Product Ruling

PR 2024/5

Challenger Lifetime Annuity (Liquid Lifetime) - 2024

-

Please note that the PDF version is the authorised version of this ruling.

| Table of Contents | Paragraph |

|---|---|

| What this Ruling is about | |

| Who this Ruling applies to | |

| Date of effect | |

| Ruling | |

| Assumptions | |

| Scheme | |

| Overview of scheme | |

| Appendix – Explanation |

Relying on this Ruling:

Relying on this Ruling:

This publication (excluding appendix) is a public ruling for the purposes of the Taxation Administration Act 1953. If this Ruling applies to you, and you correctly rely on it, we will apply the law to you in the way set out in this Ruling. That is, you will not pay any more tax or penalties or interest in respect of the matters covered by this Ruling. |

|

Terms of use of this Ruling

This Ruling has been given on the basis that the entity who applied for the Ruling, and their associates, will abide by strict terms of use. Any failure to comply with the terms of use may lead to the withdrawal of this Ruling. Changes in the law Product Rulings were introduced for the purpose of providing certainty about tax consequences for entities in schemes such as this. In keeping with that intention, the Commissioner suggests promoters and advisers ensure that participants are fully informed of any legislative changes after the Ruling has issued. Similarly, entities that are considering participating in the Project are advised to confirm with their taxation adviser that changes in the law have not affected this Ruling since it was issued. No guarantee of commercial success The Commissioner does not sanction or guarantee this product. Further, the Commissioner gives no assurance that the product is commercially viable, that charges are reasonable, appropriate or represent industry norms, or that projected returns will be achieved or are reasonably based. Potential participants must form their own view about the commercial and financial viability of the product. The Commissioner recommends a financial (or other) adviser be consulted for such information. |

1. This Ruling sets out the income tax consequences for entities referred to in paragraph 4 of this Ruling in connection with an investment in Challenger Lifetime Annuity (Liquid Lifetime) (the Annuity) issued by Challenger Life Company Limited (Challenger) and offered under a Product Disclosure Statement (PDS) dated 5 September 2022.

2. All legislative references in this Ruling are to the Income Tax Assessment Act 1936, unless otherwise indicated.

3. This Ruling does not address:

- •

- the tax consequences

- -

- of acquiring, holding and redeeming the Annuity, other than as per paragraphs 10 to 30 of this Ruling

- -

- for an Annuity purchased using a directed termination payment within the meaning of the Income Tax (Transitional Provisions) Act 1997 (IT(TP)A 1997)

- -

- for an Annuity purchased using personal injury compensation money, as per Division 54 of the Income Tax Assessment Act 1997 (ITAA 1997)

- -

- for an Annuity purchased partly or wholly using a 'roll-over superannuation benefit' as defined in section 306-10 of the ITAA 1997 by a policy owner under 60 years old[1]

- -

- upon payment of a withdrawal value due to the death of a policy owner or reversionary life insured under an Annuity purchased partly or wholly using a roll-over superannuation benefit

- •

- the deductibility of the amount invested to purchase the Annuity[2]

- •

- the deductibility of adviser service fees

- •

- the tax consequences of borrowing funds to purchase the Annuity, including the deductibility of interest on funds borrowed

- •

- whether the regular payments made by Challenger to a policy owner or reversionary life insured under the Annuity are subject to pay as you go withholding

- •

- the treatment of any duties, taxes or other government charges that may be deducted from the regular payments or withdrawal value payable by Challenger under the Annuity

- •

- a policy owner's liability to any excess transfer balance tax as a result of having purchased an Annuity using a roll-over superannuation benefit and exceeding the transfer balance cap, and

- •

- a policy owner's eligibility to claim the seniors and pensioners tax offset.

4. This Ruling applies to you if you are an Australian resident for tax purposes and are one of the following:

- (a)

- an individual policy owner (other than in the capacity of trustee of a trust estate) who purchases the Annuity described in paragraphs 10 to 30 of this Ruling on or after 1 July 2024 and on or before 30 June 2027

- (b)

- an individual (other than in the capacity of trustee of a trust estate) nominated as a reversionary life insured of a policy owner referred to in subparagraph 4(a) of this Ruling

- (c)

- a nominated beneficiary or the nominated beneficiaries of a policy owner referred to in subparagraph 4(a) of this Ruling, where the policy owner dies within the withdrawal period and they have not nominated a reversionary life insured, or where their reversionary life insured either predeceases them or ceases to be the policy owner's spouse

- (d)

- a nominated beneficiary or the nominated beneficiaries of a reversionary life insured referred to in subparagraph 4(b) of this Ruling, where both the relevant policy owner and the reversionary life insured die (in that order) within the withdrawal period

- (e)

- the trustee of the deceased estate of a policy owner referred to in subparagraph 4(a) of this Ruling, where the policy owner dies within the withdrawal period and they have either not nominated a reversionary life insured or their reversionary life insured either predeceases them or ceases to be the policy owner's spouse, and they have either not nominated a beneficiary or their nominated beneficiaries predecease them, or

- (f)

- the trustee of the deceased estate of a reversionary life insured referred to in subparagraph 4(b) of this Ruling, where both the relevant policy owner and the reversionary life insured die (in that order) within the withdrawal period, and the reversionary life insured has either not nominated a beneficiary or their nominated beneficiaries predecease them.

