Taxation Determination

TD 2004/80

Income tax: consolidation: capital gains: does an entity permanently lose its status as an 'originating company', in respect of a deferral event in subsection 170-255(1) of the Income Tax Assessment Act 1997, when the entity becomes a subsidiary member of a consolidated group?

-

Please note that the PDF version is the authorised version of this ruling.

FOI status:

may be releasedPreamble

| The number, subject heading, date of effect and paragraph 1, 7 and the note of this document are a 'public ruling' for the purposes of Part IVAAA of the Taxation Administration Act 1953 and are legally binding on the Commissioner. |

1. Yes. When the entity becomes a subsidiary member of a consolidated group, its status as the originating company for the deferral event is inherited by the head company of the group by the operation of the entry history rule in section 701-5 of the Income Tax Assessment Act 1997 (ITAA 1997). Further, the head company retains the originating company status after the subsidiary member leaves the group.

2. Subdivision 170-D of the ITAA 1997 disregards a capital loss or deduction that arises if a company (the 'originating company') that is a member of a 'linked group' disposes of an asset to another member of the group. A disposal in these circumstances is referred to as a 'deferral event'. The disregarded loss or deduction (the 'deferred loss') may be recognised subsequently as a loss of the originating company if either the asset, or the originating company, leaves the linked group. These events are referred to as 'new events': section 170-275 of the ITAA 1997.

3. The entry history rule in section 701-5 of the ITAA 1997 provides that, for the head company's income tax purposes, everything that happened in relation to an entity before it became a subsidiary member of the consolidated group is taken to have happened in relation to the head company. Section 715-355 of the ITAA 1997 makes it clear that the entry history rule operates in respect of Subdivision 170-D deferred losses. It is therefore considered that the head company inherits the full history of the entity in respect of the deferral event, including its status as the originating company, when it becomes a subsidiary member of the consolidated group.

4. Further, the head company retains this status as the originating company for the deferral event after the subsidiary member leaves the consolidated group.

5. That is, the subsidiary does not reacquire its originating company status when it leaves the consolidated group. The exit history rule in section 701-40 of the ITAA 1997 does not have that effect. We take that view even if the subsidiary leaves the group with the CGT asset that gave rise to the deferral event. The leaving of the asset from both the consolidated and linked groups may however cause a new event to happen: see paragraph 7.

6. In our view, the exit history rule confers on a leaving entity only that history in relation to the matters listed in subsection 701-40(2) (that is, assets, liabilities, business, and research and development registration). An entity's status for the purpose of recognising a deferred loss is not one of the matters listed, nor does the deferred loss form part of the history of the CGT asset that was the subject of the deferral event.

7. Implications of the views expressed in this Determination include:

- •

- no new event happens when the subsidiary member, which was the originating company before it became a member of the consolidated group, ceases to be a member of both the consolidated and linked group - for example, if the subsidiary is deregistered after liquidation (see Example 1) or shares equating to a controlling interest in it are sold to entities outside the linked group. The requirement for a new event in paragraph 170-275(1)(d) of the ITAA 1997 would not be met because the head company of the consolidated group is (now) the originating company for that deferred loss; and

- •

- if a new event happens under section 170-275 of the ITAA 1997 - for example, the CGT asset that gave rise to the deferral event ceases to exist or leaves the linked group (whether with a subsidiary member or otherwise) - the head company, as the originating company, will be taken to have made a capital loss immediately before that event happens (see Example 2). The loss amount is equal to the amount of the deferred loss, reduced to the extent of any loss denial balance if the deferred loss is in a loss denial pool at the time of the new event: sections 170-275 and 715-365 of the ITAA 1997.

Note: Where Subdivision 170-D of the ITAA 1997 defers a loss made by an entity and no new event happens before it becomes a subsidiary member of a consolidated group, the deferred loss is not a pre-joining time loss able to be transferred to the head company under Division 707 of the ITAA 1997. Accordingly, when a new event happens so that the head company makes a loss under section 170-275 of the ITAA 1997, its use is not limited by reference to any 'available fraction'.

Example 1

8. Parent Co and its wholly-owned subsidiaries Sub Co, B Co and X Co were members of a linked group within the meaning of section 170-260 of the ITAA 1997. Parent Co owned all the shares in Sub Co and B Co. Also, Sub Co owned all the shares in X Co. All of these entities are Australian resident companies.

