Practice Statement Law Administration

PS LA 2008/2

Forestry managed investment schemes-

Refer to end of document for amendment history. Prior versions can be requested by emailing TCNLawPublishingandPolicy@ato.gov.au if required.This document has changed over time. View its history.

FOI status: may be released

| Contents | |

|---|---|

| 1. What this Practice Statement is about | |

| 2. Limitations of this Practice Statement | |

| 3. What to consider when ruling on Division 394 | |

| 4. Other matters to consider | |

| 5. More information | |

| Attachment A |

| This Practice Statement is an internal ATO document and is an instruction to ATO staff.

Taxpayers can rely on this Practice Statement to provide them with protection from interest and penalties in the following way. If a statement turns out to be incorrect and taxpayers underpay their tax as a result, they will not have to pay a penalty, nor will they have to pay interest on the underpayment provided they reasonably relied on this Practice Statement in good faith. However, even if they do not have to pay a penalty or interest, taxpayers will have to pay the correct amount of tax provided the time limits under the law allow it. |

This Practice Statement will help you to prepare product rulings for forestry managed investment schemes by applying Division 394 of the Income Tax Assessment Act 1997.

1. What this Practice Statement is about

This Practice Statement will help you to apply Division 394 of the Income Tax Assessment Act 1997 (ITAA 1997) to a forestry managed investment scheme (MIS) and to prepare product rulings.

All legislative references in this Practice Statement are to the ITAA 1997, unless otherwise indicated.

Division 394 allows initial investors in a qualifying forestry MIS to claim a tax deduction equal to 100% of the contributions they make under the scheme (Division 394 deduction). To qualify, the MIS must meet several conditions, including that:

- •

- they have a reasonable expectation that at least 70% of participant contributions will be used on direct forestry expenditure (DFE) (calculated on net present value (NPV))

- •

- where the forestry manager is not dealing at arm's length with other parties in the scheme, they will use market values to calculate DFE

- •

- the scheme meets an 18-month establishment rule, and

- •

- the initial participants meet the 4-year holding period.

2. Limitations of this Practice Statement

This Practice Statement does not cover the:

- •

- treatment of secondary investors in a forestry MIS (that is, those who buy interests from an initial investor), or

- •

- capital gains tax (CGT) small business concessions under Division 152.

3. What to consider when ruling on Division 394

The following is an overview of what you need to consider when preparing a product ruling on Division 394. Each point is explained in detail in Attachment A to this Practice Statement:

- •

- whether the product ruling application is correct and complete (see section 4.3 of this Practice Statement)

- •

- whether the scheme meets the 70% DFE rule (see section 2.4 of Attachment A to this Practice Statement)

- •

- the arm's length pricing rule for items of DFE (see section 2.6 of Attachment A to this Practice Statement)

- •

- whether the NPV calculations are correct (see section 2.6 of Attachment A to this Practice Statement)

- •

- whether the forestry MIS is capable of meeting the 18-month establishment rule (see section 2.8 of Attachment A to this Practice Statement).

4.1 Non-commercial losses

Consideration must be given to whether an 'individual' participant in a forestry MIS may be carrying on a business of primary production and will therefore also be subject to the operation of Division 35 (see section 5 of Attachment A to this Practice Statement).

4.2 Additional correct form

Where the scheme satisfies the 70% DFE rule, examine the Initial contributions notification form (NAT 71434 PDF, 374KB) that the forestry manager gives to ensure that it is in the correct form (see section 2.10 of Attachment A to this Practice Statement).

4.3 Information and document requirements

Product Ruling PR 2007/71 The Product Rulings system gives our information requirements for product rulings. These are set out in the Division 394 forestry application checklist.[1]

The product ruling applicant must provide sufficient documentation to support their 70% DFE rule calculation (both numerator – the DFE amount, and denominator – the participant contributions).

If you do not have enough information and evidence to make a decision, seek additional information from the applicant. You can request the expert information used by the applicants if it has not been provided.

The information and documentary requirements are set out in detail in section 4 of Attachment A to this Practice Statement.

4.4 18-month establishment rule

You must also consider the 18-month establishment rule:

- •

- where a Failure to establish notification form is received from the forestry manager (under section 394-10 of Schedule 1 to the Taxation Administration Act 1953 (TAA)), or

- •

- the project is found to fail the 18-month establishment rule but the forestry manager has failed to notify (see section 2.8 of Attachment A to this Practice Statement).

4.5 Division 394 of Schedule 1 to the Taxation Administration Act 1953 – reporting requirements

Division 394 of Schedule 1 to the TAA imposes reporting requirements on forestry managers of forestry MIS.

A failure to comply with these requirements may give rise to administrative penalties under Subdivision 286-C of Schedule 1 to the TAA.

4.6 Division 290 of Schedule 1 to the Taxation Administration Act 1953 – promoter penalty laws and forestry MIS

If you are reviewing a forestry MIS, you may need to consider whether the promoter penalty laws under Division 290 of Schedule 1 to the TAA apply to a scheme. A forestry MIS that has received a product ruling may be subject to these laws when the scheme is promoted (from 1 July 2024) or implemented in a materially different way to that described in the product ruling, including where the 18-month establishment rule is not met (see subsections 290-50(1A) and (2) of Schedule 1 to the TAA, and Law Administration Practice Statement PS LA 2021/1 Application of the promoter penalty laws).

4.7 What your product ruling must include

Ensure that your product ruling includes:

- •

- information on record-keeping requirements, and

- •

- a statement that the product ruling does not apply to secondary investors.

For more information, see PR 2007/71.

Attachment A

1. Terms used in this Practice Statement

The following terms are used in this Practice Statement:

- •

- 4-year holding period – the period discussed at section 2.9 of this Attachment

- •

- 18-month establishment rule – the test set out in subsection 394-10(4)

- •

- Division 394 deduction – an initial investor in a qualifying forestry MIS can claim a tax deduction equal to 100% of the contributions they make under the scheme

- •

- 70% DFE rule – the test set out in section 394-35

- •

- contractor – a third party with whom the forestry manager contracts to provide goods, services or land for establishing and tending trees for felling in Australia

- •

- Failure to establish notification form (NAT 71435, 280KB) – an approved form that the forestry manager must submit under section 394-10 of Schedule 1 to the TAA, about the 18-month establishment rule

- •

- forestry managed investment scheme (forestry MIS) – a scheme for establishing and tending trees for felling in Australia, as defined in subsection 394-15(1)

- •

- forestry manager – the entity that manages, arranges or promotes a forestry MIS, as defined in subsection 394-15(2)

- •

- Initial contributions notification form (NAT 71434 PDF, 374KB) – an approved form about initial contributions to the scheme that the forestry manager must submit under section 394-5 of Schedule 1 to the TAA

- •

- initial participant – one who obtains their interest in the manner described in subsection 394-15(5)

- •

- net present value (NPV) – the value of past and future amounts in today's dollars as required by section 394-35

- •

- participant – an entity that holds a forestry interest in a forestry MIS, as defined in subsection 394-15(4)

- •

- participant contributions – payments under a forestry MIS made by a participant to a forestry manager, other than those excluded by section 394-40

- •

- test time for the 70% DFE rule – is 30 June in the income year in which a participant in the scheme first pays an amount under the scheme.