5. This Ruling does not apply to you if you:

- •

- purchase the Annuity before 1 July 2024 or after 30 June 2027

- •

- purchase the Annuity using a directed termination payment within the meaning of the IT(TP)A 1997 or personal injury compensation money that is subject to Division 54 of the ITAA 1997, or

- •

- are under 60 years old and purchase the Annuity using a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997.

Date of effect

6. This Ruling applies from 1 July 2024 to the entities specified in paragraph 4 of this Ruling in connection with an Annuity purchased from 1 July 2024 until 30 June 2027.

7. However, the Ruling only applies and may be relied on to the extent that there is no change in the scheme or in the entity's involvement in the scheme. If the scheme carried out is materially different from the Scheme described at paragraphs 10 to 30 of this Ruling, this Ruling cannot be relied upon and may be withdrawn or modified.

Ruling

8. Subject to paragraph 3 of this Ruling and the assumptions in paragraph 9 of this Ruling:

- (a)

- Annuities not purchased using a roll-over superannuation benefit (sub-subparagraphs 8(a)(i) to (x) of this Ruling only relate to Annuities purchased by a policy owner without using the whole or part of a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997).

- (i)

- An Annuity purchased by a policy owner is

- •

- not a 'qualifying security' as defined in subsection 159GP(1)

- •

- not a 'superannuation income stream' as defined in section 307-70.02 of the Income Tax Assessment (1997 Act) Regulations 2021 (ITAR (1997 Act) 2021), and

- •

- an 'annuity' as defined in subsection 27H(4).

- (ii)

- An Annuity purchased by a policy owner is not a financial arrangement to which Division 230 of the ITAA 1997 applies.

- (iii)

- The regular payments made by Challenger to a policy owner or to a reversionary life insured, as applicable, are assessable income under subsection 27H(1) to the extent that the regular payments exceed the 'deductible amount' in relation to the Annuity. The deductible amount is excluded from the assessable amount of the Annuity.

- (iv)

- The annual deductible amount in relation to the regular payments derived by a policy owner or by a reversionary life insured, as applicable, is ascertained (subject to subsection 27H(3)) in accordance with the formula set out in subsection 27H(2) on the basis that the

- •

- 'relevant share' in relation to the Annuity is one

- •

- 'undeducted purchase price' of the Annuity is the initial investment amount paid to purchase the Annuity

- •

- 'residual capital value' in relation to the Annuity is nil, and

- •

- 'relevant number' in relation to the Annuity is the life expectation factor of the policy owner, or of any reversionary life insured where they have a greater life expectation factor, determined on the commencement date of the Annuity in accordance with the prescribed Australian Life Tables.

- (v)

- Where the regular payments are not payable to a policy owner or to a reversionary life insured for the whole of an income year, the deductible amount for that year will be reduced proportionately by the Commissioner pursuant to subsection 27H(3) based on the part of the year during which the regular payments are not paid.

- (vi)

- Where the regular payments made to a policy owner or to a reversionary life insured are, as a consequence of one or more of the drivers referred to in paragraph 54 of this Ruling, exceeded by the deductible amount for an income year in relation to those regular payments, the deductible amount for the year will be reduced by the Commissioner pursuant to subsection 27H(3) to the level of the regular payments made.

- (vii)

- The amount of any reduction in the deductible amount described in sub-subparagraphs 8(a)(v) and (vi) of this Ruling can be applied to regular payments derived by a policy owner or a reversionary life insured, as applicable, in subsequent income years to the extent that those payments, individually or in aggregate, would otherwise exceed the deductible amount in those years.

- (viii)

- Any capital gain made by a policy owner or a reversionary life insured resulting from the regular payments made by Challenger is disregarded under section 118-300 of the ITAA 1997, and is not otherwise assessable as ordinary or statutory income under the ITAA 1997.

- (ix)

- Any capital gain made by a policy owner or a reversionary life insured resulting from the payment of the withdrawal value by Challenger to them upon commutation is disregarded under section 118-300 of the ITAA 1997. The payment of the withdrawal value in these circumstances is, however, included in the assessable income of the policy owner or reversionary life insured, as applicable, to the extent that it exceeds a capital component calculated as the undeducted purchase price (as per sub-subparagraph 8(a)(iv) of this Ruling) less any deductible amounts previously applied to the regular payments from the Annuity, but not reduced to less than nil.

