Goods and Services Tax Ruling

GSTR 2004/7

Goods and services tax: in the application of items 2 and 3 and paragraph (b) of item 4 in the table in subsection 38-190(1) of the A New Tax System (Goods and Services Tax) Act 1999:

- •

- when is a 'non-resident' or other 'recipient' of a supply 'not in Australia when the thing supplied is done'?

- •

- when is 'an entity that is not an Australian resident' 'outside Australia when the thing supplied is done'?

This version is no longer current. Please follow this link to view the current version. |

-

Please note that the PDF version is the authorised consolidated version of this ruling and amending notices.This document has changed over time. View its history.

| Contents | Para |

|---|---|

| What this Ruling is about | |

| Date of effect | |

| Legislative context | |

| Ruling | |

| Explanation (this forms part of the Ruling) | |

| Part I - when a supply is made to a non-resident or other recipient | |

| Part II - the meaning of 'not in Australia', 'outside Australia' and 'when the thing supplied is done' | |

| Part III - when particular entity types are in Australia in relation to the supply | |

| Part IV - apportionment | |

| Part V - further examples | |

| Detailed contents list |

Ruling

Relying on this Ruling

Relying on this Ruling

This publication is a public ruling for the purposes of the Taxation Administration Act 1953. If this Ruling applies to you and you rely on it, we will apply the law to you in the way set out in this Ruling. That is, you will not pay any more tax or penalties or interest in respect of the matters covered by this Ruling. Further, if we think that this Ruling disadvantages you, we may apply the law in a way that is more favourable to you. [Note: This is a consolidated version of this document. Refer to the Legal database (http://www.ato.gov.au/law) to check its currency and to view the details of all changes.] |

What this Ruling is about

1. This Ruling examines when a supply is made to a 'non-resident' or other 'recipient' of a supply who is 'not in Australia[A1] when the thing supplied is done' for the purposes of items 2 and 3 in the table in subsection 38-190(1) of the A New Tax System (Goods and Services Tax Act) 1999 (the GST Act). Subsection 38-190(1) sets out supplies of things (other than goods or real property) that are GST-free.

2. The Ruling also examines when a supply that is made in relation to rights is made to an entity that is not an 'Australian resident' and is 'outside Australia when the thing supplied is done' for the purposes of paragraph (b) of item 4.

3. In particular, the Ruling explains for an entity that is either an individual, company, partnership, corporate limited partnership or trust:

- •

- when a supply is made to an entity that is a 'non-resident' or 'an entity that is not an Australian resident' for the purposes of item 2 and paragraph (b) of item 4 respectively;

- •

- when a supply is made to an entity for the purposes of item 3;

- •

- when an entity is 'not in Australia' or is 'outside Australia' when the thing supplied is done; and

- •

- what apportionment is required if an entity is 'not in Australia' or is 'outside Australia' for only part of the time when the thing supplied is done.

4. The Ruling also considers the operation of subsection 38-190(4). This subsection operates to extend the scope of item 3 by deeming certain supplies[1] to be made to an entity that is 'not in Australia'.

5. This Ruling does not otherwise address the operation of the provisions of section 38-190.

6. Unless otherwise stated, all legislative references in this Ruling are to the GST Act and all references to an item number are to an item in the table in subsection 38-190(1).

Date of effect

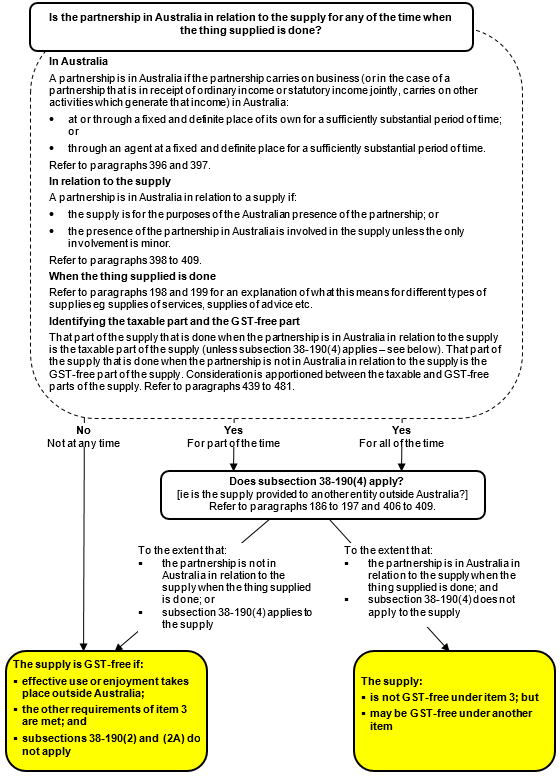

7. This Ruling applies both before and after its date of issue. However, this Ruling will not apply to taxpayers to the extent that it conflicts with the terms of a settlement of a dispute agreed to before the date of issue of this Ruling (see paragraphs 75 and 76 of Taxation Ruling TR 2006/10).

8A. Changes made to this Ruling by addenda that issued on 31 October 2012, 3 April 2013 and 15 December 2021 have been incorporated into this version of the Ruling.[1A]

Legislative context

10. Section 9-5 provides that a taxable supply is made if:

- (a)

- you make the supply for consideration;

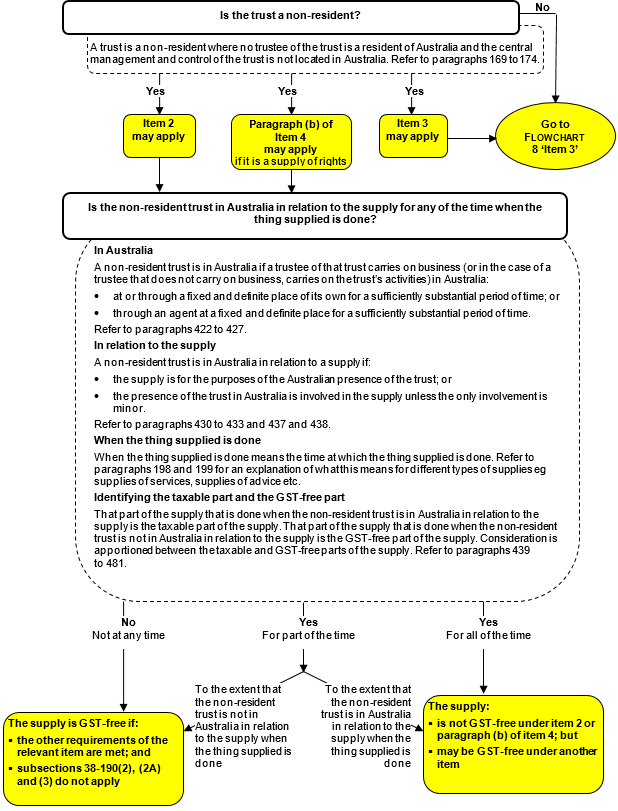

- (b)

- the supply is made in the course or furtherance of an enterprise that you carry on;

- (c)

- the supply is connected with Australia; and

- (d)

- you are registered, or required to be registered.

However, the supply is not a taxable supply to the extent that it is GST-free or input taxed.

11. A supply is GST-free if it is GST-free under Division 38 or under a provision of another Act.[3]

12. Subdivision 38-E sets out when exports of goods and other supplies for consumption outside Australia are GST-free. The Subdivision comprises:

- •

- section 38-185 - exports of goods;

- •

- section 38-187 - lease or hire of goods for use outside Australia;

- •

- section 38-188 - tooling used by non-residents to manufacture goods for export;

- •

- section 38-190 - supplies of things, other than goods or real property, for consumption outside Australia; and

- •

- section 38-191 - supplies relating to the repair, renovation, modification or treatment of goods under warranty.

