

Can the recipient of a supply issue an adjustment note?

Non-interpretative - straight application of the law

Answer

Yes, when the tax invoice issued for that supply was a recipient created tax invoice (RCTI).

Explanation

Paragraph 29-75(2)(b) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) provides that where the tax invoice in relation to a supply would have been a recipient created tax invoice, the adjustment note must be issued by the recipient of the supply.

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).