- (x)

- Any capital gain made by a nominated beneficiary referred to in subparagraph 4(c) or (d) of this Ruling, or the trustee of a deceased estate referred to in subparagraph 4(e) or (f) of this Ruling, as applicable, resulting from the payment of the withdrawal value by Challenger to them upon death is disregarded under section 118-300 of the ITAA 1997. The payment of the withdrawal value in these circumstances is, however, included in the assessable income of such nominated beneficiaries or deceased estates, as applicable, to the extent that it exceeds a capital component calculated as the undeducted purchase price (as per sub-subparagraph 8(a)(iv) of this Ruling) less any deductible amounts previously applied to the regular payments from the Annuity, but not reduced to less than nil.

- (b)

- Annuities purchased using a roll-over superannuation benefit (sub-subparagraphs 8(b)(i) to (iii) of this Ruling only relate to Annuities purchased by a policy owner using the whole or part of a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997).

- (i)

- An Annuity purchased by a policy owner is a 'superannuation income stream' as defined in section 307-70.02 of the ITAR (1997 Act) 2021, and therefore is not an 'annuity' as defined in subsection 27H(4).

- (ii)

- An Annuity purchased by a policy owner is not a financial arrangement to which Division 230 of the ITAA 1997 applies.

- (iii)

- Pursuant to section 301-10 of the ITAA 1997, any regular payments or payments of the withdrawal value upon commutation to a policy owner or a reversionary life insured 60 years old or over are not assessable income and are not exempt income.

- (c)

- Provided the scheme ruled on is entered into and carried out as described in this Ruling, the anti-avoidance provisions in Part IVA will not apply to the entities referred to in paragraph 4 of this Ruling.

9. This Ruling is made on the basis of the following necessary assumptions:

- (a)

- Each of the entities referred to in subparagraphs 4(a), (b), (c) and (d) of this Ruling are Australian residents for tax purposes and are not tax residents of a country with which Australia has concluded a double-tax treaty.

- (b)

- Each of the entities referred to in subparagraphs 4(e) and (f) of this Ruling are Australian-resident trust estates as defined in subsection 95(2) and are not resident trust estates of a country with which Australia has concluded a double-tax treaty.

- (c)

- A policy owner will not purchase the Annuity using a directed termination payment within the meaning of the IT(TP)A 1997; or using personal injury compensation money that is subject to Division 54 of the ITAA 1997.

- (d)

- A policy owner under 60 years old will not purchase the Annuity using a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997.

- (e)

- Each Annuity purchased with the whole or part of a roll-over superannuation benefit will be an annuity for the purposes of the Superannuation Industry (Supervision) Act 1993 (SISA) in accordance with subregulation 1.05(1) of the Superannuation Industry (Supervision) Regulations 1994 (SISR) by meeting all the standards of subregulation 1.06A(2) of the SISR, as intended (see paragraphs 21, 24 and 27 of this Ruling).

- (f)

- Each policy owner is the original policy owner who purchased the Annuity from Challenger for their own benefit.

- (g)

- No portion of the amount invested to purchase the Annuity is deductible.

- (h)

- All dealings between any of the entities referred to in paragraph 4 of this Ruling and Challenger will be at arm's length.

- (i)

- The scheme will be executed in the manner described in the Scheme section of this Ruling and the scheme documentation referred to in paragraph 10 of this Ruling.

Scheme

10. The scheme is identified and described in the following:

- •

- application for a product ruling as constituted by documents and information received on 19 March 2024

- •

- Challenger Lifetime Annuity (Liquid Lifetime) PDS dated 5 September 2022, and

- •

- draft Investor Certificate received on 19 March 2024.

Note: Certain information has been provided on a commercial-in-confidence basis and will not be disclosed or released under freedom of information legislation.

11. For the purposes of describing the scheme, there are no other agreements (whether formal or informal, and whether or not legally enforceable) which an entity referred to in paragraph 4 of this Ruling, or any associate of such entity, will be a party to which are a part of the scheme.

12. All Australian Securities and Investments Commission requirements are, or will be, complied with for the term of the agreements.

13. The Annuity is a 'life policy' for the purposes of the Life Insurance Act 1995 (as per paragraph 9(1)(c) of that Act), satisfies the definition of a 'life insurance policy' under subsection 995-1(1) of the ITAA 1997, and is offered by Challenger in Australia to individuals who do not:

- •

- live in a residential aged care facility, or

- •

- have an Aged Care Assessment Team or Service approval that specifies that they are eligible to move into a residential aged care facility.

14. An individual cannot purchase the Annuity jointly with another person. To purchase the Annuity, policy owners are required to execute and lodge the application form with Challenger, together with an initial investment amount of at least $10,000 which may or may not be funded using a roll-over superannuation benefit. No additional fees or charges are payable to Challenger by a policy owner, and no further capital can be added to the initial investment amount once the Annuity has commenced.

15. Upon acceptance of a valid application, a policy owner is issued with the Policy Document (a legal contract between a policy owner and Challenger) and an Investor Certificate by Challenger, setting out the relevant terms and conditions.

