Taxation Determination

TD 2023/5

Income tax: aggregated turnover and connected entities - Commissioner's discretion that an entity does not 'control' another entity

-

Please note that the PDF version is the authorised version of this ruling.There is a Compendium for this document: TD 2023/5EC .

| Table of Contents | Paragraph |

|---|---|

| What this Determination is about | |

| Purpose and context of this Determination | |

| Ruling | |

| Relevance of who has responsibility for managing day-to-day business | |

| Context of aggregated turnover tests | |

| Concept of 'control' | |

| Third entity can hold less than 40% interest | |

| Control by more than one 'third' entity | |

| Example 1 – widely-held company | |

| Example 2 – third entity owning more than 50% of shares | |

| Example 3 – effect of shareholder agreement | |

| Example 4 – third entities with total shareholding of more than 50% | |

| Example 5 – more than one entity satisfies the control percentage test | |

| Date of effect |

Relying on this Determination

Relying on this Determination

This publication is a public ruling for the purposes of the Taxation Administration Act 1953. If this Determination applies to you, and you correctly rely on it, we will apply the law to you in the way set out in this Determination. That is, you will not pay any more tax or penalties or interest in respect of the matters covered by this Determination. |

What this Determination is about

1. This Determination provides guidance on particular issues that have emerged from the administration of the discretion in subsection 328-125(6) of the Income Tax Assessment Act 1997 to determine that an entity does not 'control' another entity.

2. All legislative references in this Determination are to the Income Tax Assessment Act 1997, unless otherwise indicated.

Purpose and context of this Determination

3. An entity may need to aggregate its annual turnover with that of other entities to determine its eligibility for certain tax concessions or other tax treatment.[1] For example, an entity's aggregated turnover is relevant to determining whether it is a small business entity for an income year and able to access a range of concessions including capital gains tax concessions, shorter periods of review and exemption from fringe benefits tax for car parking fringe benefits.

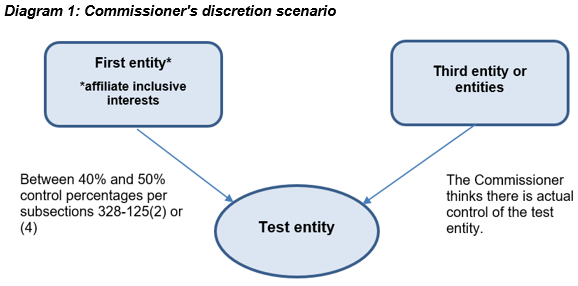

4. Aggregation will be necessary where there is a connection between the entities based on 'control'. Subsections 328-125(2) and (4) set out primary tests of control for the purposes of section 328-125. These subsections provide for the calculation of a 'control percentage' and, where an entity (the first entity) holds a percentage of at least 40% of the relevant interests in another entity (in this Determination called the test entity), the first entity is considered to control the test entity for the purposes of section 328-125.

5. Where the first entity has a control percentage of at least 40% but less than 50%, subsection 328-125(6) provides the Commissioner with a discretion to determine that it does not control the test entity (the Commissioner's discretion). To make that determination, the Commissioner must think the test entity is controlled by an entity or entities (the third entity or entities) that is not, or does not include, the first entity or any of its affiliates.

6. The statutory condition for exercising the Commissioner's discretion requires that the Commissioner positively conclude that there is actual control of the test entity by a third entity or entities. It is not sufficient to merely show that the first entity does not have actual control of the test entity.

7. Diagram 1 of this Determination sets out the scenario in which the Commissioner's discretion would be able to be exercised:

8. The principal concern of this Determination is to provide guidance on the following specific issues relating to the concept of 'control' which we have had to consider in administering the Commissioner's discretion:

- •

- requests for the Commissioner's discretion to be exercised where a third entity has sole or primary responsibility for day-to-day management of the affairs of the test entity, but holds relatively insignificant or no interests in the income or capital of the test entity, or in shares carrying voting rights (if the test entity is a company), and

- •

- applicants suggesting that their control percentage of between 40% and 50% should be disregarded because the remaining holders of interests in the test entity will together necessarily control the entity, irrespective of their number or relationship to each other.