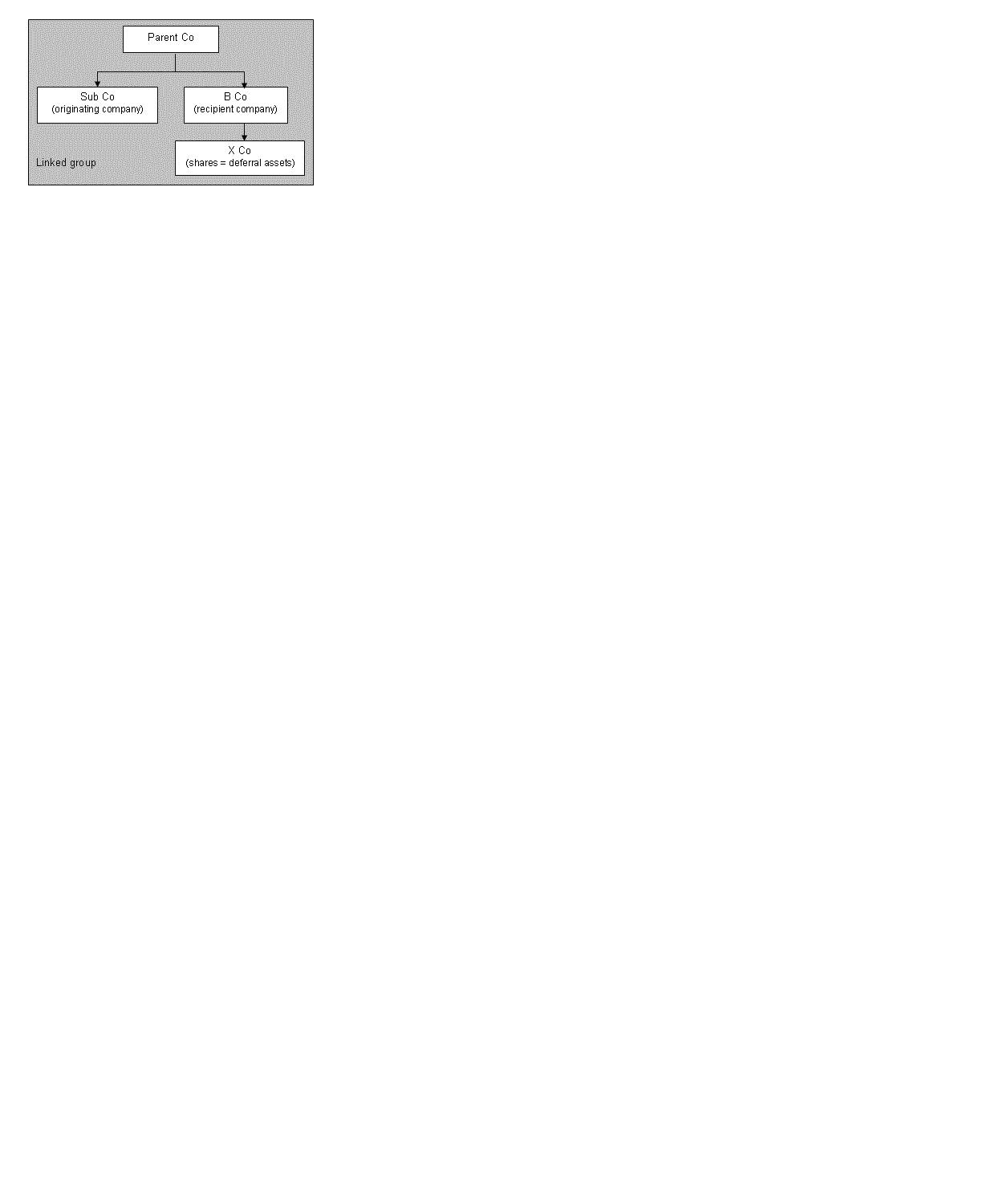

9. In November 1999, Sub Co disposed of all its shares in X Co to B Co. Because the entities were members of the same linked group, the capital loss that would otherwise have arisen as a result of this disposal was disregarded under subsection 170-270(1) of the ITAA 1997. Sub Co is the originating company in respect of this deferral event. This is what the linked group looked like just after the deferral event:

10. Parent Co chose to form a consolidated group with effect from 1 July 2002. The group comprised all of the above companies.

11. In May 2004, Sub Co was deregistered after liquidation, which resulted in Sub Co no longer being a member of both the consolidated and linked group. Because Parent Co is now regarded as the originating company and has not left the linked group, Sub Co's exit from the linked group does not trigger a 'new event' for the purposes of section 170-275 of the ITAA 1997.

Example 2

12. Following from the facts in Example 1 assume that, in October 2004, more than half of the shares in X Co were sold to an entity that was not a member of either the consolidated or linked group (and was not a connected entity of Parent Co, or an associate of a connected entity). In respect of each X Co share sold, a new event would happen pursuant to paragraph 170-275(1)(b) of the ITAA 1997.

13. Parent Co, as the originating company, will therefore be taken to have made a capital loss just before the sale of each X Co share in October 2004. The capital loss amount for each X Co share sold is equal to the capital loss deferred under Subdivision 170-D of the ITAA 1997 on each share.

Date of effect

14. This Determination applies to years commencing both before and after its date of issue. However, it does not apply to taxpayers to the extent that it conflicts with the terms of settlement of a dispute agreed to before the date of the Determination (see paragraphs 21 and 22 of Taxation Ruling TR 92/20).

Commissioner of Taxation

15 December 2004

Previously issued in draft form as TD 2004/D68.

References

ATO references:

NO 2004/13878

Related Rulings/Determinations:

TR 92/20

Subject References:

capital gains tax

capital losses

consolidation

deferral event

deferred capital losses and deductions

disregarded capital loss

head company

inherited history rules

linked group

new event

originating company

relevant CGT asset

single entity rule

subsidiary member of a consolidated group

Legislative References:

TAA 1953 Pt IVAAA

ITAA 1997 Subdiv 170-D

ITAA 1997 170-255(1)

ITAA 1997 170-260

ITAA 1997 170-270(1)

ITAA 1997 170-275

ITAA 1997 170-275(1)(b)

ITAA 1997 170-275(1)(d)

ITAA 1997 701-5

ITAA 1997 701-40

ITAA 1997 701-40(2)

ITAA 1997 Div 707

ITAA 1997 715-355

ITAA 1997 715-365

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).