13. The relevant section for the purposes of this Ruling is section 38-190.

14. Subsection 38-190(1) comprises five items which set out supplies of things other than goods or real property that are GST-free. If the requirements of one of those items are met the supply is GST-free, provided subsections 38-190(2), (2A) or (3) do not negate that GST-free status. A supply that is not GST-free under one of the items in subsection 38-190(1) may be GST-free under one of the other items.

15. Subsection 38-190(2) provides that a supply covered by any of the items 1 to 5 in the table in subsection 38-190(1) is not GST-free if it is the supply of a right or option to acquire something the supply of which would be connected with Australia and would not be GST-free.[4]

15A. Subsection 38-190(2A) provides that a supply covered by any of items 2 to 4 in the table in subsection 38-190(1) is not GST-free if the acquisition of the supply relates (whether directly or indirectly, or wholly or partly) to the making of a supply of real property situated in Australia that would be wholly or partly input taxed under Subdivisions 40-B or 40-C. Subdivision 40-B deals with the supply of premises (including a berth at a marina) by way of lease, hire or licence. Subdivision 40-C deals with the sale of residential premises and the supply of residential premises by way of long-term lease.

16. Subsection 38-190(3) provides that, without limiting subsections 38-190(2) or (2A), a supply covered by table item 2 is not GST-free if:

- (a)

- it is a supply under an agreement entered into, whether directly or indirectly, with a non-resident; and

- (b)

- the supply is provided, or the agreement requires it to be provided, to another entity in Australia; and

- (c)

- for a supply other than an input taxed supply, none of the following applies

- (i)

- the other entity would be an Australian-based business recipient of the supply[4A], if the supply had been made to it;

- (ii)

- the other entity is an individual who is provided with the supply as an employee or officer of an entity that would be an Australian-based business recipient of the supply, if the supply had been made to it; or

- (iii)

- the other entity is an individual who is provided with the supply as an employee or officer of the recipient and the recipient's acquisition of the thing is solely for a creditable purpose and is not a non-deductible expense.[4B]

17. Subsection 38-190(4) extends the scope of item 3. The subsection provides that a supply is taken, for the purposes of item 3, to be a supply made to a recipient who is not in Australia if:

- (a)

- it is a supply under an agreement entered into, whether directly or indirectly, with an Australian resident; and

- (b)

- the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.

17A. Subsection 38-190(5) limits the application of subsection (4). It provides that subsection (4) does not apply to any of the following supplies:

- (a)

- a transport of goods within Australia that is part of, or is connected with, the international transport of the goods;

- (b)

- a loading or handling of goods within Australia that is part of, or is connected with, the international transport of the goods;

- (c)

- a service, done within Australia, in relation to the goods that facilitates the international transport of the goods;

- (d)

- insuring transport covered by paragraph (a);

- (e)

- arranging transport covered by paragraph (a), or insurance covered by paragraph (d).

18. Items 2, 3 and 4 appear in the table in subsection 38-190(1) as follows:

| Supplies of things, other than goods or real property, for consumption outside Australia | ||

| Item | Topic | These supplies are GST-free [5] |

| 2 | Supply to non-resident outside Australia | a supply that is made to a non-resident who is

not in Australia when the thing supplied is done,

and: [emphasis added]

|

| 3 | Supplies used or enjoyed outside Australia | a supply:

other than a supply of work physically performed on goods situated in Australia when the thing supplied is done, or a supply directly connected with real property situated in Australia. |

| 4 | Rights | a supply that is made in relation to rights if:

|

Ruling

19. You should refer to the section headed 'Explanation' for a more detailed examination of the issues covered in the Ruling section that follows.

Items 2 and 3 and paragraph (b) of item 4

20. An important issue in the application of these items is when is a supply made to a non-resident (or other recipient[6] of a supply) who is 'not in Australia' or 'outside Australia' 'when the thing supplied is done'.

When is a supply made to an entity that is a 'non-resident' for the purposes of item 2 and paragraph (b) of item 4?

21. Item 2 applies to a supply of a thing, other than a supply of goods or real property, which is made to a non-resident.[7]

22. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to an entity that is not an Australian resident. A non-resident is an 'entity that is not an Australian resident'.[7A]

23. A supply is made to a non-resident for the purposes of item 2 and paragraph (b) of item 4 if the supply is made to an entity that is a person who is not a resident of Australia for the purposes of the Income Tax Assessment Act 1936 (ITAA 1936). A non-resident includes:

- •

- an individual who is not a resident of Australia as defined in subsection 6(1) of the ITAA 1936;[8]

- •

- a company that is not a resident of Australia as defined in subsection 6(1) of the ITAA 1936;[8A]

- •

- a partnership the central management and control of which is not located in Australia;

- •

- a corporate limited partnership that is not a resident of Australia as defined in section 94T of the ITAA 1936;[9] and

- •

- a trust of which no trustee is a resident of Australia as defined in subsection 6(1) of the ITAA 1936 and the central management and control of which is not located in Australia.

24. In the case of a trust, the supply is made to a non-resident if the trust is a non-resident, irrespective of whether the supply is expressed as being made to the trust or the trustee of that trust.

25. For further explanation about when a supply is made to a non-resident for the purposes of item 2 and paragraph (b) of item 4, refer to paragraphs 111 to 174 of the Explanation section of the Ruling.

When is a supply made to a 'recipient' for the purposes of item 3?

26. Item 3 applies to a supply of a thing, other than a supply of goods or real property, which is made to a recipient who is not in Australia when the thing supplied is done.[10]

27. A recipient, in relation to a supply, is the entity to which the supply was made.[11] An entity is defined in subsection 184-1(1). The definition of entity is reproduced and explained at paragraphs 176 and 177 in the Explanation section of the Ruling.

28. In the case of an entity that is a trust, the supply is made to the trust irrespective of whether the supply is expressed as being made to the trust or the trustee of that trust.

29. Unlike item 2 and paragraph (b) of item 4, item 3 applies to supplies made to entities irrespective of their residency status.

30. For further explanation about when a supply is made to a 'recipient' for the purposes of item 3, refer to paragraphs 175 to 179 of the Explanation section of the Ruling.

The meaning of 'not in Australia' and 'outside Australia' for the purposes of items 2 and 3 and paragraph (b) of item 4

31. The requirement that the non-resident in item 2, or the recipient in item 3, is not in Australia when the thing supplied is done is a requirement, in our view, that the non-resident or recipient is not in Australia in relation to the supply when the thing supplied is done.

32. The requirement that the non-resident is outside Australia when the thing supplied is done in paragraph (b) of item 4 is a requirement, in our view, that the non-resident is not in Australia in relation to the supply when the thing supplied is done.

33. For further explanation about the meaning of 'not in Australia' and 'outside Australia' for the purposes of items 2 and 3 and paragraph (b) of item 4, refer to paragraphs 181 to 185 of the Explanation section of the Ruling.

When is a non-resident not in Australia when the thing supplied is done for the purposes of item 2 and paragraph (b) of item 4?

34. We determine whether the not in Australia requirement is satisfied by determining whether the non-resident entity is in Australia in relation to the supply. If the entity is in Australia in relation to the supply, the entity does not satisfy the not in Australia requirement.

Non-resident individual in Australia in relation to the supply (item 2 and paragraph (b) of item 4)

35. A non-resident individual is in Australia if that individual is physically in Australia. If a non-resident individual is physically in Australia and in contact (other than contact which is only of a minor nature) with the supplier, that presence is in relation to the supply.

36. For further explanation about when a non-resident individual is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 202 to 220 of the Explanation section of the Ruling.