9. These issues have taken on added significance following the introduction of tax incentives with higher aggregated turnover thresholds, thereby extending their relevance beyond the small business market. This includes temporary measures introduced in 2020 in response to the COVID-19 pandemic, such as full expensing of depreciating assets[2] and loss carry back rules.[3]

10. This Determination does not seek to deal comprehensively with the concept of 'control' for the purposes of considering the Commissioner's discretion, nor the wide range of circumstances in which it will be relevant for the exercise of the Commissioner's discretion. The Commissioner's conclusion on control in a given case will turn on its specific facts and circumstances. General statements on the concept, supported by generic examples with narrow fact patterns, would be of limited assistance as guidance for individual cases and may even mislead. Additional public guidance may be considered in future if there is a need to clarify our views on further discrete issues arising from the ongoing administration of the Commissioner's discretion.

Relevance of who has responsibility for managing day-to-day business

11. Sole or primary responsibility for the day-to-day management of the affairs of the test entity, while not irrelevant to the question of who controls that entity, does not of itself constitute control for the purposes of the Commissioner's discretion in subsection 328-125(6). The context of the aggregated turnover rules in Subdivision 328-C, and the concept of 'control' that underpins the primary control tests, support this view.

Context of aggregated turnover tests

12. Turnover testing is used to determine eligibility for certain tax concessions. Sometimes it will be necessary to aggregate the turnovers of separate entities, recognising that they ought to be regarded as a single unit. Aggregation will be necessary when there is a connection between the entities based on 'control'[4] as described in section 328-125, the primary tests for which look to the following matters:

- •

- who owns interests carrying rights to the economic benefits flowing from the entity in the form of income and capital distributions (relevant for business entities generally[5])

- •

- who owns relevant interests carrying rights to exercise, or control the exercise of, voting power (relevant for companies[6])

- •

- who controls those responsible for managing the affairs of the business entity (relevant for companies[7] and discretionary trusts[8]).

13. Having regard to the statutory context, the nature of control relevant for the Commissioner's discretion is control over those matters typically associated with ownership of a business entity. That is, entitlements to income and capital of the entity as well as participation in decision-making on key matters affecting the entity's constitution, funding, structure and management. The latter would ordinarily include matters such as:

- •

- decision-making on the composition and oversight of the management team

- •

- amending the entity's constituent documents

- •

- deciding on capital and entity restructuring proposals, the issue of new ownership interests or winding up, and

- •

- authorising significant changes in the direction of the entity's business operations.

14. Other ways in which an entity may be said to be 'controlled', such as the control exercised by managers with responsibility for the day-to-day conduct of the business of the entity, do not of themselves constitute control of the entity in the sense contemplated by the aggregation rules. It is necessary to distinguish control of an entity from powers in respect of the conduct of an entity's business.[9]

15. Managers or directors with responsibility for the day-to-day conduct of a company's business may have considerable autonomy in making significant business decisions, but this of itself is not considered 'control' of the entity for the purposes of subsection 328-125(6).

16. Example 2.10 of the Explanatory Memorandum to the Tax Laws Amendment (Small Business) Bill 2007 (EM) illustrates when the discretion might be exercised to disregard a control percentage of between 40% and 50% on the basis of a conclusion that a third entity controls the test entity. The example refers to a manager of the test entity with a 58% shareholding in that entity, and another person with a 42% shareholding who has no dealings at all with the manager.

17. We consider that, in these circumstances, the significance of who manages the business of the test entity stems from the relative ownership interests which confer the power to determine who performs the managerial function (see also Examples 1 and 2 of this Determination). The identity of who actually performs the managerial function is generally of limited relevance to the question of control of the test entity in subsection 328-125(6). The manager in Example 2.10 of the EM, with the 58% shareholding, would not cease to control the test entity merely because they decided to appoint a new manager with full responsibility for the day-to-day conduct of the business of the entity.

18. We also consider that Example 2.10 of the EM illustrates circumstances in which we would be likely to conclude that the test entity is controlled by a third entity (the 58% shareholder) and the Commissioner's discretion to disregard the 42% shareholding would be exercised accordingly. The holding of interests carrying rights to more than 50% of the income, capital and voting power in a company is consistent with control of the company for the purposes of subsection 328-125(6). Assuming that the majority ordinary shareholding is sufficient to decide most or all of the fundamental matters relating to the test entity, we would think there is control by the third entity unless the third entity's control through its majority ordinary shareholding is in some way qualified or compromised by other circumstances or arrangements.