2. Section 394-10 general conditions

For a participant to qualify for a Division 394 deduction, the forestry MIS they contribute to must be a qualifying scheme that meets the following conditions in section 394-10:

- •

- The forestry manager must have a reasonable expectation at test time that they will spend at least 70% of participant contributions on DFE during the life of the project (see sections 2.1 and 2.2 of this Attachment for more on the 70% DFE rule).

- •

- The scheme's trees are established within 18 months of the end of the income year in which the first payment is made by the participant (see section 2.8 of this Attachment for more on the 18-month establishment rule).

- •

- The participant is an initial participant.

- •

- The participant holds the interest for 4 years from the end of the income year in which they first paid an amount under the scheme (see section 2.9 of this Attachment for more on the 4-year holding rule).

2.1. The 70% DFE rule – overview

To ensure that most of the funds contributed by participants are spent on activities directly related to establishing, tending, felling and harvesting trees, the scheme's forestry manager must ensure that no less than 70% of contributions are spent on DFE at test time. This requirement is explained at paragraph 8.36 of the Explanatory Memorandum to the Tax Laws Amendment (2007 Measures No. 3) Bill 2007 (EM).

The rule is an objective test of a reasonable expectation that 70% of payments under the scheme will be expended on DFE over the life of the project, using an NPV calculation for past and future expenditure.

DFE includes actual and notional amounts attributable to establishing, tending, felling and harvesting trees (see subsection 394-45(1)), as well as certain amounts not expressly excluded from the definition of DFE by subsections 394-45(3) and (4). This is explained in more detail in section 2.4 of this Attachment.

The 70% DFE rule calculation is met if the NPV of DFE is no less than 70% of the NPV of participant contributions.

Section 394-40 also lists payments by a participant which are excluded for the purposes of payments under a forestry MIS. These payments, such as borrowing costs, may be relevant to other parts of the ITAA 1997. These payments are not relevant to the 70% DFE rule calculation.

Example 1 – simple 70% DFE rule calculation

In year 1, a participant acquires a 1-hectare interest in a 10-year plantation for $10,000 and holds it until harvest. Also in year 1, the forestry manager pays $8,000 in DFE and there are no further anticipated or actual expenses or participant contributions over the life of the project.

This scheme passes the 70% DFE rule, as $8,000 is 80% of $10,000.

2.2 Reasonable expectation

Under subsection 394-35(1), the forestry manager must be able to demonstrate a reasonable expectation of meeting the 70% DFE rule over the life of the project. The test is objective but applies to both the objective and subjective knowledge of the forestry manager.

The term 'reasonable' is not defined in the ITAA 1997 and therefore has its 'ordinary meaning'.

In this context, we consider the objective standard of 'reasonable' is that of a reasonable person standing in the shoes of the forestry manager. That is, whether there is about an even chance that a reasonable person would expect that the project would meet the 70% DFE rule.

This approach is consistent with paragraph 8.38 of the EM and the other views we have released on the 'ordinary meaning' of 'reasonable', including:

- •

- paragraphs 19, 20 and 37 to 46 of Goods and Services Taxation Ruling GSTR 2000/7 Goods and Services Tax: transitional arrangements – supplies, including supplies of rights, made before 1July 2000 and the extent to which such supplies are taken to be made on or after 1 July 2000

- •

- paragraphs 27 to 29 of Miscellaneous Taxation Ruling MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard, and

- •

- subparagraphs 10B, 10C, 10E and 10F of Law Administration Practice Statement PS LA 2012/5 Administration of the false or misleading statement penalty – where there is a shortfall amount.

To apply the objective test, assume that the forestry manager has all of the information that a reasonable person would require in order to make a reasonable estimate of the DFE over the term of the project. This includes knowledge that is not generally available and which may apply only to the particular scheme.

The forestry manager must have taken the steps that a reasonable person would have taken at the time to obtain sufficient information about the forestry industry, and the relevant costs of carrying out such a project.

Example 2 – 70% DFE rule met, despite changes

In the first year of a 10-year blue gum project, the forestry manager reasonably expects that the proportion of contributions spent on DFE under the scheme will be 75%. This expectation is based on the forestry manager's knowledge of present felling technology and prevailing economic conditions.

The forestry manager estimates that the cost of felling and loading the plantation in 10 years' time in NPV terms will be $4,000 per hectare. This estimate is based on reports from independent experts on the methods of felling blue gums in the plantation's region.

Subsequently, technological advances in felling methods (that were not reasonably foreseeable when the project was planted) result in the cost of felling being reduced by 25% to $3,000 per hectare. This means that the actual DFE on the project during its life is below 70% of total fees charged to participants. The forestry manager becomes aware of this in year 8 of the project.

The forestry manager could not have been expected to foresee the technological advancement at the time of making the estimate. Therefore, the reasonable expectation test is met at the time of the estimate.

Example 3 – 70% DFE rule and foreseeable changes

A forestry manager's estimated labour cost for a project is based on the future value of current costs of similar-sized projects and includes labour costs for pest control.

During the 3 years before the commencement of the project, the use of advanced methods of pest control increases steadily from 10% of industry projects to 30%.

In the year before the project commences, industry reports indicate that, in the next 10 years, this method will spread to all parts of the industry.

This method of pest control is actually adopted in the project from commencement and significantly reduces labour costs below that used in the estimates of DFE. A reasonable estimate of the proportion of contributions spent on DFE based on the reasonably expected use of the advanced pest control method would be below 70%.

The forestry manager could reasonably have expected to be able to use these methods during the project's life and did actually expect to use them. The reasonable expectation test is never met, therefore, and the participants in the scheme are never entitled to the specific deduction of the amounts they paid under the forestry MIS.

2.3. Participant contributions

Participant contributions are payments under a forestry MIS made by the participant to the forestry manager. These participant contributions, calculated on an NPV basis, form the denominator in the 70% DFE rule calculation.

For the purposes of paragraph 394-10(1)(b), 'payment' includes an amount paid at the direction of a participant in the scheme, such as a financial institution paying the scheme manager an amount as part of funding a loan to the participant.

Under Division 394, the following payments are not considered to be made under a forestry MIS and are excluded from the 70% DFE rule calculation:

- •

- borrowing costs

- •

- interest, and payments in the nature of interest (such as a premium on repayment or redemption of a security, or a discount of a bill or bond)

- •

- stamp duty

- •

- goods and services tax

- •

- stockpiling costs

- •

- processing costs, and

- •

- specified transport and handling costs.