16. In exchange for the initial investment amount and subject to the payment of a withdrawal value, the Annuity provides regular payments (monthly) for the lifetime of the policy owner and, where applicable, the reversionary life insured. At the time the Annuity is purchased, a policy owner can elect that, on their death, the regular payments continue to be made to their spouse as the reversionary life insured for the duration of the reversionary life insured's life.

17. The amount of the regular payments payable by Challenger is determined at the time the Annuity is purchased and depends on a number of factors, including:

- •

- the amount of the initial investment

- •

- prevailing investment market conditions

- •

- the policy owner's life expectancy (and the life expectancy of any reversionary life insured) at the time of purchase

- •

- the time at which the regular payments commence

- •

- the withdrawal period (if any), and

- •

- the policy owner's choice to have their regular payments fixed or adjusted (in accordance with the options available under each of the Annuity variations listed at paragraph 18 of this Ruling).

18. A policy owner is able to choose from different variations of the Annuity. These variations are the:

- •

- Flexible Income (Immediate payments) option – including the Enhanced Income (Immediate payments) option

- •

- Flexible Income (Deferred payments) option – including the Enhanced Income (Deferred payments) option, and

- •

- Flexible Income (Market-linked payments) option – including the Enhanced Income (Market-linked payments) option.

19. The Flexible Income (Immediate payments) option is available for purchase using a roll-over superannuation benefit by anyone 60 years[3] or older with unrestricted access to their superannuation, or otherwise (using non-superannuation money) by anyone 18 years or older. Under this option:

- •

- The first regular payment is made one month after the Annuity starts.

- •

- The regular payments will, as selected by the policy owner, be

- -

- fixed (such that they will not change over the term of the Annuity)

- -

- adjusted fully in line with changes in the Reserve Bank of Australia (RBA) cash rate (that is, increased or decreased whenever there is a change in the RBA cash rate)

- -

- adjusted partially in line with annual movements in the Consumer Price Index (CPI) (that is, increased in line with any increase in the CPI in excess of 2% and decreased in line with any decrease in the CPI), or

- -

- adjusted fully in line with annual movements in the CPI.

- •

- The Annuity has a withdrawal period based on the policy owner's life expectancy during which time the Annuity has a withdrawal value, payable by Challenger as a lump sum if during this period the policy owner (or the reversionary life insured, as applicable) chooses to end their Annuity early (by commutation); the policy owner dies without a reversionary life insured; or both the policy owner and their reversionary life insured die.

- •

- The Annuity ceases to have a withdrawal value after the end of the withdrawal period.

- •

- The maximum withdrawal value payable by Challenger as a result of the policy owner's (or the reversionary life insured's) commutation starts at 100% of the initial investment amount and progressively reduces until it reaches zero at the end of the withdrawal period.

- •

- A partial commutation of the Annuity is not permitted.

- •

- Challenger will pay a withdrawal value (as a death benefit) equal to

- -

- 100% of the initial investment amount, for the first half of the withdrawal period (rounded down to a whole year), or

- -

- the maximum withdrawal value payable under a commutation, for the remainder of the withdrawal period.

20. There is no withdrawal value[4] under the Enhanced Income (Immediate payments) option. The Enhanced Income (Immediate payments) option is the same as the Flexible Income (Immediate payments) option in all other respects.

21. Both the Flexible Income (Immediate payments) option and the Enhanced Income (Immediate payments) option are, when purchased with the whole or part of a roll-over superannuation benefit within the meaning of section 306-10 of the ITAA 1997, designed to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR by meeting all of the standards of subregulation 1.06A(2) of the SISR.

22. The Flexible Income (Deferred payments) option is only available for purchase using a roll-over superannuation benefit by an individual 60 years[5] or older with unrestricted access to their superannuation. Under this option:

- •

- Any reversionary life insured must be 65 years or older at the time of purchase.

- •

- The regular payments commence after the latter of a period of deferral (in whole years) selected by the policy owner and the policy owner's satisfaction of a condition of release mentioned in item 101 (retirement), 102A (terminal medical condition), 103 (permanent incapacity) or 106 (attaining 65 years old) of Schedule 1 to the SISR.

- •

- The policy owner has the option to fix or adjust the regular payments on the same basis as that under the Flexible Income (Immediate payments) option (as per paragraph 19 of this Ruling).

- •

- A withdrawal value is payable on the same basis as that under the Flexible Income (Immediate payments) option (as per paragraph 19 of this Ruling).

- •

- A partial commutation of the Annuity is not permitted.

23. There is no withdrawal value[6] under the Enhanced Income (Deferred payments) option. The Enhanced Income (Deferred payments) option is the same as the Flexible Income (Deferred payments) option in all other respects.

24. Both the Flexible Income (Deferred payments) option and the Enhanced Income (Deferred payments) option are designed to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR by meeting all of the standards of subregulation 1.06A(2) of the SISR.