Third entity can hold less than 40% interest

19. Ownership of a majority of interests carrying relevant rights is a likely basis for concluding that a third entity controls the test entity for the purposes of subsection 328-125(6). However, in considering whether to exercise the Commissioner's discretion under subsection 328-125(6), the Commissioner is not confined to identifying a third entity with the requisite control percentage under the primary tests for control (that is, in subsections 328-125(2) to (4)).

20. The language of subsection 328-125(6), which requires the Commissioner to 'think' there is a controlling third entity (or entities), is consistent with the Commissioner needing to form a view on actual control by reference to all relevant circumstances.[10] In providing for this enquiry, subsection 328-125(6) does not limit the Commissioner to a class of potential controllers having a control percentage of 40% or more under the primary tests. This view is supported by paragraph 2.60 of the EM which states:

The Commissioner may think that another entity controls the entity either based on fact or on a reasonable assumption or inference. Whether or not the third entity has a 40 per cent interest may assist in determining whether the third entity controls the other entity, but it is not decisive.

21. This does not mean, however, that a different concept of 'control' than that contemplated by subsections 328-125(2) to (4) applies to determine that a third entity controls the test entity for the purposes of subsection 328-125(6). The focus remains on control of the test entity in the sense described in paragraph 13 of this Determination. That is, control over those matters typically associated with ownership of a business entity.

22. It, therefore, may be possible to control an entity in the relevant sense by means other than formal ownership of interests carrying relevant rights. For example, an owner of shares carrying a certain percentage of the voting power in a company may effectively surrender those rights by legal agreement with a third entity.

23. We might readily infer that the third entity controls the test entity from legally enforceable arrangements of this kind (see Example 3 of this Determination). However, we would closely scrutinise assertions that a third entity controls the test entity on the basis of informal arrangements, practices or patterns of behaviour alone. This is especially if they appear inconsistent with the legal interests held by entities in the test entity.

Control by more than one 'third' entity

24. The exercise of the Commissioner's discretion is based on a conclusion that the test entity is controlled by a third entity (or entities) that does not include the first entity or any of its affiliates. This is clear from the statutory text.[11]

25. We do not accept as correct that an entity's control percentage of between 40% and 50% should be disregarded on the basis that the remaining interest holders together necessarily control the test entity, irrespective of their number or relationship to each other. While we may look beyond a single third entity for relevant control, the discretion would not be exercised merely on the basis of identifying a group of unrelated entities that, when individual control percentages are aggregated, holds interests in the test entity amounting to a control percentage of more than 50%.

26. For example, a pattern of consistent voting behaviour by a group of unrelated minority shareholders in a widely-held company would not constitute control of that company by those shareholders, even if collectively they held more than 50% of the total shares.

27. In order to form a view that a group of third entities controls the test entity, we would expect to see that the group has agreed to operate, and does operate, as a single controlling mind when it comes to decision-making generally in respect of the test entity. This might be in accordance with proxy arrangements that put voting power in the hands of one member of the group, or other legal arrangements under which the entities are broadly bound to act jointly in respect of the affairs of the test entity.

28. While control by a group of entities could be established without the existence of a formal agreement to act jointly, strong evidence would be required to support assertions that there is joint control in such circumstances. We would closely scrutinise the nature of the relationship between the entities and ongoing patterns of behaviour in relation to the test entity to determine if there is a sound evidentiary basis for the Commissioner to think there is control of the test entity by a group.

29. The conclusion that there is a single controlling mind is more readily reached in these circumstances if the group consists of associated entities in terms of common ownership or close familial relationships. Mere alignment of purpose (for example, shareholders wanting to maximise profits) or agreement to act cooperatively on certain issues by otherwise unrelated entities would rarely, if ever, be a sufficient basis to determine that there is control of the test entity by a group of third entities (see Examples 1 and 4 of this Determination).