2.4. Direct forestry expenditure

DFE is defined in subsection 394-45(1) as:

- (a)

- an amount paid under the scheme that is attributable to establishing, tending, felling and harvesting trees; and

- (b)

- notional amounts reflecting the market value of goods, services or the use of land, provided by the forestry manager of the scheme, for establishing, tending, felling and harvesting trees.

Section 394-45 also sets out exclusions to DFE and exceptions to those exclusions.

Where only part of an amount is attributable to DFE, the forestry manager must apportion the amount when calculating whether the scheme passes the 70% DFE rule.

Where a grant is received towards expenditure that is undertaken by the scheme manager, then only the net expense of the scheme manager is taken into account in calculating DFE. That is, the grant amount is excluded from the DFE calculation. Refer to paragraph 8.43 of the EM.

Exclusions from DFE

Subsection 394-45(3) states that the following types of expenditure are excluded from DFE to the extent that they relate to any of the following:

- (a)

- marketing of the scheme;

- Example: Advertising, sales, sponsorship and entertainment.

- (b)

- insurance, contingency funds or provisions (other than provisions for employee entitlements);

- (c)

- financing;

- (d)

- lobbying;

- (e)

- general business overheads (but not overheads directly related to forestry);

- (f)

- subscriptions to industry bodies;

- (g)

- commissions for financial planners or financial advisers;

- (h)

- compliance with requirements related to the structure and operations of the forestry manager of the scheme;

- Example: Product design and preparation of product disclosure statements.

- (i)

- supervision and auditing of contracts, other than direct supervision of direct forestry activities (such as establishing trees for felling);

- (j)

- legal fees relating to any matter mentioned in this subsection.

Subsection 394-45(4) states that expenditure is excluded from DFE to the extent that it relates to any of the following:

- (a)

- transportation and handling of felled trees that happens after the earliest of the following:

- (i)

- sale of the trees;

- (ii)

- arrival of the trees at the mill door;

- (iii)

- arrival of the trees at the port;

- (iv)

- arrival of the trees at the place of processing (other than where processing happens in-field);

- (b)

- processing;

- (c)

- stockpiling (other than in-field stockpiling);

- (d)

- marketing and sale of forestry produce.

Amounts that are DFE

As they are not specifically excluded by subsections 394-45(3) or (4), the following types of expenditure are included as DFE:

- •

- transportation and handling expenses to the first stages of milling or processing (paragraph 8.61 of the EM)

- •

- the first leg of transport after in-field chipping to a mill or wharf (paragraph 8.61 of the EM)

- •

- research and development (R&D) that is attributable to establishing, tending, felling and harvesting trees (paragraph 8.62 of the EM)

- •

- overheads directly related to forestry (paragraph 394-45(3)(e))

- •

- provisions for employee entitlements (paragraph 394-45(3)(b)), and

- •

- direct supervision of direct forestry activities (such as establishing trees for felling) (paragraph 394-45(3)(i)).

Example 4 – corporate overheads

Example 8.9 from the EM provides guidance on activities of employees that are not direct forestry activities. It states:

Greentrees Ltd's sole business is the management of bluegum forestry projects. The costs of an employee of Greentrees Ltd who only carries out the following tasks would be regarded as corporate overheads and not included in DFE: chief executive officer, personnel manager or accounts manager.

Example 5 – direct forestry activities

Example 8.10 in the EM provides guidance on the activities of employees that are direct forestry activities. It states:

The costs of an employee who only carries out the following tasks would be included in DFE:

- •

- a 'project coordinator' who undertakes community liaison, education programmes and land purchase;

- •

- a 'case and systems manager' located at head office who operates Private Plantation Management Information System (PPMIS) allocations, mapping services, geology, planning applications, remote sensing and survival analysis;

- •

- a 'resource manager' who undertakes harvest scheduling, inventory, survival analysis, mill liaison and in-field project analysis;

- •

- a 'head of forestry operations' who undertakes final land approval, seedling [and] cutting strategy, plantation and base design and government and community liaison (noting that there is a specific exception for lobbying); and

- •

- an 'in-field technical supply officer' who undertakes satellite operations, personal digital assistant (PDA) support, mapping and taping out and reserve monitoring.

Example 6 – in-field chipping

This example illustrates that DFE does not include the cost of in-field chipping which is a processing cost under paragraph 394-45(4)(b).

Gum Blue Pty Ltd is an entity engaged in a forestry MIS. According to its cost analysis done internally, it is more economical for them to chip the felled trees on-site before transporting them to a mill.

While the first leg of transport is included in DFE, the costs of the 'in-field chipping' are not. This is consistent with paragraph 8.67 of the EM, which states that while the concept of harvesting is exclusive of processing, including the costs of 'in-field chipping', a forestry manager may claim costs of transport to a mill or wharf subsequent to in-field chipping (but not the costs of the chipping, or where transport is after the sale).

2.5. Apportioning DFE amounts

Paragraph 8.51 of the EM explains that the forestry manager should use a reasonable apportionment method when apportioning DFE amounts to determine the extent to which the expenditure is attributable to establishing, tending, felling and harvesting trees on the project. This excludes the extent to which the goods or services acquired:

- •

- have an effective life greater than the scheme they were acquired for, or

- •

- are used in multiple schemes.

Example 7 – apportionment scenarios

Scenario 1: A forestry manager incurs R&D costs attributable to establishing, tending, felling and harvesting trees in Australia. These R&D costs relate to multiple projects. It is permissible for the forestry manager to apportion the R&D costs on a reasonable basis, such as the proportion of the area under plantation or the value of the R&D to individual projects (verified by documentary evidence to support the area or value for each plantation).

Scenario 2: A forestry manager purchases harvesting equipment for $100,000. The equipment will be used equally on 5 forestry projects for the whole of the equipment's life. Therefore, $20,000 is allocated to each of the 5 projects.

Scenario 3: An entity engaged in a forestry project employs a person to supervise its team of foresters and accounting staff. If a forestry manager includes the costs of this supervisor in the calculation of DFE for the 70% DFE rule, then it must apportion the costs (including the labour costs of employing the supervisor) between DFE and general overheads. Only the portion that relates directly to supervising the foresters is DFE.

An internal report stating the intended proportion of the supervisor's time to be spent supervising the foresters is used to determine how the costs of employing the supervisor should be apportioned. Apportionment based on time spent supervising the foresters is the most appropriate method in this instance.

Scenario 4: An entity engaged in a 10-year forestry project purchases a 10-year water licence for $10,000. The cost of the licence is in line with other licences purchased in the recent past for a similar period. The licence grants the entity access to 5,000 megalitres of water each year and this water will be used primarily for the forestry project (as specified within the project plan). However, the water will also be used for other purposes.

It would be appropriate to apportion the cost of the licence when calculating DFE based on the likely water usage of the type and number of trees in the plantation. An expert's report detailing the expected total water usage of the plantation shows that the plantation is expected to use 4,000 megalitres of water each year. Therefore, $8,000 of the licence costs will be attributable to DFE.

