Taxpayer Alert

TA 2021/2

Disguising undeclared foreign income as gifts or loans from related overseas entities-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

| Table of Contents | Paragraph |

|---|---|

| Description | |

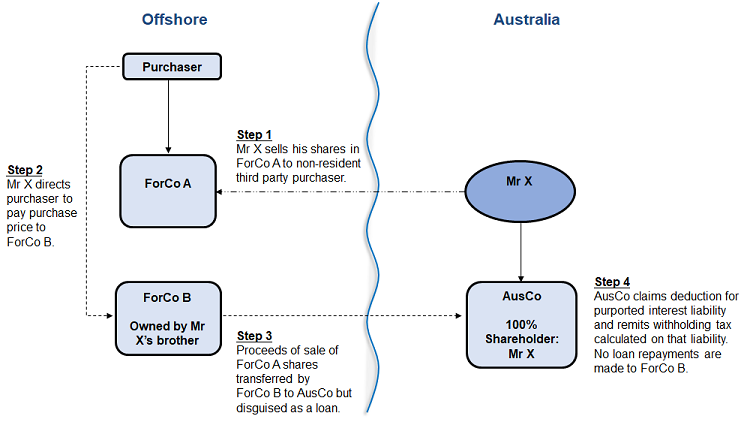

| Examples | |

| Example 1 - disguising foreign capital gain as a loan from a related overseas entity | |

| Example 2 - disguising foreign income as a gift from a related overseas entity | |

| Example 3 - disguising repatriation of profits from a foreign company as a gift from a related overseas entity | |

| What are our concerns? | |

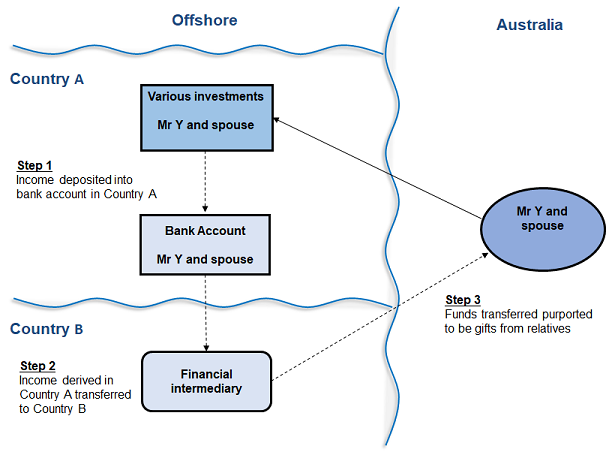

| What are we doing? | |

| What should you do? | |

| Do you have information? |

About Taxpayer Alerts

About Taxpayer Alerts

Alerts provide a summary of our concerns about new or emerging higher risk tax or superannuation arrangements or issues that we have under risk assessment. While an Alert describes a type of arrangement, it is not possible to cover every potential variation of the arrangement. The absence of an Alert on an arrangement or a variation of an arrangement does not mean that we accept or endorse the arrangement or variation, or the underlying tax consequences. Refer to PS LA 2008/15 for more about alerts. See Alerts issued to date. |

1. We continue to encounter instances where Australian-resident taxpayers derive income or capital gains offshore (foreign assessable income) but fail to declare it in their Australian income tax returns.

2. In some instances, taxpayers who are not Australian citizens may fail to declare their foreign assessable income as they are unaware they may be Australian residents for tax purposes and, as such, assessable on the worldwide income they derive as well as on certain profits derived by offshore entities they control.[1]

3. However, the arrangements with which this Alert is concerned are ones where taxpayers are aware of their residency status, as well as the tax implications that flow from it, but attempt to avoid or evade tax on their foreign assessable income by concealing the character of funds upon their repatriation to Australia by disguising the funds received as a gift, or a loan, from a related overseas entity.

4. Taxpayers and their advisers who enter into these arrangements will face substantial penalties and may be at risk of potential sanctions under criminal law.

5. These arrangements typically display all or most of the following features:

- •

- An Australian-resident taxpayer derives foreign assessable income and does not declare it in their Australian income tax return. The amounts derived may be

- -

- actual amounts of foreign assessable income, such as income from employment, interest, dividends, or a capital gain on the disposal of assets, such as shares in a foreign company

- -

- deemed amounts of foreign assessable income, such as amounts assessable under the controlled foreign company (CFC) provisions in Part X of the Income Tax Assessment Act 1936[2], or under the transferor trust provisions in Division 6AAA of Part III, or

- -

- amounts assessable as dividends as a result of section 47A or Division 7A of Part III applying, or amounts from trusts assessable under section 99B.