Example 1 – widely-held company

30. ABC Co holds 43% of the ordinary shares in listed XYZ Co. The remaining 57% of ordinary shares are held by various, unrelated institutional and other investors. None of the other shareholders holds more than 5% of the shares in their own right. XYZ Co's board of directors makes all strategic decisions for the company and delegates the day-to-day decisions to the executive management team. None of the individual directors or members of the executive management team owns more than a small percentage of the shares in XYZ Co.

31. ABC Co satisfies the test for control of XYZ Co in subsection 328-125(2) as it holds at least 40% of relevant interests. ABC Co seeks the exercise of the Commissioner's discretion to disregard its control percentage in XYZ Co on the basis that:

- •

- the directors and executive management team control XYZ Co because they carry out all of the functions relating to the strategic and day-to-day management, operation and administration of the company's business, or

- •

- the shareholders who own the remaining 57% of shares in XYZ Co control the company.

32. In this case, the Commissioner would not think that the directors or executive management team controls XYZ Co in the relevant sense because although they manage the strategic and day-to-day business affairs of XYZ Co:

- •

- they do not have controlling stakes in the income, capital or voting in respect of XYZ Co, and

- •

- ultimately they would be accountable to the shareholders, of which ABC Co is clearly the most significant, in performing the management function.

33. On these facts, the question of who is responsible for the day-to-day management of XYZ Co is of no particular relevance to the question of control in subsection 328-125(6).

34. The Commissioner also would not think that XYZ Co is controlled by the remaining 57% of shareholders. There is no evidence that each shareholder is not acting independently in respect of their ownership rights in XYZ Co. A history of, or potential for, shareholders to act in unison on particular issues would not alter this conclusion.

35. There is no basis for the Commissioner to think that any entity other than ABC Co controls XYZ Co.

Example 2 – third entity owning more than 50% of shares

36. Tech Pty Ltd carries on a business of selling a software product it has developed. Mr W, who started Tech Pty Ltd, owns 56% of the shares in the company. The remaining 44% is owned by Ms Q, a passive investor who had provided capital for Tech Pty Ltd as a start-up entity. Mr W manages all aspects of the business of Tech Pty Ltd and his majority shareholding enables him to unilaterally approve ordinary resolutions on all matters concerning the company, apart from those where a special resolution is required by law. Tech Pty Ltd seeks an exercise of the Commissioner's discretion to ignore Ms Q's control percentage in the company for the purpose of calculating its aggregated turnover.

37. The Commissioner would conclude that Mr W controls Tech Pty Ltd in this case and exercise the discretion accordingly. Mr W's management of the day-to-day affairs of Tech Pty Ltd is relevant to the extent that it reflects his actual control of the company through his majority shareholding.

Example 3 – effect of shareholder agreement

38. Assume the same facts as for Example 2 of this Determination, except the 44% interest is owned by Finance Co which has entered into a Shareholders' Agreement with Mr W. The agreement specifies many matters relating to the business affairs of Tech Pty Ltd that require approval by a special resolution (that is, the approval of the holders of at least 75% of all shares). This includes matters relating to business funding, significant new transactions and changes in the nature of the existing business. Tech Pty Ltd seeks an exercise of the Commissioner's discretion to ignore Finance Co's control percentage for the purpose of calculating its aggregated turnover, on the basis that Mr W has actual control.

39. Depending on the nature and extent of matters to be dealt with by special resolution under the Shareholders' Agreement, the Commissioner may not think that Mr W actually controls Tech Pty Ltd for the purposes of subsection 328-125(6). This is notwithstanding his majority shareholding and responsibility for managing the business of Tech Pty Ltd. If his rights in respect of Tech Pty Ltd have been substantially compromised by the special resolution requirements, it is likely that the Commissioner will reach this conclusion and not exercise the discretion to ignore the control percentage of Finance Co. (Note that if this were the case, Tech Pty Ltd would work out its aggregated turnover by including the annual turnovers of Mr W and Finance Co. There is no scope for the exercise of the Commissioner's discretion to ignore Mr W's interest as his control percentage exceeds 50%.)