Non-resident company in Australia in relation to the supply (item 2 and paragraph (b) of item 4)

37. A non-resident company is in Australia if that company carries on business (or in the case of a company that does not carry on business, carries on its activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

38. We consider that it would be reasonable for a supplier to conclude that a non-resident company is in Australia if:

- •

- the company is registered with ASIC; or

- •

- the company has a permanent establishment in Australia for income tax purposes.

39. However, a non-resident company to which the supplier makes a supply may be able to demonstrate to the supplier that, even though it is registered with ASIC or has a permanent establishment, on application of the test (at paragraph 37) to its particular circumstances, the non-resident company is not in Australia.

40. Suppliers should be aware that even if a company is not registered with ASIC, it may still be in Australia on an application of the test (at paragraph 37). Similarly, even if a company does not have a permanent establishment in Australia for income tax purposes, it may still be in Australia on application of the test to its particular circumstances.

41. A non-resident company is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence, for example, its Australian branch. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the company is in Australia in relation to the supply, except where the only involvement is minor.

42. For further explanation about when a non-resident company is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 230 to 332, 347 to 372 and 374 to 379 of the Explanation section of the Ruling.

Non-resident partnership (other than a corporate limited partnership) in Australia in relation to the supply (item 2 and paragraph (b) of item 4)

43. A non-resident partnership is in Australia if that partnership carries on business (or in the case of a partnership that is in receipt of ordinary income or statutory income jointly, other activities which generate that income) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

44. A non-resident partnership is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence, for example, its Australian branch. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the partnership is in Australia in relation to the supply, except where the only involvement is minor.

45. For further explanation about when a non-resident partnership is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 381 to 395 and 398 to 405 of the Explanation section of the Ruling.

Non-resident corporate limited partnership in Australia in relation to the supply (item 2 and paragraph (b) of item 4)

46. We consider that a non-resident corporate limited partnership is in Australia if that partnership carries on business (or in the case of a corporate limited partnership that does not carry on business, carries on its activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

47. A non-resident corporate limited partnership is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence, for example, its Australian branch. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the partnership is in Australia in relation to the supply, except where the only involvement is minor.

48. For further explanation about when a non-resident corporate limited partnership is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 411 and 413 and 417 to 418 of the Explanation section of the Ruling.

Non-resident trust in Australia in relation to the supply (item 2 and paragraph (b) of item 4)

49. We consider that a non-resident trust is in Australia if a trustee of that trust, acting in its capacity as trustee, carries on business (or in the case of a trustee that does not carry on business, carries on the trust's activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

50. A non-resident trust is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence of that trust, for example, its Australian branch. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the trust is in Australia in relation to the supply, except where the only involvement is minor.

51. For further explanation about when a non-resident trust is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 421 to 427 and 430 to 433 of the Explanation section of the Ruling.

When is a recipient not in Australia when the thing supplied is done for the purposes of item 3?

52. As mentioned at paragraph 31, we determine whether the not in Australia requirement is satisfied by determining whether the recipient is in Australia in relation to the supply. If the recipient is in Australia in relation to the supply the recipient does not satisfy the not in Australia requirement.

53. Item 3 may apply irrespective of whether the recipient is a resident or non-resident of Australia.

Application of subsection 38-190(4) with respect to item 3

54. If a supply is made to a recipient who fails the 'not in Australia' requirement in paragraph (a) of item 3, it is necessary to consider whether subsection 38-190(4) applies.[11A] That subsection extends the scope of item 3 by treating a supply that is made to a recipient who is in Australia in relation to the supply as being made to a recipient who is not in Australia if:

- •

- the supply is made under an agreement entered into, whether directly or indirectly, with an Australian resident; and

- •

- the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.

55. A supply that is made under an agreement with an individual, a company or a corporate limited partnership, that is a resident of Australia for income tax purposes, is a supply made under an agreement with an Australian resident.

56. A supply that is made under an agreement with a partnership or trust that is a resident of Australia (as determined in accordance with this Ruling) is a supply made under an agreement with an Australian resident.

57. Subsection 38-190(4), by means of the expression 'provided, or the agreement requires it to be provided, to another entity', seeks to identify the entity to which the item 3 supply actually flows.

58. For example, if a supply of a service is made to an Australian resident recipient who is in Australia in relation to the service and that service is rendered to or received by another entity at the time it is performed, the supply is provided to that other entity. If that other entity is outside Australia, subsection 38-190(4) treats the supply as being made to a recipient who is not in Australia. For a further example refer to Example 1 at paragraph 196 of the Explanation section of the Ruling.

59. For further explanation about subsection 38-190(4), refer to paragraphs 186 to 197 of the Explanation section of the Ruling.

Individual in Australia in relation to the supply (item 3)

60. A resident individual[12] who is physically in Australia when the thing supplied is done is in Australia in relation to the supply.

61. A non-resident individual who is physically in Australia when the thing supplied is done is in Australia in relation to the supply to the extent that the non-resident is in contact (other than contact which is only of a minor nature) with the supplier while in Australia.

62. For further explanation about when a recipient individual is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 221 to 228 of the Explanation section of the Ruling.

63. A supply made under an agreement entered into, whether directly or indirectly, with a resident individual who is in Australia in relation to the supply when the thing supplied is done may be treated under subsection 38-190(4) as a supply made to a recipient who is not in Australia for the purposes of item 3 if the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[12A] Refer to paragraphs 186 to 197 and 227 of the Explanation section of the Ruling for a more detailed discussion

Company in Australia in relation to the supply (item 3)

64. A company is in Australia if it is incorporated in Australia. If the company is not incorporated in Australia, the company is in Australia (irrespective of the residency status of that company) if the company carries on business (or in the case of a company that does not carry on business, carries on its activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

65. A company is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence, for example, its Australian branch, representative office or agent if it is a non-resident company or the Australian head office if it is an Australian incorporated company. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the company is in Australia in relation to the supply, except where the only involvement is minor.

66. For further explanation about when a recipient company is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 333 to 379 of the Explanation section of the Ruling.

67. A supply made under an agreement entered into, whether directly or indirectly, with a resident company[13] that is in Australia in relation to the supply when the thing supplied is done, may be treated under subsection 38-190(4) as a supply made to a recipient that is not in Australia for the purposes of item 3, if the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[13A] Refer to paragraphs 186 to 197 and 373 of the Explanation section of the Ruling for a more detailed discussion.

Partnership (other than a corporate limited partnership) in Australia in relation to the supply (item 3)

68. A partnership (irrespective of its residency status as determined in accordance with this Ruling) is in Australia if the partnership carries on business (or in the case of a partnership that is in receipt of ordinary income or statutory income jointly, other activities which generate that income) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

69. A partnership is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the partnership is in Australia in relation to the supply, except where the only involvement is minor.

70. For further explanation about when a recipient partnership is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 396 to 409 of the Explanation section of the Ruling.

71. A supply made under an agreement entered into, whether directly or indirectly, with a resident partnership[14] that is in Australia in relation to the supply when the thing supplied is done may be treated under subsection 38-190(4) as a supply made to a recipient that is not in Australia for the purposes of item 3, if the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[14A] Refer to paragraphs 186 to 197 and 406 to 409 of the Explanation section of the Ruling for a more detailed discussion.

Corporate limited partnership in Australia in relation to the supply (item 3)

72. If a corporate limited partnership is formed in Australia the partnership is in Australia by virtue of its formation in Australia in the same way that a company is in Australia by virtue of its incorporation in Australia.