- •

- The foreign assessable income is repatriated to the taxpayer, or an associate of the taxpayer, in Australia. The repatriation is achieved by a related overseas entity transferring the funds directly to the taxpayer (or an associate), or by using the services of an offshore financial intermediary to transfer the funds. The related overseas entity is typically a family member, a friend or some other kind of associate (such as a related company or trust).

- •

- The foreign assessable income may be repatriated in a single lump sum or in instalments.

- •

- The repatriation of the foreign assessable income may occur in the income year in which it is derived, in a later income year or over the course of several income years.

- •

- The true character of the foreign assessable income is concealed upon its repatriation to Australia under the guise that the foreign assessable income is instead a gift or a loan from the related overseas entity.

- •

- In some cases, documentation is prepared that purports to show that the repatriated funds have the character of a gift, or an advance of funds by way of a loan, but that occurs in circumstances where the objectively ascertainable facts do not support that characterisation. Examples include where the parties may not have acted in a way that is consistent with the documented agreement or, in the case of a purported loan, where the terms of the documented agreement lack commercial explanation. In other cases, the repatriated amounts might be properly characterised as a genuine gift or loan but the objectively ascertainable facts demonstrate that the gift or loan is connected or related to foreign assessable income which has not been declared in Australian tax returns.

- •

- Where the purported loan is used by the Australian-resident taxpayer for the purposes of gaining or producing assessable income, the taxpayer claims a deduction for amounts of interest that are said to have been incurred. Although withholding tax calculated upon the amount of the claimed interest incurred may be remitted to the Commissioner, often no amount of interest or principal is ever paid to the related overseas entity. Instead, the claimed interest liability is capitalised resulting in continuously increasing claims for deductions in respect of the purported interest liability.[3]

- •

- When these transactions are identified or audited, the Australian-resident taxpayer may subsequently admit that the funds were not actually received as gifts or loans, but claim that they were instead disguised transfers of funds from other sources in offshore jurisdictions, including to avoid laws in other countries. However, no evidence is then provided as to an alternative, non-assessable, underlying source of the funds or how the purported method of fund extraction is required to successfully avoid foreign laws.

|

Note:

This Taxpayer Alert does

not

cover circumstances where an Australian-resident taxpayer has not derived any foreign assessable income but receives a genuine gift or loan from a related overseas entity. In this context, a

genuine gift or loan

is one where:

Appropriate documentation for a genuine gift will depend on the size of the gift and whether the nature of the relationship is one where gifts might be made in the ordinary course of that relationship. For larger gifts or where there is an atypical relationship between the donor and donee, this might require a contemporaneous Deed of Gift. We would also expect there to be evidence showing the donor's capacity to make the gift from their own resources as well as financial records reflecting the donor's transfer. Appropriate documentation for a genuine loan would typically include a properly documented loan agreement that evidences the parties to the loan, its terms and relevant conditions. We would also expect there to be financial records showing the advance of funds and repayments of principal and interest. While outside the scope of this Alert, care should still be taken in relation to genuine gifts or loans received in these circumstances as there may be Australian tax consequences - for example, section 99B may apply if the amounts are paid by or through trusts. For further information, see Gifts or loans from related overseas entities on ato.gov.au. |

6. The following examples are of arrangements where foreign assessable income is disguised as a gift or loan from a related overseas entity. These examples are illustrative of the broader features of these arrangements and our concern is not limited to the specific scenarios described.

Example 1 - disguising foreign capital gain as a loan from a related overseas entity

7. Mr X is an Australian-resident taxpayer. In the 2017 income year, Mr X sells his shares in an offshore entity, ForCo A, to a third-party purchaser. Under the terms of the sale, the sale proceeds for the shares are directed to be paid into the bank account of another offshore entity, ForCo B, the shares in which are wholly-owned by Mr X's brother, Mr Y. Mr X did not report the capital gains made on the sale of those shares in his Australian tax return for the 2017 income year.

8. During the 2018 income year, ForCo B uses the sale proceeds to make a purported loan to AusCo, an Australian-resident company of which Mr X is the sole director and shareholder. A purported loan agreement is prepared to support the purported loan outlining the terms of the loan including the rate of interest to be charged.