2.6. Net present value calculation – overview

The concept of NPV is used to calculate amounts for the purposes of the 70% DFE rule.

The scheme is a qualifying scheme if the NPV of its DFE divided by the NPV of its participant contributions is equal to or greater than 70% (see section 394-35, and paragraph 8.46 of the EM).

When calculating the NPV of amounts to establish the ratio of DFE to participant contributions, the amounts used may be actual or notional.

Under paragraph 394-45(1)(b), notional expenditure includes any notional amount attributable to the use of land for establishing trees under the scheme, or the notional charges for goods or services that the forestry manager provides in house rather than acquiring from a contractor.

Under subsection 394-45(2), notional expenditure is calculated as if it were paid annually for each income year based on the market value of the goods or services provided, or the use of land.

Under subsection 394-45(2), the notional amount is taken to have been paid on 1 January in an income year, unless:

- •

- the first amount paid by a participant under the scheme occurs after the income year commences, or

- •

- the scheme ceases before the end of the income year.

Where the first amount paid by the participant under the scheme occurs after the income year commences, the notional amount is taken to have been paid on the last day of the income year (paragraph 394-45(2)(b)).

If the scheme ceases before the end of the income year, the notional amount is taken to have been paid on the day the scheme ceases (paragraph 394-45(2)(c)).

Example 8 – notional amount for land use

Hardywood Pty Ltd's (Hardywood) landowning division carries out an ongoing program of identifying and acquiring land that is suitable for growing hardwood eucalypts. This land is held in the company's land bank and, under a licence arrangement, made available to participants who acquire interests in a forestry MIS promoted by Hardywood.

An annual fee for use of the land is charged to participants over the term of the forestry MIS. Each participant's fee is based on the number of forestry interests they hold as a proportion of all interests in the scheme. There is no actual amount paid for the land, as Hardywood owns the land made available to the scheme participants.

Hardywood engages a qualified land valuer who provides written advice that, if the land was leased from an independent third party, the company would pay an average of $200 per hectare.

Under section 394-45, this amount can be used as the basis of determining the notional amount for the use of land in the DFE calculation for the project.

Example 9 – notional amount for forestry services

Hugetree Pty Ltd is an integrated forester that has been engaged in forestry in its own right for over 50 years and has extensive tracts of its own trees, expert knowledge, its own nursery and a highly qualified workforce. The company's expertise and workforce is made available to the forestry MIS, as necessary, to provide tree seedlings and carry out the pre-planting, establishment, maintenance and harvesting services over the term of the scheme.

The actual costs associated with providing the seedlings and the establishment services to the participants in the forestry MIS is minimal due to economies of scale achieved by using the company's own expertise and existing workforce.

Hugetree Pty Ltd is aware that most other promoters of forestry MIS engage independent third-party contractors to provide seedlings and establishment services. The company obtains a written opinion from an independent expert that the average cost for these services on similar land would be $1,900 per hectare.

Under section 394-45, this amount can be used as the basis of determining the notional cost of establishment in the calculation of DFE for the project.

Market value substitution rule – arm's length expenditure

Under subsection 394-35(8), a forestry manager must substitute the market value of goods or services for the price they actually paid when:

- •

- the transaction is not at arm's length, and

- •

- the amount paid is or will be more or less than the market value of what it is for.

For more guidance on the principle of arm's length and how to apply it, see:

- •

- Chapter 2 of Taxation Ruling TR 97/20 Income tax: arm's length transfer pricing methodologies for international dealings for discussion on the key concepts of the arm's length principle, and

- •

- Chapter 3 of TR 97/20 for discussion on the accepted methods used to test compliance with the arm's length principle.

Example 10 – market value substitution

Treeteak Pty Ltd, a company which manages a forestry MIS based in north-western Western Australia, decides to purchase teak seedlings from Unique Treeteak Ltd (UTL), their wholly owned subsidiary, for $10,000. UTL is one of a number of suppliers of teak seedlings in Australia.

A review of commercially available information on recent sales of teak seedlings by other reputable suppliers shows that the normal market value of the seedlings is $4,000, instead of $10,000. For the purpose of the 70% DFE rule calculation, the amount of $4,000 is therefore substituted for the $10,000 as the amount of DFE. The amount of participant contributions is not affected by this substitution and neither is the NPV of those contributions.

Carrying out the NPV calculation

Paragraph 8.44 of the EM states:

The amount spent on DFE over the life of the project will be determined in 'net present value' terms. Net present value is a way of converting past and future costs into today's dollars. Discounting is the technique used to make the conversion. Discounting recognises that a dollar today is not worth the same as a dollar in the future because (even in the absence of inflation) today's dollar can be invested.

The NPV is the sum of all present values of amounts that have been or will be paid. Present values are calculated by discounting future amounts at an appropriate discount rate. For Division 394, the discount rate is the yield on Commonwealth Government Securities that are Treasury bonds with a maturity closest to 10 years (as published by the Reserve Bank of Australia). The forestry manager should use the current quoted rate as a proxy for the rate on 30 June.

Calculating present values for past amounts

To calculate the present value of an amount paid on or before the day on which the 70% DFE rule is calculated, treat the amount as having been paid on 30 June in the income year in which the amount was actually paid(subsection 394-35(4)).

To calculate present values for past amounts, multiply the amount by the compounded discount rate. The general formula for calculating the present value of a past amount is:

PV = P(1 + r)T

Where:

- •

- PV is the present value at the current time (where time (t) = M)

- •

- P is the amount of payment made in the past (where t = 0)

- •

- r is the discount rate for the appropriate period (in this instance 'period' = 'year')

- •

- T is the number of periods between t = 0 and t = M.

Calculating NPV for future amounts

To calculate the present value of an amount paid after the day on which the 70% DFE rule is calculated, treat the amount as having been paid on 1 January in the income year in which the amount is expected to be paid (subsection 394-35(5)).

To calculate present values for future amounts, divide the amount by the compounded discount rate. The general formula for calculating the present value of a future amount is:

PV = P ÷ (1 + r)T

Where:

- •

- PV is the present value at the current time (where time (t) = 0)

- •

- P is the amount of payment made in the future (where t = M)

- •

- r is the discount rate for appropriate period

- •

- T is the number of periods between t = 0 and t = M.

T will always be a number of years plus a half-year period, as the amount will be discounted back from 1 January in the year paid to the relevant 30 June. Refer to Example 12 of this Practice Statement.

The NPV of DFE under a scheme is the sum of the present values of all past and future amounts. This sum forms the numerator in the 70% DFE rule calculation (subsection 394-35(2)).

The denominator in the 70% DFE rule calculation is found by summing the present values of all past and future contributions under the scheme. That is, the sum of the present values of all amounts that the participants in the scheme have paid (that is, past amounts) or will pay (that is, future amounts) (subsection 394-35(3)).