73. If a corporate limited partnership is formed outside Australia the partnership (irrespective of its residency status) is in Australia if the partnership carries on business (or in the case of a corporate limited partnership that does not carry on business, carries on its activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

74. A corporate limited partnership is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the partnership is in Australia in relation to the supply, except where the only involvement is minor.

75. For further explanation about when a recipient corporate limited partnership is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 414 to 419 of the Explanation section of the Ruling.

76. A supply made under an agreement entered into, whether directly or indirectly, with a resident corporate limited partnership[15] that is in Australia in relation to the supply when the thing supplied is done may be treated under subsection 38-190(4) as a supply made to a recipient that is not in Australia for the purposes of item 3, if the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[15A] Refer to paragraphs 186 to 197 and 419 of the Explanation section of the Ruling for a more detailed discussion.

Trust in Australia in relation to the supply (item 3)

77. A trust (irrespective of its residency status as determined in accordance with this Ruling) is in Australia if a trustee of that trust, acting in its capacity as trustee, carries on business (or in the case of a trustee that does not carry on business, carries on the trust's activities) in Australia:

- (a)

- at or through a fixed and definite place of its own for a sufficiently substantial period of time; or

- (b)

- through an agent at a fixed and definite place for a sufficiently substantial period of time.

78. A trust is in Australia in relation to the supply if the supply is solely or partly for the purposes of the Australian presence of that trust. If the supply is not for the purposes of the Australian presence but that Australian presence is involved in the supply, the trust is in Australia in relation to the supply, except where the only involvement is minor.

79. For further explanation about when a trust is in Australia in relation to a supply when the thing supplied is done refer to paragraphs 428 to 436 of the Explanation section of the Ruling.

80. A supply made under an agreement entered into, whether directly or indirectly, with a resident trust[16] that is in Australia in relation to the supply when the thing supplied is done may be treated under subsection 38-190(4) as a supply made to a recipient that is not in Australia for the purposes of item 3, if the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[16A] Refer to paragraphs 186 to 197 and 434 to 436 of the Explanation section of the Ruling for a more detailed discussion.

The meaning of 'the thing supplied is done'

81. The phrase 'the thing supplied is done' has the same meaning as the expression 'the thing is done' in paragraph 9-25(5)(a).[17] Under that paragraph, a supply is connected with Australia if the thing being supplied is done in Australia.[17A]

82. For further explanation about the meaning of when the thing supplied is done, refer to paragraphs 198 and 199 of the Explanation section of the Ruling.

83. If the 'not in Australia in relation to the supply' requirement for the non-resident or other recipient of the supply is met for only part of the time when the thing supplied is done, the supply is only partly GST-free under items 2 or 3.

84. The need to apportion in the context of items 2 and 3 arises if the thing supplied is done over a period of time. For example, apportionment is necessary if the recipient of a supply of services is in Australia in relation to the supply for part of the time over which the services are performed. That part of the supply that is done when the recipient is in Australia in relation to the supply is the taxable part of the supply. That part of the supply that is done when the recipient is not in Australia in relation to the supply is the GST-free part of the supply, provided the other requirements of the item are met.

85. If there is a supply that is made in relation to rights to which paragraph (b) of item 4 applies, apportionment is only necessary if there is an application of subsection 38-190(2) to negate, in part, the GST-free status of the supply under paragraph (b) of item 4.[18]

86. If a supply consists of a taxable part and a GST-free part, it is necessary to apportion the consideration between these parts to work out the GST payable on the taxable part of the supply.

87. For further explanation about apportionment, refer to paragraphs 439 to 481 of the Explanation section of the Ruling.

Application of items 2 and 3 and paragraph (b) of item 4

88. The flowcharts that follow illustrate, in broad terms, the application of items 2 and 3 and paragraph (b) of item 4 to:

- •

- a supply (other than a supply of goods or real property) that is made to an individual (refer to flowcharts 1 and 2 on pages 19 and 20 respectively);

- •

- a supply (other than a supply of goods or real property) that is made to a company (refer to flowcharts 3 and 4 on page 21 and 22 respectively);

- •

- a supply (other than a supply of goods or real property) that is made to a partnership other than a corporate limited partnership (refer to flowcharts 5 and 6 on pages 23 and 24 respectively); and

- •

- a supply (other than a supply of goods or real property) that is made to a trust (refer to flowcharts 7 and 8 on pages 25 and 26 respectively).

89. The flowcharts highlight that there are different tests to determine whether an entity is in Australia depending on the type of entity. The flowcharts should be read in conjunction with the relevant paragraphs in this Ruling. These paragraphs are noted in the flowcharts.

FLOWCHART 1 - Supply made to a non-resident individual

Item 2 and paragraph (b) of item 4

FLOWCHART 2 - Supply made to an individual including a non-resident individual[18A]

Item 3

FLOWCHART 3 - Supply made to a non-resident company

Item 2 and paragraph (b) of item 4

FLOWCHART 4 - Supply made to a company including a non-resident company[18B]

Item 3

FLOWCHART 5 - Supply made to a non-resident partnership (other than a non-resident corporate limited partnership)

Item 2 and paragraph (b) of item 4

FLOWCHART 6 - Supply made to a partnership (other than a corporate limited partnership) including a non-resident partnership[18C]

Item 3

FLOWCHART 7 - Supply made to a non-resident trust

Item 2 and paragraph (b) of item 4

FLOWCHART 8 - Supply made to a trust including a non-resident trust[18D]

Item 3

Explanation (this forms part of the Ruling)

Overview of items 2 and 3 and paragraph (b) of item 4

90. Section 38-190 is headed 'Supplies of things, other than goods or real property, for consumption outside Australia'. The items in the table in subsection 38-190(1) set out supplies of things, other than goods or real property, for consumption outside Australia that are GST-free if certain requirements are met.

91. The policy intention, as evidenced by the headings to both section 38-190 and the table in subsection 38-190(1), is to treat supplies of services or things other than goods or real property as GST-free supplies if consumption of those supplies occurs outside Australia.[19]

92. For a supply to be within the scope of item 2, the supply must be made to 'a non-resident who is not in Australia when the thing supplied is done'. The meaning of 'non-resident' is discussed at paragraphs 111 to 174. The requirement that the recipient is not in Australia when the thing supplied is done (the 'not in Australia' requirement) is discussed at paragraphs 181 to 185 and 198 and 199.

93. Although not addressed in this Ruling, it is important to note the other requirements of item 2. To be GST-free under item 2, either paragraph (a) or paragraph (b) must be satisfied.

94. For a supply to satisfy paragraph (a) of item 2, the supply must neither be a supply of work physically performed on goods situated in Australia when the work is done nor a supply directly connected with real property situated in Australia.[20]

95. For a supply to satisfy paragraph (b) of item 2, the non-resident must acquire the thing in carrying on the non-resident's enterprise but the non-resident must not be registered, or required to be registered, for GST.

Subsections 38-190(2), (2A) and (3)

96. Subsections 38-190(2)[21], (2A) and (3) negate, in certain circumstances, the GST-free status that would otherwise apply to a supply covered by item 2.

97. Item 3 applies to a supply that is made to 'a recipient[22] who is not in Australia when the thing supplied is done'.

98. Although not addressed in this Ruling, it is important to note the other requirements of item 3 for a supply to be GST-free. The effective use or enjoyment of the supply must take place outside Australia. Further, the supply must neither be a supply of work physically performed on goods situated in Australia when the work is done nor a supply directly connected with real property situated in Australia.[23]

99. While for the purposes of item 2 and paragraph (b) of item 4, the supply must be made to a non-resident, this requirement does not apply for the purposes of item 3. Item 3 applies to supplies made to recipients, that is, all entities to which a supply is made including non-residents. Item 3 is, therefore, broader in scope and may apply if a supply is made, for instance, to an Australian resident.