25. The Flexible Income (Market-linked payments) option is available for purchase using a roll-over superannuation benefit by anyone 60 years[7] or older with unrestricted access to their superannuation, or otherwise (using non-superannuation money) by anyone 18 years or older. Under this option:

- •

- The first regular payment is made one month after the Annuity starts.

- •

- The regular payments will, as selected by the policy owner, be

- -

- adjusted fully in line with annual changes in the Cash index, Conservative index, Conservative balanced index, Balanced index or Growth index[8] (that is, increased or decreased annually in line with any positive or negative movement in the index), or

- -

- adjusted partially in line with annual changes in the Cash index, Conservative index, Conservative balanced index, Balanced index or Growth index (that is, an Accelerated payment option under which the annual indexation rate is reduced by 1% to 5%).

- •

- The selected index can be switched before each anniversary of the commencement date of the Annuity (although the removal of the Accelerated payment option or a change in the indexation reduction percentage is not permitted).

- •

- A withdrawal value is payable on the same basis as that under the Flexible Income (Immediate payments) option (as per paragraph 19 of this Ruling).

- •

- A partial commutation of the Annuity is not permitted.

26. There is no withdrawal value[9] under the Enhanced Income (Market-linked payments) option. The Enhanced Income (Market-linked payments) option is the same as the Flexible Income (Market-linked payments) option in all other respects.

27. Both the Flexible Income (Market-linked payments) option and the Enhanced Income (Market-linked payments) option are, when purchased with the whole or part of a roll-over superannuation benefit within the meaning of section 306-10 of the ITAA 1997, designed to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR by meeting all of the standards of subregulation 1.06A(2) of the SISR.

28. Any withdrawal value payable by Challenger as a death benefit (under any of the variations discussed at paragraphs 19, 22 and 25 of this Ruling) will be paid to the policy owner's nominated beneficiary or beneficiaries, or to the policy owner's deceased estate, as applicable, where the policy owner dies within the withdrawal period and they have:

- •

- not elected a reversionary life insured, or

- •

- elected a reversionary life insured but the reversionary life insured has either predeceased the policy owner or ceased to be the policy owner's spouse.

29. Where the policy owner dies within the withdrawal period and the reversionary life insured in receipt of the policy owner's regular payments then also dies within the withdrawal period, Challenger will pay the withdrawal value to the nominated beneficiary or beneficiaries of the reversionary life insured, or to the deceased estate of the reversionary life insured, as applicable.

30. Anyone nominated as a beneficiary under an Annuity purchased using a roll-over superannuation benefit must be a dependant of the policy owner or reversionary life insured, as applicable.

Commissioner of Taxation

15 May 2024

Appendix – Explanation

This Appendix is provided as information to help you understand how the Commissioner's view has been reached. It does not form part of the binding public ruling.

This Appendix is provided as information to help you understand how the Commissioner's view has been reached. It does not form part of the binding public ruling.

|

| Table of Contents | Paragraph |

| Annuity not purchased using a roll-over superannuation benefit | 31 |

| Subsection 27H(4) – annuity | 32 |

| Division 16E – qualifying security | 36 |

| Superannuation income stream | 39 |

| Division 230 of the ITAA 1997 – taxation of financial arrangements | 42 |

| Section 27H – assessability of regular payments | 47 |

| Assessability of withdrawal value | 58 |

| Capital gain or capital loss from payments under the Annuity disregarded | 60 |

| Section 118-300 of the ITAA 1997 – regular payments | 62 |

| Section 118-300 of the ITAA 1997 – payment of withdrawal value | 66 |

| Annuity purchased using a roll-over superannuation benefit | 69 |

| Subsection 27H(4) – annuity | 70 |

| Superannuation income stream | 71 |

| Division 230 of the ITAA 1997 – taxation of financial arrangements | 74 |

| Division 301 of the ITAA 1997 – assessability of regular payments and withdrawal value upon commutation | 75 |

Annuity not purchased using a roll-over superannuation benefit

31. Paragraphs 32 to 68 of this Ruling apply exclusively to Annuities purchased by a policy owner without using the whole or part of a roll-over superannuation benefit.

32. Subsection 27H(4) defines an 'annuity' to mean:

... an annuity, a pension paid from a foreign superannuation fund (within the meaning of the Income Tax Assessment Act 1997) or a pension paid from a scheme mentioned in paragraph 290-5(c) of that Act, but does not include:

- (a)

- an annuity that is a qualifying security for the purposes of Division 16E; or

- (b)

- a superannuation income stream (within the meaning of the Income Tax Assessment Act 1997).

33. This definition encompasses an annuity on ordinary concepts, as contemplated within various judicial authorities and discussed in Taxation Ruling IT 2480 Income tax: variable annuities. An annuity on ordinary concepts is a contract under which a principal sum is converted into an income stream[10] of payments that are at least annual, fixed or variable in a way that is calculable, and which will continue to be paid for a fixed or determinable period.