Example 11 – selecting a rate for present value

This example regarding selecting a rate for present value appears at Example 8.5 in the EM:

On 30 June 2008, a scheme manager is seeking to establish the net present value of future expenditure. The manager consults the Indicative Mid Rates of Selected Commonwealth Government Securities as published by the Reserve Bank of Australia for that day. According to the Reserve Bank, a Treasury Fixed Coupon Bond with a yield of 5.910 per cent will mature in February 2017 and another Treasury Fixed Coupon Bond with a yield of 5.880 per cent will mature in March 2019. No other bonds with a longer maturity are listed. The bond maturing in March 2019 should be chosen as it has the maturity closest to 10 years.

Example 12 – NPV calculation for present and future amounts, passing 70% DFE rule

A forestry manager offers forestry interests in a forestry MIS under a product disclosure statement at a cost of $10,000 per each one-hectare forestry interest. A participant that makes an application acquires a one-hectare interest in an 11-year plantation for $10,000 and holds their interest until harvest.

We receive a Division 394 product ruling application from the forestry manager on 23 November 2010. On that date, the discount rate used to calculate the NPV of the project's participant contributions and DFE is the interest rate on Commonwealth Government Securities. For the purposes of this example an interest rate of 5.0% is used.

In their application, the forestry manager provides us with all relevant details, summarised as follows:

Project details

Following the issue of the ATO product ruling, the project will be marketed until 30 June 2011. There will be 1,000 one-hectare forestry interests available under the product disclosure statement and all forestry interests are expected to be sold.

Final harvest of the project trees is expected to occur in February 2022 and all sale proceeds returned to participants by June 2022.

Participant contributions

Total participant contributions on acceptance in the project is projected to be $10 million payable before 30 June 2011 (1,000 one-hectare forestry interests at $10,000 per forestry interest). A further $1 million ($1,000 per forestry interest) is required to be paid by participants in December 2021 to fund the harvesting of the plantation and the transportation of the harvested timber to the timber mill.

Net present value of participant contributions

The initial payment of $10 million does not need to be discounted as it occurs in the base year for which we are trying to determine the present value (that is, at time t = 0).

To discount the $1 million payable in December 2021, the number of periods between the base time t = 0 and December 2021 must be determined. The base time is 30 June 2011 and (as per Notional amounts in section 2.6 of this Attachment ) the $1 million is taken to have been paid on 1 January 2022.

Therefore, the $1 million payment must be discounted with reference to a time period of 10.5 years.

The present value of $1 million to be contributed in December 2021 is:

$1,000,000 ÷ 1.0510.5 = $599,118

The NPV of the participant contributions for the project is $10,599,118. This is based on the calculation:

$10,000,000 + $599,118 = $10,599,118

DFE of forestry MIS

Prior to 30 June 2011 (year 0), the forestry manager leases the land and begins preparing it for planting. The forestry manager incurs $3 million in DFE.

In the year following 30 June 2011, the forestry manager will organise for the trees to be planted and will incur a further $4.5 million in DFE.

The harvesting and transportation of the harvested timber to the timber mill in February 2022 is forecast to cost $700,000 in DFE.

Net present value of forestry MIS DFE

The $3 million in DFE is incurred by the forestry manager in the base year and this value is therefore not discounted.

The $4.5 million in DFE for planting costs to be incurred by the forestry manager is deemed to occur on 1 January 2012 and should be discounted for 6 months. This equates to:

$4,500,000 ÷ 1.050.5 = $4,391,550

The harvesting cost is deemed to occur on 1 January 2022. This equates to:

$700,000 ÷ 1.0510.5 = $419,383

Therefore, the NPV of all DFE for the forestry MIS is:

$3,000,000 + $4,391,550 + $419,383 = $7,810,933

Application of the 70% DFE rule

The 70% DFE rule is passed as $7,810,933 is equal to or more than 70% of $10,599,118.

Discussion

It is important that when calculating the relevant proportion of contributions spent on DFE, all DFE after year 0 is properly discounted back to June 30 of year 0 from 1 January of the financial year in which it is incurred. For ease of calculations, we are satisfied if an annualised Treasury bond interest rate is used.

Example 13 – NPV calculation, failing 70% DFE rule

This example has been based on scenario 4 of Example 8.6 in the EM and provides guidance on a calculation of ratio of NPV of DFE to NPV of participant contributions that fails the 70% DFE rule.

In year 1 (t = 0), a participant acquires a one-hectare interest in a 10-year plantation for $10,000 and holds their interest until harvest. In years 2 to 9, the participant pays $500 in fees each year. In year 10, the participant pays $2,000 in fees.

The discount rate is 7%.

The participant's total contribution in nominal terms is $16,000.

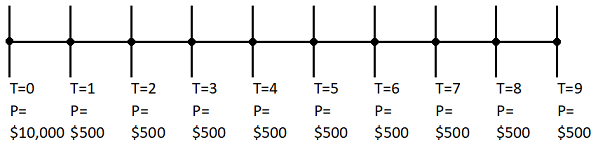

Diagram 1: Participant's contributions

The initial payment of $10,000 does not need to be discounted. The subsequent payments, as explained under Notional amounts in section 2.6 of this Attachment, are deemed to occur on 1 January of each income year, so there will be (M-1) time periods between times t = 0 and t = M.

The NPV of participant contributions is $14,074, calculated as present values of all payments (10,000 t=0; $500 t = 2....9; $2,000 t = 10):

($10,000 ÷ 1.070) + ($500 ÷ 1.071) + ($500 ÷ 1.072) + ($500 ÷ 1.073) + ($500 ÷ 1.074) + ($500 ÷ 1.075) + ($500 ÷ 1.076) + ($500 ÷ 1.077) + ($500 ÷ 1.078) + ($2,000 ÷ 1.079) = $14,074

The forestry manager outlays $5,000 of the initial $10,000 participant contribution. In years 2 to 9, the forestry manager's expenditure on DFE is $300 per annum and, in year 10, expenditure on DFE is $1,000.

The forestry manager's total DFE in nominal terms is $8,400. The NPV of DFE is $7,335, calculated as:

($5,000 ÷ 1.070) + ($300 ÷ 1.071) + ($300 ÷ 1.072) + ($300 ÷ 1.073) + ($300 ÷ 1.074) + ($300 ÷ 1.075) + ($300 ÷ 1.076) + ($300 ÷ 1.077) + ($300 ÷ 1.078) + ($1,000 ÷ 1.079) = $7,335

The 70% DFE rule is failed, as $7,335 is 52% of $14,074.

2.7. Specific interest in land

An initial participant of a forestry MIS can qualify for the Division 394 deduction without holding a specific interest in a particular plot of land.

The notional use of land inclusion in the DFE definition at paragraph 394-45(1)(b) allows for a proportional interest in an aggregate holding of land. It allows the inclusion of actual or notional amounts for the use of land proportional to the participants' share of the total project investment.