100. This means, for example, that a supply made to a company incorporated in Australia which does not come within the scope of item 2 or paragraph (b) of item 4 because the company is not a non-resident (see discussion at paragraphs 119 to 126 regarding the meaning of 'non-resident') may still be GST-free under item 3 if the other requirements of that item are met.

101. Subsection 38-190(4) extends the scope of item 3 by treating certain supplies that would otherwise fail the 'not in Australia' requirement as if they are made to recipients who are not in Australia when the thing supplied is done. The subsection provides that a supply is taken to be a supply made to a recipient who is not in Australia if the supply is made under an agreement with an Australian resident and the supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[23A] Subsection 38-190(4) is discussed in Part II at paragraphs 186 to 197.

Subsections 38-190(2) and (2A)

102. Subsections 38-190(2)[24] and (2A) negate, in certain circumstances, the GST-free status that would otherwise apply to a supply covered by item 3.

103. Under paragraph (b) of item 4, a supply that is made in relation to rights must be made to 'an entity that is not an Australian resident' and is 'outside Australia' when the thing supplied is done.

104. As the term 'non-resident' is defined in section 195-1 to mean 'an entity that is not an Australian resident', it follows that paragraph (b) of item 4 only applies to supplies made to non-residents. When a supply is made to a 'non-resident' is discussed at paragraphs 111 to 174.

105. We consider that 'outside Australia' has the same meaning as 'not in Australia' in items 2 and 3. This is supported by the use of the terms in the legislation. The topic description for item 2 refers to 'Supply to non-resident outside Australia' while the words used in the third column to describe the supply are 'supply that is made to a non-resident who is not in Australia'. The discussion of the meaning of 'not in Australia' at paragraphs 181 to 185 is relevant, therefore, for the purposes of applying paragraph (b) of item 4.[25]

Subsections 38-190(2) and (2A)

106. Subsections 38-190(2)[26] and (2A) negate, in certain circumstances, the GST-free status that would otherwise apply to a supply covered by item 4.

How the various requirements of items 2 and 3 and paragraph (b) of item 4 are discussed in this Ruling

107. We have divided the Explanation section which follows into five parts:

| Part # | Paragraph references | |

| Part I | When a supply is made to a non-resident or other recipient | 109 to 179 |

| Part II | The meaning of 'not in Australia', 'outside Australia' and 'when the thing supplied is done' | 180 to 199 |

| Part III | When particular entity types are in Australia in relation to the supply | 200 to 438 |

| Part IV | Apportionment | 439 to 481 |

| Part V | Further examples | 482 to 508 |

108. The flowchart on the next page is a guide to the requirements of items 2 and 3 and paragraph (b) of item 4. Where those requirements are discussed in this Ruling paragraph references are given.

Items 2 and 3 and paragraph (b) of item 4[26A]

NB: this flowchart is a general guide only and should be used in conjunction with the relevant paragraphs of this Ruling.

Part I - when a supply is made to a non-resident or other recipient

109. In this Part, we explain when an entity is a non-resident for the purposes of item 2 and paragraph (b) of item 4. Both these provisions apply only to supplies made to non-residents.

110. We also explain when a supply is made to a non-resident for the purposes of each of these items and when a supply is made to a recipient for the purposes of item 3.

| In particular we discuss... | at paragraphs |

| When is a supply made to a non-resident for the purposes of item 2 and paragraph (b) of item 4? | 111 to 174 |

| - A supply is made to an individual who is a non-resident | 114 to 118 |

| - A supply is made to a company that is a non-resident | 119 to 126 |

| - A supply is made to a partnership (other than a corporate limited partnership) that is a non-resident | 127 to 157 |

| - A supply is made to a corporate limited partnership that is a non-resident | 158 to 168 |

| - A supply is made to a trust that is a non-resident | 169 to 174 |

| When is a supply made to a recipient for the purposes of item 3? | 175 to 179 |

When is a supply made to a non-resident for the purposes of item 2 and paragraph (b) of item 4?

111. The term 'non-resident' is defined in section 195-1 to mean 'an entity that is not an Australian resident'.

112. 'Australian resident' is defined in section 195-1 to mean 'a person who is a resident of Australia for the purposes of the ITAA 1936'.

113. We discuss below when an entity that is an individual, company, partnership, corporate limited partnership or a trust is a resident of Australia for the purposes of the ITAA 1936.

A supply is made to an individual who is a non-resident

114. A supply that is made to an individual is a supply to a non-resident if the individual is not a resident of Australia, as defined in subsection 6(1) of the ITAA 1936, for Australian income tax purposes.

115. An individual is a 'resident of Australia' as defined in subsection 6(1) of the ITAA 1936 if that individual is:

- (a)

- a person, other than a company, who resides in Australia and includes a person:

- (i)

- whose domicile is in Australia, unless the Commissioner is satisfied that the person's permanent place of abode is outside Australia;

- (ii)

- who has actually been in Australia, continuously or intermittently, during more than one-half of the year of income, unless the Commissioner is satisfied that the person's usual place of abode is outside Australia and that the person does not intend to take up residence in Australia; or

- (iii)

- who is:

- (A)

- a member of the superannuation scheme established by deed under the Superannuation Act 1990; or

- (B)

- an eligible employee for the purposes of the Superannuation Act 1976; or

- (C)

- the spouse, or a child under 16, of a person covered by sub-subparagraph (A) or (B).

116. Residency status is a question of fact and is one of the main criteria that determine an individual's liability to Australian income tax. Taxation Ruling TR 98/17 Income tax: residency status of individuals entering Australia provides guidance on determining residency status under the income tax definition.

117. Item 2 applies to a supply that is made to a non-resident individual who is not in Australia when the thing supplied is done.

118. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to a non-resident individual who is outside Australia when the thing supplied is done.

A supply is made to a company that is a non-resident

119. The term 'company' is not found in the definition of entity in subsection 184-1(1). For the purposes of this Ruling a company is an entity that is a body corporate or any other unincorporated association or body of persons but does not include a partnership or a non-entity joint venture as those terms are defined in section 195-1. This is consistent with the definition of company in section 195-1.

120. A body corporate includes a company incorporated under an Australian law (for example, a company incorporated under the Corporations Act 2001) or a company incorporated elsewhere under a foreign law. An unincorporated association or body is not a legal person. Unlike a body corporate it has no separate legal identity. It consists of the aggregate of its members at any particular time and does not have perpetual succession.

A company that is a non-resident

121. A supply that is made to a company is a supply to a non-resident if the company is not a resident of Australia, as defined in subsection 6(1) of the ITAA 1936, for Australian income tax purposes.

122. As defined in that subsection a company is a resident if the company is incorporated in Australia or, if not incorporated in Australia, it carries on business in Australia and has either its central management and control in Australia[27A], or its voting power controlled by shareholders who are residents of Australia.

123. Thus if, for example, a company is incorporated in Australia under the Corporations Act 2001, it is a resident of Australia.

124. Bodies corporate can be incorporated under legislation other than the Corporations Act 2001. For example, the Associations Incorporation Act 1981 (Qld) provides for associations that are formed for certain specified purposes to be incorporated. If bodies incorporate under this Act, or a similar Australian Act, they are residents of Australia for the purposes of this Ruling.

125. Item 2 applies to a supply that is made to a non-resident company that is not in Australia when the thing supplied is done.

126. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to a non-resident company that is outside Australia when the thing supplied is done.