34. A policy owner's initial investment amount is applied to purchase the regular payments payable by Challenger under the terms of the Annuity, a contract between the policy owner and Challenger. Those regular payments are a series of periodic payments (payable monthly), either fixed at the time of purchase or variable in a way that is calculable by reference to the CPI, the RBA cash rate or index movements, and (unless commuted earlier for the withdrawal value) continue for the life of the policy owner or reversionary life insured, as the case may be. The policy owner's or reversionary life insured's ability to commute does not of itself result in the Annuity failing to be accepted as an annuity contract (see paragraph 25 of IT 2480).

35. An Annuity purchased by a policy owner therefore constitutes an annuity on ordinary concepts and, subject to the exclusions in paragraphs (a) and (b) of the definition (considered at paragraphs 36 to 41 of this Ruling), constitutes an annuity as defined in subsection 27H(4).

Division 16E – qualifying security

36. A 'qualifying security' is defined in subsection 159GP(1). For the purposes of determining whether an arrangement is a qualifying security, that arrangement must be a 'security', also defined in subsection 159GP(1) to mean:

- (a)

- stock, a bond, debenture, certificate of entitlement, bill of exchange, promissory note or other security;

- (b)

- a deposit with a bank or other financial institution;

- (c)

- a secured or unsecured loan; or

- (d)

- any other contract, whether or not in writing, under which a person is liable to pay an amount or amounts, whether or not the liability is secured.

37. The Annuity is not considered to have sufficient debt-like obligations to be a contract to which paragraph (d) of the definition of security in subsection 159GP(1) applies, nor does it fall within paragraphs (a), (b) or (c) of that definition. Therefore, the Annuity does not meet the definition of security under subsection 159GP(1) and, as such, is not a qualifying security for the purposes of Division 16E.

38. Additionally, an annuity will not be a qualifying security for the purposes of subsection 159GP(1) where it is an 'ineligible annuity', a term also defined in subsection 159GP(1) to include 'an annuity that is issued by a life assurance company to or for the benefit of a natural person other than in the capacity of trustee of a trust estate'. An Annuity issued by Challenger to a policy owner or held by a reversionary life insured (that is, a natural person other than in the capacity of trustee of a trust estate) is an ineligible annuity.

39. A 'superannuation income stream' has the meaning given by the ITAR (1997 Act) 2021 (subsection 307-70(2) of the ITAA 1997). Subsection 307-70.02(1) of the ITAR (1997 Act) 2021 defines superannuation income stream in relation to an annuity commenced after 19 September 2007 to mean:

- •

- an income stream that is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR, or

- •

- a deferred superannuation income stream that is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR because the contract for the provision of the income stream meets the standards of subregulation 1.06A(2) of the SISR.

40. Subregulation 1.05(1) of the SISR provides a number of requirements that must be met for a benefit provided by a life insurance company to be taken to be an annuity for the purposes of the SISA. One of those requirements in respect of a benefit purchased on or after 1 July 2007 is that it is purchased with the whole or part of a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997, or the whole or part of a directed termination payment within the meaning of the IT(TP)A 1997.

41. As per subparagraph 9(c) of this Ruling, it is assumed for the purposes of this Ruling that a policy owner will not purchase the Annuity using a directed termination payment within the meaning of the IT(TP)A 1997. Accordingly, where the policy owner does not purchase the Annuity using the whole or part of a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997, the Annuity is not a superannuation income stream for the policy owner.

Division 230 of the ITAA 1997 – taxation of financial arrangements

42. Division 230 of the ITAA 1997 sets out the tax treatment of gains or losses from a 'financial arrangement'. Generally, a financial arrangement is a cash settlable legal or equitable right to receive a financial benefit, or obligation to provide such benefit, or a combination of one or more such rights or obligations (subsection 230-45(1) of the ITAA 1997). A right to receive or obligation to provide a financial benefit can be 'cash settlable' under subsection 230-45(2) of the ITAA 1997 if the benefit is money, or if it is a right the taxpayer intends to satisfy or settle by receiving money, or if it is an obligation that the taxpayer intends to satisfy or settle by providing money.

43. The Annuity constitutes a financial arrangement for the purposes of Division 230 of the ITAA 1997 on the basis that the entities referred to in paragraph 4 of this Ruling have cash settlable rights to receive a financial benefit in the form of the regular payments or the withdrawal value or both, as applicable, and on the basis that a policy owner has a cash settlable obligation to provide a financial benefit in the form of the initial investment amount.

44. Subject to exceptions under Subdivision 230-H of the ITAA 1997, gains made from a financial arrangement are included in assessable income under subsection 230-15(1) of the ITAA 1997 and are not (to any extent) to be included in assessable income pursuant to any other taxing provision of the income tax Acts (subsection 230-20(4) of the ITAA 1997), including section 27H.