9. AusCo claims deductions for interest incurred on the purported loan in its income tax returns for the 2018 and 2019 income years and pays withholding tax on the interest to the ATO. However, no 'loan repayments' are made by AusCo to ForCo B with the interest purportedly capitalised.

10. The actions of Mr X in directing the purchaser of the shares to pay the purchase price to ForCo B and of ForCo B in purporting to lend those funds to AusCo are not commercially explicable.

11. By entering into this arrangement, Mr X has:

- •

- attempted to avoid or evade tax in Australia on the net capital gain from the sale of his shares in ForCo A

- •

- sought to disguise the repatriation of the sale proceeds to Australia as a loan

- •

- ensured an Australian-resident entity he controls, AusCo, has full use and enjoyment of those sale proceeds, and

- •

- sought to have AusCo claim deductions for interest purportedly incurred on the purported loan when Mr X is, in substance, accessing his own funds.

Example 2 - disguising foreign income as a gift from a related overseas entity

12. In the 2017 income year, Mr Y and his spouse migrated to Australia from Country A. Mr Y and his spouse have retained various investments in Country A. From the 2017 income year onwards, Mr Y and his spouse are Australian-resident taxpayers.

13. During the 2017 to 2019 income years, Mr Y and his spouse continue to derive income from their investments in Country A but do not report that income in their Australian tax returns for those years. The income from their investments is paid into a bank account that Mr Y and his spouse maintain in Country A. Mr Y and his spouse then engage the services of an offshore financial intermediary in Country B to arrange for that income to be repatriated to them in Australia. Mr Y and his spouse conceal the character of the funds transferred to them in Australia from Country B by contending that the funds represent gifts from wealthy relatives living in Country B.

14. By entering into this arrangement, Mr Y and his spouse have:

- •

- attempted to avoid or evade tax in Australia on the income from their investments while at the same time ensuring they have full use and enjoyment of that income in Australia, and

- •

- sought to disguise the repatriation of that foreign income to Australia as gifts from relatives living overseas.

Example 3 - disguising repatriation of profits from a foreign company as a gift from a related overseas entity

15. Mr X is an Australian-resident taxpayer married to Mrs X. Mrs X resides in Country A and is a non-resident for Australian tax purposes. ForCo is a private company incorporated in Country A[4] with Mr X and Mrs X being the two shareholders. Mrs X is the sole director of ForCo. ForCo carries on a profitable active business in Country A and all profits are retained within the company.

16. Mr and Mrs X wish to extract profits from ForCo to fund Mr X's lifestyle in Australia. Rather than having ForCo pay a dividend, Mrs X instead undertakes the following steps in order to conceal ForCo as being the original source of the funds:

- •

- ForCo lends funds to Mrs X, and

- •

- Mrs X in turn gifts those funds to Mr X.

17. An alternative is that Mrs X simply directs ForCo to pay a dividend directly to Mrs X (contrary to the relative shareholdings), and then purports to gift Mr X's share of the dividend to him.

18. Mr X uses the funds for private purposes.

19. The receipt of funds by Mr X from ForCo (via Mrs X) will trigger the operation of section 47A or, alternatively, Division 7A of Part III with the result that the amount received will be assessable to him as a dividend. Despite this, Mr X does not report any of the funds received as assessable income in his tax return.

20. Under the alternative, the dividend is simply assessable to Mr X.

21. By Mr and Mrs X entering into this arrangement:

- •

- Mr X has attempted to avoid or evade tax in Australia on the profits extracted from ForCo and distributed (via Mrs X) to him

- •

- they have sought to disguise the repatriation of ForCo's profits as a gift from Mrs X to Mr X, and

- •

- they have ensured Mr X has the full use and enjoyment of ForCo's profits in Australia.

22. We are concerned that Australian-resident taxpayers are entering into these arrangements to attempt to avoid or evade Australian tax on their foreign assessable income.

23. In those cases where the funds are repatriated to Australia in the form of a purported loan, we are also concerned that taxpayers may be entering into, or taking additional advantage of, these arrangements to claim deductions for interest that was never incurred.