A supply is made to a partnership (other than a corporate limited partnership)[28] that is a non-resident

127. Although a partnership is not a legal entity separate from its members, it is treated, for GST purposes, as if it were a separate entity.[29] That is, the partnership is recognised as an entity separate from the persons that form the partnership. A supply, acquisition or importation made by (or on behalf of) a partner of a partnership in the capacity as a partner is taken to be a supply, acquisition or importation made by the partnership.[30]

128. A partnership is defined in section 195-1 as having the meaning given by section 995-1 of the Income Tax Assessment Act 1997 (ITAA 1997). A partnership, therefore, includes an association of persons carrying on business as partners or in receipt of ordinary income or statutory income jointly but does not include a company.

A partnership (other than a corporate limited partnership) that is a non-resident

129. The GST Act in section 195-1 defines a 'non-resident' to mean an entity that is not an 'Australian resident'. It defines Australian resident to mean 'a person who is a resident of Australia for the purposes of the ITAA 1936'.

130. The GST Act definition of 'non-resident' refers to 'entity' and a partnership is an entity for GST purposes. However, the definition of Australian resident in the GST Act refers to a 'person' who is a resident of Australia for the purposes of the ITAA 1936. Person, for the purposes of the GST Act or the ITAA 1936, includes an individual (according to its ordinary meaning) and is also defined to include a company. Company is defined in the GST Act to mean a body corporate or an unincorporated association or body of persons but specifically excludes a partnership or a non-entity joint venture. Therefore, neither the GST Act nor the ITAA 1936 includes a partnership as a 'person'.[30A]

131. Additionally, the ITAA 1936 does not provide a definition of resident that is applicable generally to partnerships.

132. On a strict literal interpretation of the definition of 'non-resident' in the GST Act it could be said that not only is an individual or a company a non-resident if the individual or company is not a 'resident of Australia' for the purposes of the ITAA 1936 but so too are other entity types such as partnerships, that are not persons, and therefore, not included in the definition of 'resident of Australia' in subsection 6(1) of the ITAA 1936.

133. On this interpretation all partnerships, including partnerships of which all the partners are residents of Australia and which do not carry on any activities outside Australia (referred to here as domestic partnerships), would be non-residents. This is not consistent with the purpose of item 2 which is to make GST-free only those supplies made to non-residents outside Australia.

134. Alternatively it could be said that as the only entity types mentioned in the definition of 'resident of Australia' in subsection 6(1) of ITAA 1936 are individuals and companies, it is only an individual or company that is capable of being a non-resident for the purposes of the GST Act.

135. On this view, a partnership could not be considered a non-resident and therefore a supply to a partnership would not come within the scope of item 2 or paragraph (b) of item 4. However, there is no discernible policy intention to limit the scope of these provisions to certain entity types such as individuals and companies, and exclude others such as partnerships.

136. The adoption of either of these approaches also produces absurd or unreasonable outcomes for other provisions of the GST Act that have application if an entity is a non-resident. In particular, problems arise with regard to both Divisions 57[31] and 83.[32]

137. Division 57 generally provides that a resident agent that makes a taxable supply or taxable importation[32A] on behalf of a non-resident is liable for the GST payable on those supplies or importations. Further, a resident agent is entitled to the input tax credits on creditable acquisitions and creditable importations made through them by a non-resident. As explained in the Explanatory Memorandum[33], the reason for this is that if a non-resident is acting through an agent, there is someone in the Australian jurisdiction on whom liability can be placed. Placing the liability on someone who is in Australia decreases the compliance risk.

137A. A resident agent is not liable to pay GST on behalf of a non-resident if the non-resident makes taxable supplies or taxable importations through an enterprise that the non-resident carries on in Australia.[33A]

137B. A non-resident agent is also not liable to pay GST on behalf of a non-resident if the supply is only a taxable supply because of the application of the reverse charge rules under section 84-5.

137C. The non-resident and the resident agent can agree in writing under section 57-7 to 'opt in' to the agency rules to make the resident agent the liable entity rather than the recipient (the reverse charge rules in Division 84 do not apply) in the following circumstances:

- •

- the non-resident makes a supply that is not connected to Australia because of subsection 9-26(1);

- •

- the agreement must apply to all supplies made by the non-resident through the resident agent; and

- •

- if the recipient of the supply is an Australian-based business recipient, the recipient is given notice in the approved form.[33B]

138. If either of the two approaches discussed above (see paragraphs 129 to 136) is adopted in interpreting 'non-resident', Division 57 would operate in unintended ways.

139. If all partnerships were 'non-residents' for the purposes of Division 57, resident agents of all partnerships including domestic partnerships would potentially be liable for GST payable on all supplies and entitled to input tax credits on all acquisitions made on behalf of the partnerships. We consider that this is not the intended application of Division 57.

140. If, on the other hand, no partnerships were regarded as being non-residents, Division 57 would have no application to partnerships and Parliament's intention to decrease compliance risks would not have effect for a whole class of suppliers, that is, partnerships.

141. Division 83 allows a non-resident supplier and the recipient of a supply by the non-resident supplier to agree that the GST liability is to be borne by the recipient where certain requirements are met.[34]

142. On the alternative meanings of 'non-resident' discussed above, Division 83 would either apply to all partnerships, including domestic partnerships, or alternatively, it would not apply to any partnership. We consider that neither of these outcomes is intended. Division 83 was inserted in recognition of the fact that many non-resident entities that make supplies that are connected with Australia may not have a presence in Australia and may have practical difficulties in providing details necessary for registration.[35]

143. Given the difficulties that arise in taking the approach that all partnerships are non-residents, or all partnerships are residents of Australia, we have not adopted either of these interpretations.

Should the residence of a partnership be determined by the residence of the partners?

144. As the GST Act refers to a person who is a resident of Australia for the purposes of the ITAA 1936 to determine who is a resident of Australia, and ultimately who is a non-resident, it could be argued that for GST purposes Parliament intended the residence of a partnership to be determined by reference to the persons comprising the partnership, that is, the individual and/or corporate partners.

145. However, as the partnership is the relevant entity for GST purposes, we consider that a Court, if required to determine the residence status of a partnership for GST purposes, would be unlikely to take this approach.

Our approach - for determining the residence of a partnership

146. We consider it more likely that a court would consider that, since the GST Act does not provide a definition of resident of Australia for a partnership, the Court would need to determine the residence of the partnership having regard to any relevant authorities.

147. The High Court of Australia in both Koitaki Para Rubber Estates Ltd v. Federal Commissioner of Taxation[36] ('Koitaki') and North Australian Pastoral Co Ltd v. Federal Commissioner of Taxation[37] ('Napco') considered the meaning of 'resident' in the context of a company. The definition of 'resident' or 'resident of Australia' in subsection 6(1) of the ITAA 1936 was not relevant to the issue in those cases. In both cases the issue was whether a company was a 'resident' of a particular territory within Australia (the Northern Territory in the case of Napco) or, to which the Act extended (Papua in the case of Koitaki).

148. In the later case, Waterloo Pastoral Company Limited v. The Federal Commissioner of Taxation [38] ('Waterloo'), Williams J again made the point that the definition of resident of Australia in subsection 6(1) of the ITAA 1936 is expressly confined to residents of Australia and that there was no indication of any intention in the Act to make it applicable to residents of a particular territory.[39]

149. With respect to determining the residence of a company, Dixon J stated in Napco, that:

...it is well to remember that the basal principle is that a company resides where its real business is carried on and that it is for the purpose of ascertaining where that is that the subsidiary principle is invoked that the place where the superior direction and control is exercised determines where the real business is carried on.[40]

150. Dixon J made this comment having had regard to earlier decisions of the House of Lords and the earlier High Court case of Koitaki.