Example 14 – notional land use

In January 2008, Jennifer invests in a forestry project offered by Primary Bluegums Ltd. The project is a forestry MIS that has a product ruling from us confirming that deductions are allowable for initial participants under section 394-10.

Under the scheme, initial participants pay for one or more forestry interests. A forestry interest gives the investor a right to receive a proportional share of the net proceeds at the termination of the forestry MIS. Jennifer is not required to enter into a sublease, nor is she allocated any specific allotments. Her rights to share proportionally in the net proceeds of the forestry MIS only require that she hold one or more forestry interests in the forestry MIS.

2.8. 18-month establishment rule

Under subsection 394-10(4), the scheme's trees must all be established in the ground in Australia within 18 months of the end of the income year when an amount was first paid under the scheme by a participant.

The term 'established' is not defined for the purposes of Division 394. However, paragraph 8.27 of the EM states that the concept of 'establishing' a plantation includes 'planting, coppicing and grafting activities and other methods of plant propagation that result in a forest being established'.

Paragraph 8.27 of the EM explains that acquiring an immature forest is not establishing a plantation.

Paragraph 8.28 of the EM provides that the site preparation necessary to establish trees and enable them to survive is included in establishment. Therefore, these costs, as they relate to the scheme, are included in DFE.

As stated in Taxation Determination TD 2006/46 Income tax: what amounts are included in 'establishment expenditure' for the purposes of working out the decline in value of a horticultural plant under section 40-545 of the Income Tax Assessment Act 1997?, the term 'establish' in the context of the establishment of a horticultural plant is to plant it in its long-term growing medium. Therefore, in order to satisfy the 18-month establishment rule, the trees must be planted permanently in the ground.

Should the trees not be planted within 18 months, the participant's deduction may be denied. In addition, the promoter penalty provisions may be applied against the forestry manager (see paragraph 8.21 of the EM).

Failure to establish notification form

Section 394-10 of Schedule 1 to the TAA requires the forestry manager to give us a statement of reasons why they failed to meet the 18-month establishment rule.

The statement must be in the approved form and must be given to us within 3 months after the end of the 18-month period. This form is called a Failure to establish notification form.

On the Failure to establish notification form, the forestry manager should provide sufficient information for us to determine whether any action should be taken to deny deductions.

As a general guide, we would be satisfied if the forestry manager provided the following explanations as reasons for failing to adhere to the 18-month establishment rule:

- •

- a reasonable mistake on the forestry manager's part in the management, arrangement or promotion of the forestry MIS that sufficiently impedes its establishment

- •

- an act or default of another entity (other than of the forestry manager) that sufficiently impedes the establishment of the forestry MIS, or

- •

- an accident or some other cause beyond the forestry manager's control that sufficiently impedes the establishment of the forestry MIS.

For each of the above explanations, the forestry manager must show that they took reasonable precautions or exercised due diligence to prevent such acts from impeding the establishment of the forestry MIS.

Where the forestry manager does not notify us

We may discover cases where the 18-month establishment rule is not met for a forestry project in the course of other activities, such as conformance audits for product rulings. In such cases, forestry managers should inform us about:

- •

- the name of the scheme

- •

- the identity of the forestry manager (or their associate)

- •

- the circumstances under subsection 394-10(4) of Schedule 1 to the TAA that gave rise to the 18-month establishment rule not being satisfied, and

- •

- the reasons why a notification form was not provided, as specified in section 394-10 of Schedule 1 to the TAA, once the 18-month establishment rule was not satisfied.

The information provided must be sufficient for us to determine whether any action should be taken against the forestry manager and participants in the forestry MIS for failing to satisfy the 18-month establishment rule and the failure by the forestry manager to provide the Failure to establish notification form.

A failure to comply with this reporting requirement may give rise to administrative penalties under Subdivision 286-C of Schedule 1 to the TAA. Refer to section 3 of this Attachment.

2.9. 4-year holding period

In order for a participant to qualify for the Division 394 deduction under subsections 394-15(5) and 394-10(5), they must obtain a relevant forestry interest and hold it under the scheme for 4 years from the end of the income year in which they first paid an amount under the scheme.

Paragraph 394-10(5)(b) denies deductions by an initial participant for contributions made under a forestry MIS if a CGT event happens in relation to the interests within 4 years after the end of the income year in which they first paid an amount under the scheme (that is, if the initial participant sells their interest in the forestry MIS).

However, subsection 394-10(5A) stipulates that paragraph 394-10(5)(b) does not apply to a CGT event if:

- •

- the CGT event happens because of circumstances outside an initial participant's control (for example, the forestry interest is compulsorily acquired), and

- •

- when the initial participant acquired the forestry interest, the initial participant could not reasonably have foreseen the CGT event happening.

Under subsection 394-25(2), where a CGT event happens in relation to the interests within 4 years, but the initial participant still holds the interests after the event, the initial participant's assessable income for the income year in which the CGT event happens will include the decrease (if any) in the market value of the interests as a result of the CGT event.

Consistent with the approach taken under CGT provisions and outlined in paragraph 9.34 of the EM, an initial participant is taken to dispose of their interests under a forestry MIS at the time of entering into an agreement for disposal.

An initial participant's assessments may be amended within 2 years from the end of the income year in which the investor disposed of the interests, where the interest is disposed of within 4 years (subsection 394-10(6)).

2.10. Initial contributions notification form

Where the scheme meets the 70% DFE rule, the forestry manager must give us information about amounts paid or payable by participants under the scheme (section 394-5 of Schedule 1 to the TAA) – via the Initial contributions notification form.

Under subsections 394-5(4) and (5) of Schedule 1 to the TAA, this approved form requires forestry managers to provide information about:

- •

- the name of the scheme

- •

- the identity of the forestry manager (or associate)

- •

- the amounts paid or payable under the scheme by participants, and

- •

- anything else that we may consider relevant.

Where the forestry manager does not notify us

A failure to comply with this reporting requirement may give rise to administrative penalties under Subdivision 286-C of Schedule 1 to the TAA. Refer to section 3 of this Attachment.

3. Administrative penalty – failure to lodge

Division 394 of Schedule 1 to the TAA imposes the reporting requirements, as outlined in this Attachment, on forestry managers of forestry MIS. These reporting requirements apply whether or not the forestry MIS has been issued with a product ruling. The reporting requirements also apply whether or not a scheme is a MIS.

A failure to comply with these requirements may give rise to administrative penalties under Subdivision 286-C of Schedule 1 to the TAA. Paragraph 286-80(2)(a) of Schedule 1 to the TAA provides that where there is failure to provide a return, notice or other document on time or in the approved form, the base penalty amount is one penalty unit[2] for each period of 28 days or part of a period of 28 days starting on the day when the document is due and ending when the document is given. This amount may be multiplied by 2, 5, or 500, by virtue of subsections 286-80(3), (4) and (4A) of Schedule 1 to the TAA, depending on whether the forestry manger is a medium withholder[3], large withholder[4] or a significant global entity.[5]

4. Product ruling application – documentation requirements

Our information and documentation requirements for product rulings are set out in the Division 394 forestry application checklist. Without limiting the documentation that may be required, the following paragraphs of this Attachment discuss the document requirements for supporting claims made in Division 394.