24. More specifically, we are concerned that:

- •

- taxpayers are entering into these arrangements to conceal their foreign assessable income and/or interests in foreign assets

- •

- taxpayers have not declared all their ordinary income under section 6-5 of the Income Tax Assessment Act 1997 (ITAA 1997)

- •

- taxpayers have not declared all their statutory income, such as amounts assessable under the CFC provisions in Part X, under the transferor trust provisions in Division 6AAA of Part III, under section 99B, or amounts assessable as dividends as a result of section 47A or Division 7A of Part III applying

- •

- taxpayers may not have disclosed all their offshore interests at the relevant labels of their income tax returns

- •

- in cases where the funds received are repatriated to Australia in the form of a purported loan, deductions claimed by taxpayers for purported interest under section 8-1 of the ITAA 1997 may not be allowable because a loss or outgoing was never incurred and the purported loan agreements are a sham

- •

- to the extent the arrangements are legally effective, and to the extent the taxpayers have obtained a tax benefit in connection with a scheme, the general anti-avoidance provisions in Part IVA may apply to cancel any such tax benefit, and

- •

- the conduct of taxpayers under these arrangements, when assessed objectively, may result in the Commissioner forming an opinion that there has been fraud or evasion.

25. We are currently undertaking reviews and audits and actively engaging with taxpayers who have entered into these arrangements.

26. As part of that process, we are using our exchange of information powers to gather information from other countries, including the foreign assessable income derived by taxpayers in those countries. We also use other sources of information, such as data from the Australian Transaction Reports and Analysis Centre (AUSTRAC) which identifies movements of funds into Australia as well as the data we receive via the Common Reporting Standard and the Foreign Account Tax Compliance Act.

27. Taxpayers and their advisers who enter into these arrangements will be subject to increased scrutiny and may be at risk of potential sanctions under criminal law.

28. If you have entered, or are contemplating entering, into an arrangement of this type, we encourage you to:

- •

- phone or email us using the contact details provided in this Alert

- •

- seek independent professional advice, and/or

- •

- make a voluntary disclosure to reduce penalties that may apply.

29. If you would like to correct something in your Australian income tax return, more information on this is available at ato.gov.au by searching for 'Correcting your tax return or activity statement'.

30. Penalties may apply to participants in, and promoters of, this type of arrangement. This includes serious penalties under Division 290 of Schedule 1 to the Taxation Administration Act 1953 for promoters. In more serious cases, sanctions under criminal law may apply. Registered tax agents involved in the promotion of this type of arrangement may be referred to the Tax Practitioners Board to consider whether there has been a breach of the Tax Agent Services Act 2009.

31. If you participate in an arrangement similar to that described in this Alert, you may be liable for penalties of up to 75% of the tax shortfall (in addition to being required to pay any tax that is avoided).

32. To provide information about this type of arrangement, or a promoter of this or another arrangement, you can:

- •

- phone us on 1800 060 062

- •

- complete the ATO Tip-Off Form

- •

- contact the officer named in this Alert.

Commissioner of Taxation

17 September 2021

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Amendment history

| Date of amendment | Comment |

|---|---|

| 19 January 2024 | Updated ATO tip-off hotline number |

Date of Issue: 17 September 2021

Date of Effect: N/A

Taxpayers who are unsure of either their residency status or of the tax treatment of amounts that are derived offshore, either directly or through an offshore entity that they control, should engage with us or seek independent professional advice.

All legislative references in this Alert are to the Income Tax Assessment Act 1936 unless otherwise indicated.

We are equally concerned with those arrangements where purported 'loan repayments' are made to the offshore 'lender'. In such cases, the purported loan repayments often create a circular flow of funds wherein the Australian taxpayer retains effective control of those funds offshore.

Country A is an unlisted country for the purposes of the CFC provisions in Part X.

File 1-QUOKLQA

Related Practice Statements:

PS LA 2008/15

Other References:

Common Reporting Standard

Correct (amend) your tax return

Correct an activity statement

Legislative References:

ITAA 1936 Pt III Div 6AAA

ITAA 1936 Pt III Div 7A

ITAA 1936 47A

ITAA 1936 99B

ITAA 1936 Pt IVA

ITAA 1936 Pt X

ITAA 1997 6-5

ITAA 1997 8-1

TAA 1953 Sch 1 Div 290

Foreign Account Tax Compliance Act

Tax Agent Services Act 2009

Louise Clarke

Deputy Commissioner

| Contact officer: | Dr Barnali Banerjee |

| Email address: | barnali.banerjee@ato.gov.au |

| Telephone: | (03) 9275 2317 |

ISSN: 2651-9550

| Date: | Version: | |

| 17 September 2021 | Original alert | |

| You are here | 19 January 2024 | Updated alert |