45. However, where the rights or obligations under an arrangement are the subject of an exception under section 230-460 of the ITAA 1997, Division 230 of the ITAA 1997 does not apply in relation to gains or losses from a financial arrangement for any income year (subsection 230-460(1) of the ITAA 1997). Subsection 230-460(5) of the ITAA 1997 provides a specific exception as follows:

A right or obligation under a life insurance policy is the subject of an exception unless:

- (a)

- you are not a life insurance company that is the insurer under the policy; and

- (b)

- the policy is an annuity that is a qualifying security.

46. As the Annuity is a life insurance policy as defined in subsection 995-1(1) of the ITAA 1997 (as per paragraph 13 of this Ruling) that is not a qualifying security (as defined in subsection 159GP(1) and discussed at paragraphs 36 to 38 of this Ruling), the exception in subsection 230-460(5) applies and Division 230 of the ITAA 1997 does not apply to any gains or losses derived from an Annuity purchased by a policy owner.

Section 27H – assessability of regular payments

47. Paragraph 27H(1)(a) includes in the assessable income of a taxpayer of a year of income the amount of any annuity derived by the taxpayer during that year excluding, in the case of an annuity that has been purchased, any amount that is the deductible amount in relation to the annuity in relation to the year of income. The regular payments made by Challenger to a policy owner or to a reversionary life insured, as applicable, are therefore assessable income under subsection 27H(1) to the extent that the regular payments exceed the deductible amount in relation to the Annuity.

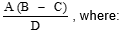

48. The deductible amount is excluded from the assessable amount of the annuity and is tax free to the recipient because it represents the return to them of the amount paid to acquire the annuity. Subsection 27H(2) provides for the calculation of the deductible amount in relation to an annuity derived by a taxpayer during a year of income, subject to subsections 27H(3) and (3A), in accordance with the following formula:

A is the relevant share in relation to the annuity in relation to the taxpayer in relation to the year of income.

B is the amount of the undeducted purchase price of the annuity.

C is:

- (a)

- if there is a residual capital value in relation to the annuity and that residual capital value is specified in the agreement by virtue of which the annuity is payable or is capable of being ascertained from the terms of that agreement at the time when the annuity is first derived – that residual capital value; or

- (b)

- in any other case – nil; and

D is the relevant number in relation to the annuity.

49. The relevant share in relation to the Annuity (component A) for a policy owner or reversionary life insured is one, in accordance with the definition of that term in subsection 27H(4).

50. The undeducted purchase price in relation to an Annuity (component B) that is purchased by a policy owner is the whole of the purchase price of the Annuity (the initial investment amount), reduced by any portion of the initial investment amount that is an allowable deduction. As per subparagraph 9(g) of this Ruling, it is assumed for the purposes of this Ruling that no portion of the initial investment amount is deductible.

51. The residual capital value in relation to an annuity is defined in subsection 27H(4) as 'the capital amount payable on the termination of the annuity'. As the terms of the Annuity do not provide for any residual capital value in relation to the Annuity, it (component C) is nil.

52. Where an annuity is payable during the lifetime of a person and not thereafter, the relevant number in relation to that annuity in relation to a year of income is defined in subsection 27H(4) to include the life expectation factor of the person. The relevant number in relation to the Annuity (component D) is therefore the life expectation factor of the policy owner, or any other life insured under the Annuity (such as the reversionary life insured) who has a greater life expectation factor.[11] The life expectation factor in relation to a person in relation to an annuity is defined in subsection 27H(4) as:

... the number of years in the complete expectation of life of the person as ascertained by reference to the prescribed Life Tables at the time at the beginning of the period to which the first payment of the annuity relates.

Note: The most recently published Australian Life Tables[12] are used.

53. Where the Commissioner considers that the deductible amount ascertained in accordance with the formula in subsection 27H(2) is inappropriate, having regard to the terms and conditions applying to the annuity and to any other relevant matters, the Commissioner may, subject to subsection 27H(3A), determine the deductible amount that applies pursuant to subsection 27H(3). In making a determination pursuant to subsection 27H(3), the Commissioner may have regard to the terms and conditions applying to the annuity, to a certificate supplied by an actuary and to any other matters considered relevant.

54. Paragraphs 16 to 24 of IT 2157 provide some guidelines as to the exercise of the discretion under subsection 27H(3). Applying those guidelines to the Annuity and having regard to other relevant matters, the Commissioner may exercise the discretion under subsection 27H(3) where the:

- •

- regular payments are not payable for the whole of an income year, in which case the deductible amount ascertained under subsection 27H(2) will be inappropriate and reduced proportionately based on the part of the year during which the regular payments are not paid, and

- •

- quantum of the regular payments may vary as a consequence of one or more of a number of specific drivers, including prevailing investment market conditions; the choice to have the regular payments subjected to movements in the RBA cash rate, CPI, Cash index, Conservative index, Conservative balanced index, Balanced index or Growth index; the nomination of a reversionary life insured under the Annuity; and any variation in the life expectancy of the policy owner (or any reversionary life insured) calculated by Challenger (based on its modelling) as compared to that set out in the prescribed Australian Life Tables.