If the forestry manager has not provided expert information, consider whether, and how much, additional information would influence your decision on the relevant tests in Division 394. Request additional expert information from the forestry manager if you decide that it is appropriate to do so.

4.1. Additional expert information

If the forestry manager has expert information, you can request them to provide it to verify the assumptions and estimates in the application. For example:

- •

- forestry expert reports to verify the nature, extent and timing of proposed forestry activities

- •

- forestry expert reports to determine the suitability of land, and the type of trees to be planted

- •

- valuation expert reports to verify the cost of activities, and the value of assets, and

- •

- details of each of the experts' engagement, including

- -

- copies of letters of engagement

- -

- client instructions and assumptions, and information used in preparing the reports, and

- -

- their qualifications and relevant expertise.

4.2. Documentation required for the reasonable expectation test

The forestry manager should supply the following information in support of the reasonable expectation test:

- •

- a sufficiently detailed description of past and projected expenditure in each class, including its nature, amount, timing and any independent valuation reports they have

- •

- a sufficiently detailed description of the experts who prepared any relevant reports (such as forestry experts and valuers), including

- -

- their commercial experience in their relevant fields

- -

- the nature of the services provided, and

- -

- a copy of their engagement letter, and

- •

- a sufficiently detailed description of how the evidence supports the forestry manager's conclusion that they have a reasonable expectation of passing the 70% DFE rule at test time.

The larger a class of expenditure, the more influence it has on the outcome of the reasonable expectation test. Therefore, for higher value classes of expenditure, we should expect the forestry manager to supply more detail to support their claims.

Where the class of expenditure is too broad, a breakdown of the components within that class of expenditure should be requested. For example, if a class of expenditure groups together all the costs of preparing land, establishing the acquiring the seedlings and planting into to one amount, you should request a breakdown of the amounts for each component.

You may request additional valuation reports or supporting documents if you have not received enough to make a decision.

4.3. Documentation required to determine DFE – general

The forestry manager should supply the following information about the amounts they claim as DFE:

- •

- a detailed description of each class of expenditure claimed to be DFE

- •

- an explanation of how each class of expenditure meets the definition of DFE in section 394-45, and

- •

- each class of DFE to be categorised as either a notional or an actual amount of expenditure (see sections 4.4 and 4.5 of this Attachment).

Where the projections of future costs used in the NPV calculation differ materially from the current values of the same services, or use of land, seek an explanation for the differences from the forestry manager.

4.4. Documentation – actual amounts

The forestry manager should supply the following information about DFE that is paid, or will be paid, under the scheme:

- •

- the date the expenditure was paid if this is known

- •

- the name of the supplier or contractor that did supply, or is expected to supply, the goods or services, if it is known

- •

- whether the supplier is, or is expected to be, an associated entity, an independent contractor or an independent supplier

- •

- where the expenditure is an amount that is attributable to more than one scheme, how the amount has been allocated across different schemes (past, current, future) and how the amount was apportioned, including the calculations

- •

- where the expenditure relates to acquiring a depreciating asset with an effective life in excess of the duration of the project, how the amount has been apportioned between this project and the period of effective life outside the duration of the project, including calculations, and

- •

- documentary evidence to verify the actual expenditure.

Where an item of DFE is provided under a contract with an entity that is not an associate of the forestry manager, the documentation should include:

- •

- a copy of the contract

- •

- any additional or supplementary documentation relating to the contract that shows how and when services under the contract will be delivered; this should include such details as timelines, work schedules and subcontracts, and

- •

- where the contract is not yet in place for goods or services that are to be provided under the contract, a statement to that effect and an estimate of when such a contract is likely to be executed.

4.5. Documentation – notional amounts

The forestry manager should supply the following information in respect of notional DFE under the scheme:

- •

- documentary evidence to support the notional expenditure calculations

- •

- a detailed explanation of how the market value of each item was determined

- •

- if the notional expenditure will be attributed to more than one scheme, details about how the amount will be allocated across past, current and future schemes, including the calculations

- •

- if the notional expenditure is an amount for the use of land

- -

- documents provided by a qualified land valuer and the letter of engagement (if there is one), or

- -

- an explanation detailing why a qualified land valuer was not considered necessary, and a detailed explanation of the method used to determine the notional value of the land, and

- •

- if the notional expenditure is an amount for transporting and handling felled trees, details of the calculations and assumptions they used, including

- -

- the point to which the notional amount has been calculated, and

- -

- the details of any assumptions made for the purposes of the calculation, such as volume of timber expected to be harvested, average kilometres, cost per kilometre (see paragraph 394-45(4)(a)).

If a forestry manager receives (or expects to receive) an item of DFE from an internal division or a non-arm's length entity, they should provide the following information (in addition to the non-arm's length information):

- •

- working papers setting out how the amount was determined, including details of the component that represents profit by the internal division, and

- •

- any other documentation relevant to determining the character, amount and timing of the item of expenditure. This will include such things as

- -

- timelines

- -

- work schedules, and

- -

- subcontracts with arm's length suppliers.

Where an item of DFE is for plant or equipment already held by the forestry manager, their documentation should include either:

- •

- copies of any invoices showing the date of purchase, the purchase price and whom the plant or equipment was purchased from, or

- •

- a copy of the relevant extracts from their asset register, or depreciation schedule.

Where the projected costs of goods, services or use of land is based on expenditure currently being incurred by the forestry manager or their associates, the forestry manager should supply evidence of this expenditure.

4.6. Documentation – NPV calculation

The forestry manager should provide the following documentation about the NPV calculation:

- •

- an explanation of how the present value of each item of DFE has been calculated, including the provision of the relevant worksheets and formulas

- •

- a detailed description of each amount paid or payable under the scheme by each participant who holds an interest in the scheme, outlining what each amount was paid for

- •

- the sum of the present value of each amount paid or payable under the scheme by each participant

- •

- how the sum of the present value of each amount paid or payable under the scheme by each participant has been determined, including the relevant calculations, and

- •

- the income year in which each amount was paid, or is payable, under the scheme by each participant.

4.7. Documentation required – non-arm's length pricing

The forestry manager should provide the following documentation regarding the potential application of the arm's length pricing rule:

- •

- details about any dealings in relation to DFE over the life of the project that are not, or may not be, at arm's length

- •

- details of the variation between the actual or notional amounts that all such dealings have or may have had on the market value of those items of DFE over the life of the project, and

- •

- details of how the arm's length principle was applied in determining amounts for goods and services and for the use of land where the transaction is internally generated or is between one or more associated entities.

4.8. Documentation – 18-month establishment rule

When a forestry manager requests a product ruling, they must provide sufficient documentation to show that they can satisfy the 18-month establishment rule in subsection 394-10(4). We will not issue a product ruling unless this can be shown. In these cases, you should follow the steps set out in PR 2007/71 for situations where we refuse to rule.