151. In Waterloo Williams J referred back to what was said in his honour's earlier judgment in Koitaki:

... the crucial test is to ascertain where the real business of the company is carried on, not in the sense of where it trades but in the sense of from where its operations are controlled and directed. It is the place of the personal control over and not of the physical operations of the business which counts.[41]

152. Although the decisions in Koitaki, Napco and Waterloo all pertain to the residence of a company the principle is, in our view, one that is capable of application to a partnership.

153. We also consider that determining the residence of a partnership according to central management and control achieves appropriate outcomes for Divisions 57 and 83. If the central management and control of the partnership is located in Australia it is considered reasonable that Division 57 should not apply to require a resident agent to be responsible for the GST consequences of that partnership.

154. Accordingly, if the central management and control of a partnership is in Australia the partnership is, in our view, a resident of Australia (whether the central management and control of the partnership is also located elsewhere). Conversely, a partnership is a non-resident if its central management and control is not located in Australia.[42]

155. If the partnership is not carrying on business (that is, it is a partnership because the partners are in receipt of ordinary income or statutory income jointly), we consider that the test of central management and control may also be applied. Although stated in the context of a company that carried on business, Williams J in Waterloo stated that the important element in determining the location of central management and control is the place of personal control over, and not the physical operations of, the business.[42A] While a partnership that is a partnership for GST purposes only because it is in receipt of income jointly may not have physical operations in the sense of carrying on of a business, it will nonetheless have person(s) exercising control over the activities generating the income of the partnership. We therefore consider it appropriate to apply a central management and control test with reference to the activities of the partnership.

156. Item 2, therefore, applies to a supply that is made to a partnership that is a non-resident and not in Australia when the thing supplied is done.

157. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to a partnership that is a non-resident and outside Australia when the thing supplied is done.

A supply is made to a corporate limited partnership that is a non-resident

158. We consider that a corporate limited partnership, as defined in section 94D of the ITAA 1936, is a resident of Australia for the purposes of the ITAA 1936 if it satisfies the requirements of section 94T of the ITAA 1936.[43]

159. The GST Act defines a 'non-resident' to mean an entity that is not an 'Australian resident'. It defines Australian resident to mean 'a person who is a resident of Australia for the purposes of the ITAA 1936'. Arguably the reference to 'person' could refer to a 'person' as defined for the purposes of the ITAA 1936 or, alternatively, as defined for the purposes of the GST Act.

160. In this Ruling we have taken the view that the reference to 'person' refers to 'person' as defined for the purposes of the ITAA 1936. A corporate limited partnership is included as a company (other than for the definitions of 'dividend', 'resident' or 'resident of Australia' in subsection 6(1)).[44] As a company is included as a person,[45] a corporate limited partnership is a person for the purposes of the ITAA 1936.

161. The alternative view that 'person' refers to 'person' as defined for the purposes of the GST Act would mean that the definition of Australian resident refers to a company or an individual. However, as 'company' is not defined to include a corporate limited partnership for the purposes of the GST Act, if this view were taken it would require the residency status of a corporate limited partnership to be determined on a different basis for GST than for the purposes of the ITAA 1936.

162. With respect to corporate limited partnerships, we consider therefore that the better view is that a corporate limited partnership is 'a person' within the meaning of the expression 'a person who is a resident of Australia for the purposes of the ITAA 1936'.

163. It follows that if a corporate limited partnership is a resident of Australia for income tax purposes, it is also an Australian resident under the GST Act, being 'a person who is a resident of Australia for the purposes of the ITAA 1936'.

164. For the purposes of the income tax law a corporate limited partnership is a resident of Australia if the requirements of section 94T of the ITAA 1936 are met. That section provides that a corporate limited partnership is:

- (a)

- a resident; and

- (b)

- a resident within the meaning of section 6; and

- (c)

- a resident of Australia; and

- (d)

- a resident of Australia within the meaning of section 6;

- if and only if:

- (e)

- the partnership was formed in Australia; or

- (f)

- either:

- (i)

- the partnership carries on business in Australia; or

- (ii)

- the partnership's central management and control is in Australia.

165. This means that a supply that is made to a corporate limited partnership is a supply to a non-resident if the corporate limited partnership is not a resident of Australia as defined in section 94T of the ITAA 1936. A corporate limited partnership is a 'resident' of Australia if and only if:

- •

- the partnership was formed in Australia; or

- •

- the partnership carries on business in Australia; or

- •

- the partnership's central management and control is in Australia.[46]

166. Accordingly, we consider that a supply made to a corporate limited partnership is a supply made to a 'non-resident' if:

- •

- the partnership was formed outside Australia; and

- •

- the partnership does not carry on business in Australia; and

- •

- the partnership's central management and control is not in Australia.

167. Item 2 applies to a supply that is made to a corporate limited partnership that is a non-resident and not in Australia when the thing supplied is done.

168. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to a corporate limited partnership that is a non-resident and outside Australia when the thing supplied is done.

A supply is made to a trust that is a non-resident

169. Determining whether a trust is a non-resident for GST purposes gives rise to similar issues to those discussed at paragraphs 129 to 143 with respect to partnerships.

170. As with partnerships, a trust is an entity for GST purposes but is not a 'person' for the purposes of either the GST Act or the ITAA 1936. A trust does not fall within the ordinary meaning of person and is not specifically included in the definition of person in either Act.

171. The GST Act determines who is an Australian resident by reference to a person who is a resident of Australia for the purposes of the ITAA 1936. The broad intention of the GST Act seems to have been to adopt income tax definitions for the purpose of determining when an entity is a resident. Subsection 95(2) of the ITAA 1936 provides a definition of 'resident trust estate'. Considering this, and that the concept of whether a trust is a resident is so closely analogous to the concept of a resident trust estate, we consider the most probable outcome if a court were confronted with the issue would be that it would be decided that Parliament intended that a trust should be regarded as a resident for GST purposes if it is a resident trust estate for income tax purposes.

172. Accordingly, in our view, a trust is a resident of Australia if at least one of its trustees is a resident of Australia or the trust's central management and control is located in Australia (whether the central management and control of the trust is also located elsewhere). Conversely, a trust is a non-resident if its central management and control is not located in Australia and none of its trustees are residents of Australia.

173. Item 2, therefore, applies to a supply that is made to a trust that is a non-resident and not in Australia when the thing supplied is done.

174. Paragraph (b) of item 4 applies to a supply that is made in relation to rights if that supply is to a trust that is a non-resident and outside Australia when the thing supplied is done.

When is a supply made to a recipient for the purposes of item 3?

175. Recipient is defined in section 195-1 and means, in relation to a supply, the entity to which the supply was made.

176. An entity is defined in subsection 184-1(1) to mean any of the following:

- (a)

- *an individual;

- (b)

- a body corporate;

- (c)

- a corporation sole;

- (d)

- a body politic;

- (e)

- *a partnership;

- (f)

- any other unincorporated association or body of persons;

- (g)

- a trust; and

- (h)

- a superannuation fund.

Note: a company as defined for GST purposes in section 195-1 means a body corporate or any other unincorporated association or body of persons but does not include a partnership or a non-entity joint venture.

177. The asterisked terms (*) are defined in section 195-1. With respect to a trust the GST Act recognises that it is the trustee of a trust, as the legal person, upon whom the rights and obligations are conferred or imposed.[47] The Act does not create two separate entities - the trust and trustee - but rather the relevant entity is the trust, with the trustee standing as that entity if legal personality is required for the purposes of conferring or imposing rights and obligations. Under subsection 184-1(2) the trustee of a trust comprises the person, or persons, acting in the capacity of trustee of the trust at any given time. In accordance with the GST Act we refer in this Ruling to the 'trust' other than where the legal status of the trustee is relevant.