Example 4 – third entities with total shareholding of more than 50%

40. Cellnet Pty Ltd carries on a business of developing products to be used in connection with mobile phones. Cellnet Pty Ltd was originally started by Ms A and Mr B who now each own 28% of the company. The remaining 44% is owned by an unrelated company, MobTel Pty Ltd. Cellnet Pty Ltd has 3 directors, Ms A, Mr B and Mr C (arepresentative of MobTel Pty Ltd). Ms A and Mr B meet regularly to discuss operational and strategic matters relating to Cellnet Pty Ltd, and have a history of reaching agreement on decisions relating to Cellnet Pty Ltd. Ms A and Mr B are otherwise unrelated and independent of each other. Cellnet Pty Ltd seeks an exercise of the Commissioner's discretion to ignore the control percentage of MobTel Pty Ltd for aggregated turnover purposes.

41. The Commissioner in this case would not exercise the discretion as it would not be concluded that Cellnet Pty Ltd is controlled by Ms A and Mr B. Although they have a history of agreement on issues relating to the company:

- •

- they are not bound to act jointly, and

- •

- each would require the support of MobTel Pty Ltd or its representative to prevail in decision-making if not supported by the other.

42. In the absence of arrangements or circumstances of the kind described in paragraphs 27 or 28 of this Determination, it would not be concluded that Ms A and Mr B control Cellnet Pty Ltd for the purposes of subsection 328-125(6).

Example 5 – more than one entity satisfies the control percentage test

43. Entity A and Entity B each hold 45% of the ordinary shares in ABC Co and each satisfies the test for control in subsection 328-125(2) for their respective interests. Entity C holds the remaining 10% of shares in ABC Co. ABC Co seeks the exercise of the Commissioner's discretion on the basis that either Entity A or Entity B actually controls ABC Co, but not both, because they each have a control percentage of at least 40% in ABC Co.

44. In the absence of further facts, the Commissioner would not conclude that either Entity A or Entity B actually controls ABC Co, merely because they satisfy a primary control test by having a control percentage of at least 40%. To exercise the discretion, the Commissioner must think that ABC Co is actually controlled by either Entity A or Entity B. It is possible in the circumstances that neither Entity A nor Entity B actually controls ABC Co for the purposes of subsection 328-125(6), in which case both will be connected with ABC Co for aggregation purposes.

45. This Determination applies both before and after its date of issue. However, this Determination will not apply to taxpayers to the extent that it conflicts with the terms of settlement of a dispute agreed to before the date of issue of this Determination (see paragraphs 75 to 76 of Taxation Ruling TR 2006/10 Public Rulings).

Commissioner of Taxation

6 September 2023

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Footnotes

Section 328-115, subsection 328-125(1) and section 328-130.

Rules dealing with temporary full expensing of depreciating assets are contained in Subdivision 40-BB of the Income Tax (Transitional Provisions) Act 1997.

The loss carry back rules are provided in Division 160.

An entity's aggregated turnover will also include the annual turnover of its affiliates. See paragraph 328-115(2)(c), subject to subsection 328-115(3).

Paragraph 328-125(2)(a) and subsection 328-125(4).

Paragraph 328-125(2)(b).

Paragraph 328-125(2)(b).

Subsection 328-125(3).

Commissioner of Taxation (Cth) v Commonwealth Aluminium Corporation Ltd [1980] HCA 28; 80 ATC 4371 at 4379.

A predecessor provision under the former Simplified Tax System regime (former subsection 328-380(7)), used the language of the Commissioner 'being satisfied, or thinking it reasonable to assume' that there is a third entity controller.

Subsection 328-125(6).

Previously released in draft form as TD 2023/D2

References

ATO references:

NO 1-JOQR9RB

Legislative References:

ITAA 1997 Div 160

ITAA 1997 Subdiv 328-C

ITAA 1997 328-115(2)(c)

ITAA 1997 328-115(3)

ITAA 1997 328-125

ITAA 1997 328-125(2)

ITAA 1997 328-125(2)(a)

ITAA 1997 328-125(2)(b)

ITAA 1997 328-125(3)

ITAA 1997 328-125(4)

ITAA 1997 328-125(6)

ITAA 1997 former 328-380(7)

IT(TP)A 1997 Subdiv 40-BB

Cases Relied on:

Commissioner of Taxation (Cth) v Commonwealth Aluminium Corporation Ltd

[1980] HCA 28

(1980)143 CLR 646

80 ATC 4371

11 ATR 42

30 ALR 449

Other References:

Explanatory Memorandum to the Tax Laws Amendment (Small Business) Bill 2007

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).