Without limiting the information and documentation requirements in the Division 394 forestry application checklist, the forestry manager should provide the following information:

- •

- documentation about establishing all the trees under the scheme, including

- -

- the variety of trees

- -

- the number of trees

- -

- time of planting

- -

- type of planting

- -

- location of the proposed woodlots

- -

- suitability of proposed woodlots for that species of tree, and

- -

- activities to support their establishment

- •

- an explanation of the methods to be used to establish the plants in the ground (that is, through planting, coppicing, grafting or other methods of propagation), and

- •

- documentation to demonstrate that the seedlings have been, or can be, obtained and planted in the ground in their permanent positions within the establishment period.

4.9. Documentation – failing to give a failure to establish notice

We may discover instances where a project has failed to meet the 18-month establishment rule but has not notified us. This may happen in the course of other activities, such as conformance audits for product rulings. When this occurs, make enquiries to find out:

- •

- why the 18-month establishment rule under subsection 394-10(4) was not satisfied, and

- •

- why a failure to establish notification form (section 394-10 of Schedule 1 to the TAA) was not provided once the manager had failed the 18-month establishment rule.

The information obtained by such enquiries should be sufficient to determine whether we should take action against the forestry manager or participants in the forestry MIS for the failure to satisfy the 18-month establishment rule and the failure by the forestry manager to provide the failure to establish notification form.

5. Non-commercial losses

Although not relevant for the purposes of Division 394, an individual participant in a forestry MIS who is considered to be carrying on a business of primary production will also be subject to the operation of Division 35. Therefore, you must consider whether the participants are carrying on a business.

In Hance v Commissioner of Taxation [2008] FCAFC 196, the Full Federal Court found that participants in a forestry MIS carry on a business where the purpose of the MIS is the production of produce for sale at a profit. The retention of ownership by individual members of the produce of the scheme is the key feature in determining whether participants in a forestry MIS are carrying on a business and thus whether Division 35 is applicable.

For guidance on non-commercial business losses, you should refer to Taxation Ruling TR 2001/14 Income tax: Division 35 – non-commercial business losses. For business activities carried on in partnership, you should refer to Taxation Ruling TR 2003/3 Income tax: Non-commercial losses – application of subsections 35-10(2) and 35-10(4) of the Income Tax Assessment Act 1997 to business activities carried on in partnership.

For guidance on the application of our discretion within Division 35, you should refer to Taxation Ruling TR 2007/6 Income tax: non-commercial business losses: Commissioner's discretion.

Amendment history

| Part | Comment |

|---|---|

| Sections 4.6 and 3 of Attachment A | Updated the information on promoter penalty laws to reflect the amendments made by the Treasury Laws Amendment (Tax Accountability and Fairness) Act 2024, effective from 1 July 2024. |

| Section 2.2 of Attachment A | Removed the references to TR 94/4 and PS LA 2006/2 (now both withdrawn) and replaced with MT 2008/1 and PS LA 2012/5 respectively. |

| Throughout | Content checked for technical accuracy and currency.

Updated in line with current ATO style and accessibility requirements. |

| Part | Comment |

|---|---|

| All | Updated to new LAPS format and style. |

| Part | Comment |

|---|---|

| Contact details | Updated. |

| Part | Comment |

|---|---|

| Contact details | Updated. |

| Part | Comment |

|---|---|

| Contact details | Updated. |

Date of Issue: 31 January 2008

Date of Effect: 31 January 2008

Note: The checklist will be updated from time to time to address any challenges, trends or unanticipated issues that arise from Division 394 in the future. See Information required for a product ruling application - forestry Division 394.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 and is indexed regularly. The dollar amount of a penalty unit is available at Penalties.

Medium withholder is defined in section 16-100 of Schedule 1 to the TAA.

Large withholder is defined in section 16-95 of Schedule 1 to the TAA.

Significant global entity is defined in section 960-555.

File 07/12826; 1-13P7U4QQ

Related Rulings/Determinations:

GSTR 2000/7

MT 2008/1

PR 2007/71

TD 2006/46

TR 97/20

TR 2001/14

TR 2003/3

TR 2007/6

Related Practice Statements:

PS LA 2012/5

PS LA 2021/1

Other References:

Explanatory Memorandum to the Tax Laws Amendment (2007 Measures No. 3) Bill 2007

Failure to establish notification form

Information required for a production ruling application - forestry Division 394

Initial contributions notification form

Legislative References:

ITAA 1997 Div 35

ITAA 1997 Div 152

ITAA 1997 Div 394

ITAA 1997 394-10

ITAA 1997 394-10(1)(b)

ITAA 1997 394-10(4)

ITAA 1997 394-10(5)

ITAA 1997 394-10(5)(b)

ITAA 1997 394-10(5A)

ITAA 1997 394-10(6)

ITAA 1997 394-15(1)

ITAA 1997 394-15(2)

ITAA 1997 394-15(4)

ITAA 1997 394-15(5)

ITAA 1997 394-25(2)

ITAA 1997 394-35

ITAA 1997 394-35(1)

ITAA 1997 394-35(2)

ITAA 1997 394-35(3)

ITAA 1997 394-35(4)

ITAA 1997 394-35(5)

ITAA 1997 394-35(8)

ITAA 1997 394-40

ITAA 1997 394-45

ITAA 1997 394-45(1)

ITAA 1997 394-45(1)(b)

ITAA 1997 394-45(2)

ITAA 1997 394-45(2)(b)

ITAA 1997 394-45(3)

ITAA 1997 394-45(3)(b)

ITAA 1997 394-45(3)(e)

ITAA 1997 394-45(3)(i)

ITAA 1997 394-45(4)

ITAA 1997 394-45(4)(a)

ITAA 1997 394-45(4)(b)

ITAA 1997 960-555

TAA 1953 Sch 1 16-95

TAA 1953 Sch 1 16-100

TAA 1953 Sch 1 Div 286-C

TAA 1953 286-80(2)(a)

TAA 1953 Sch 1 286-80(3)

TAA 1953 Sch 1 286-80(4)

TAA 1953 Sch 1 286-80(4A)

TAA 1953 Sch 1 Div 290

TAA 1953 Sch 1 290-50(1A)

TAA 1953 Sch 1 290-50(2)

TAA 1953 Sch 1 394-5

TAA 1953 Sch 1 394-5(4)

TAA 1953 Sch 1 394-5(5)

TAA 1953 Sch 1 394-10

Crimes Act 1914 4AA

Case References:

Hance v Commissioner of Taxation

[2008] FCAFC 196

2008 ATC 20-085

74 ATR 644

ISSN: 2651-9526

| Date: | Version: | |

| 31 January 2008 | Original statement | |

| 25 September 2015 | Updated statement | |

| You are here | 19 September 2024 | Updated statement |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).