178. Item 3 therefore applies to a supply that is made to any one of the following entities:

- •

- an individual;

- •

- a company (as that term is defined for GST purposes);

- •

- a partnership[47A] (other than a corporate limited partnership);

- •

- a corporate limited partnership[47B]; or

- •

- a trust

that is not in Australia when the thing supplied is done and the other requirements of the item are met. Unlike item 2, item 3 may apply irrespective of the residency status of the entity.

179. This means that even if the recipient of a supply is an Australian resident, the supply may be GST-free under item 3 if the resident entity is not in Australia when the thing supplied is done and the other requirements of item 3 are met.[48]

Part II - the meaning of 'not in Australia', 'outside Australia' and 'when the thing supplied is done'

180. In this Part, we discuss the expressions 'not in Australia'; 'outside Australia'; and 'when the thing supplied is done'. We also explain the application of subsection 38-190(4).

| In particular we discuss | at paragraphs |

| The meaning of 'not in Australia' and 'outside Australia' | 181 to 185 |

| Application of subsection 38-190(4) with respect to item 3 | 186 to 197 |

| The meaning of 'when the thing supplied is done' | 198 and 199 |

The meaning of 'not in Australia' and 'outside Australia'

181. The requirement that a supply is made to a non-resident (item 2), or recipient (item 3), who is 'not in Australia' 'when the thing supplied is done' is in effect a proxy test for determining where the supply to that entity is consumed. The presumption is that if the non-resident or other recipient of the supply is 'not in Australia' when the thing supplied is done, the supply of that thing is for consumption outside Australia and is GST-free, provided the other requirements of the item are met.

182. A strict literal interpretation of the 'not in Australia' requirement merely requires a presence of that entity in Australia when the thing supplied is done for that requirement not to be satisfied. A literal approach would mean, for example, that a supply made to a non-resident individual who happens to be in Australia on holidays when the thing supplied is done fails the not in Australia requirement even though his or her presence in Australia is completely unrelated to the supply.

183. A literal approach would also mean, for example, that a supply provided to the offshore branch of an Australian resident company would not be GST-free under item 3 due to the presence of the Australian resident company in Australia. Subsection 38-190(4) could not apply to treat the supply as made to a recipient that is not in Australia as paragraph 38-190(4)(b) requires the supply to be provided to another entity, which a branch is not. A literal approach, therefore, does not give effect to the policy intent to only tax supplies consumed in Australia.

184. As the Australian location of the entity to which the supply is made at the relevant time is a proxy test for identifying when consumption occurs in Australia, we consider that the expression 'not in Australia' should be interpreted in the context of the supply in question. The expression 'not in Australia' requires, in our view, that the non-resident or other recipient is not in Australia in relation to the supply. This means that a non-resident or other recipient of a supply may satisfy the 'not in Australia' requirement if that entity is in Australia but not in relation to the supply. We examine this more fully when considering the application of items 2 and 3 and paragraph (b) of item 4 to specific entity types in Part III.

185. As noted at paragraph 105, we consider that the requirement in paragraph (b) of item 4 that a recipient of a supply is 'outside Australia' is the same as the requirement that a recipient of a supply is 'not in Australia'. Thus, a recipient of a supply is outside Australia if the recipient is not in Australia in relation to the supply.

Application of subsection 38-190(4) with respect to item 3

186. For the purposes of item 3, subsection 38-190(4) treats a supply to a recipient who is in Australia in relation to the supply as if it were a supply to a recipient who is not in Australia if:

- •

- the supply is made under an agreement entered into, whether directly or indirectly, with an Australian resident; and

- •

- that supply is provided, or the agreement requires it to be provided, to another entity outside Australia.[48A]

The supply is made under an agreement entered into, whether directly or indirectly, with an Australian resident

187. For subsection 38-190(4) to apply to a supply that is made to a recipient who is in Australia in relation to the supply, the supply must be made under an agreement entered into, directly or indirectly, with an Australian resident.[48B]

188. The agreement is entered into directly with an Australian resident if the parties to the agreement are an Australian resident and the supplier.

189. In the context of subsection 38-190(4), we consider that entering into an agreement indirectly with an Australian resident occurs if an entity such as a nominee or agent or the like enters into the agreement on behalf of the supplier or the Australian resident. For example, a supplier may enter into an agreement with an agent, or representative, or associate of the Australian resident acting on behalf of the Australian resident.

190. 'Australian resident' is defined in section 195-1 and means a person who is a resident of Australia for the purposes of the ITAA 1936.[49]

191. When explaining the application of item 3 and subsection 38-190(4) to specific entity types in Part III, we discuss supplies that are made under an agreement with an Australian resident.

That supply is provided, or the agreement requires it to be provided, to another entity outside Australia

192. That supply refers to the supply made to a recipient who is in Australia in relation to the supply.

193. Subsection 38-190(4), by means of the expression 'provided to another entity' seeks to identify the entity to which the item 3 supply actually flows.

194. If the supply is made under an agreement with an Australian resident recipient but the thing supplied is provided, or the agreement requires it to be provided, to another entity located outside Australia, subsection 38-190(4) applies and the not in Australia requirement in item 3 is satisfied.[49A]

195. An example illustrating the application of subsection 38-190(4) (and provided in the Explanatory Memorandum for subsection 38-190(4))[50] is a supply of training services made to an Australian employer but provided to employees attending a training course conducted outside Australia. The Australian employer is treated as a recipient who is not in Australia in relation to the supply because the supply is provided to another entity (an employee) outside Australia.

Example 1 - supply made to an Australian company and provided to employees outside Australia

196. BrisAir Pty Ltd, a Brisbane based airline, enters into an agreement with Australian Hospitality Training ('AHT') to have its employees attend a training course conducted by AHT in Fiji. Subsection 38-190(4) applies to treat BrisAir as not in Australia in relation to the supply when the training services are performed as, under the agreement with AHT, the training is provided to another entity, the employee, outside Australia.

197. Subsection 38-190(4) recognises that a supply under an agreement with an Australia resident may be provided, or be required by an agreement to be provided, to another entity. If that other entity is located outside Australia, subsection 38-190(4) requires the location test in paragraph (a) of item 3 to take account of the location of that other entity.[51]

The meaning of 'when the thing supplied is done'

198. The phrase 'the thing supplied is done' has the same meaning as the expression 'the thing is done' in paragraph 9-25(5)(a).[51A] Under that paragraph, a supply is connected with Australia if the thing being supplied is done in Australia.[52]

199. Consistent with the views expressed in GSTR 2019/1:[53]

- •

- if the thing supplied is a service - when the service is done refers to the period of time during which the service is performed;

- •

- if a supply is the provision of advice or information and the supply involves work to create, develop or produce that information or advice for the recipient - the thing supplied is the performance of services. When the thing supplied is done includes that period of time during which the advice is prepared, produced or created, as the case may be;

- •

- if the supply is an instantaneous provision of advice or information - when the thing supplied is done is the time at which the advice or information is provided;

- •

- if the supply is the creation, grant, transfer, assignment or surrender of a right - the thing supplied is done at the time the right is created, granted, transferred, assigned or surrendered; and

- •

- if the supply is the entry into, or release from, an obligation to do anything, or refrain from an act, or to tolerate an act or situation - when the thing supplied is done is the time at which the obligation is entered into or the release is effected.

Part III - when particular entity types are in Australia in relation to the supply

200. In this Part, we explain, in terms of specific entity types namely, individuals, companies, partnerships, corporate limited partnerships and trusts, when an entity is 'not in Australia'. We do this by describing when an entity is in Australia in relation to the supply.

| In particular we discuss... | at paragraphs |

| When an individual is in Australia in relation to the supply | 201 to 228 |