55. The Commissioner will only alter the deductible amount pursuant to subsection 27H(3) where the deductible amount ascertained in accordance with the formula under subsection 27H(2) for a full year exceeds the minimum annual amount proposed to be paid under the annuity contract. Therefore, where the quantum of the regular payments under the Annuity is impacted by any of the drivers referred to in paragraph 54 of this Ruling and the deductible amount ascertained under subsection 27H(2) for a full year consequently exceeds the regular payments to be paid by Challenger under the Annuity to a policy owner or to a reversionary life insured, as applicable, the Commissioner will alter that deductible amount pursuant to subsection 27H(3).

56. The deductible amount excluded in accordance with subsection 27H(3) under the circumstances set out in paragraph 55 of this Ruling is to be so much of the deductible amount ascertained in accordance with the formula under subsection 27H(2) as does not exceed the annuity payment (in this case, the regular payments for the relevant year). The balance of the deductible amount ascertained in accordance with the formula under subsection 27H(2) is to be carried forward and excluded (along with the following year's deductible amount ascertained in accordance with the formula under subsection 27H(2)) from the following year's annuity payment (see paragraph 21 of IT 2157). As such, this amount will be used to reduce the portion of the regular payments assessable in the following year.

57. As the Annuity cannot be partly commuted, subsection 27H(3A) cannot have any application on the determination of the deductible amount in relation to the Annuity.

Assessability of withdrawal value

58. The receipt of the withdrawal value from Challenger by a:

- •

- policy owner or a reversionary life insured upon commutation of the Annuity, or

- •

- nominated beneficiary referred to in subparagraph 4(c) or (d) of this Ruling, or the trustee of a deceased estate referred to in subparagraph 4(e) or (f) of this Ruling, on the death of a policy owner or the death of a reversionary life insured, as applicable,

is assessable income to the extent that it does not comprise a repayment of capital. The capital component of the withdrawal value in these circumstances is the undeducted purchase price of the Annuity less any deductible amounts previously applied to the regular payments from the Annuity, but not reduced to less than nil.

59. Any amount referred to in paragraph 58 of this Ruling which is included in the assessable income of a trustee of a deceased estate shall be deemed to be income to which no beneficiary is presently entitled pursuant to subsection 101A(1).

Capital gain or capital loss from payments under the Annuity disregarded

60. Under subsection 108-5(1) of the ITAA 1997, a CGT asset is any kind of property or a legal or equitable right that is not property. The contractual rights of the entities referred to in paragraph 4 of this Ruling under the Annuity are legally-enforceable rights and therefore a CGT asset according to the definition in subsection 108-5(1) of the ITAA 1997. Generally, the discharge or satisfaction of contractual rights give rise to a CGT event C2 (paragraph 104-25(1)(b) of the ITAA 1997).

61. Section 118-300 of the ITAA 1997 exempts certain capital gains and losses made in respect of a policy of insurance on the life of an individual or an annuity instrument. An annuity instrument is defined broadly in subsection 995-1(1) of the ITAA 1997 to mean an instrument that secures the grant of an annuity (whether dependent on the life of an individual or not).

Section 118-300 of the ITAA 1997 – regular payments

62. Table item 3 of subsection 118-300(1) of the ITAA 1997 provides that a capital gain or capital loss made from a CGT event happening in relation to a CGT asset that is an interest in rights under a life insurance policy or an annuity instrument is disregarded where that CGT event happens to the original owner of the policy or instrument (other than the trustee of a complying superannuation entity).

63. As an individual to whom the Annuity is first issued, a policy owner is regarded as an original owner of an annuity instrument. Pursuant to table item 3 of subsection 118-300(1) of the ITAA 1997, any capital gain or capital loss a policy owner makes under section 104-25 of the ITAA 1997 from the receipt of regular payments by Challenger under the Annuity is therefore disregarded.

64. Table item 4 of subsection 118-300(1) of the ITAA 1997 provides that a capital gain or capital loss made from a CGT event happening in relation to a CGT asset that is an interest in rights under a life insurance policy or an annuity instrument is disregarded where that CGT event happens to an entity that acquired the interest in the policy or instrument for no consideration.

65. A reversionary life insured is an entity that acquires, on the death of a policy owner, an interest in the Annuity for no consideration. Pursuant to table item 4 of subsection 118-300(1) of the ITAA 1997, any capital gain or capital loss the reversionary life insured makes under section 104-25 of the ITAA 1997 from the receipt of regular payments by Challenger under the Annuity is therefore disregarded.

Section 118-300 of the ITAA 1997 – payment of withdrawal value

66. As a policy owner is regarded as an original owner of an annuity instrument, pursuant to table item 3 of subsection 118-300(1) of the ITAA 1997, they will disregard any capital gain or capital loss they make under section 104-25 of the ITAA 1997 from the receipt of the withdrawal value from Challenger upon commutation of the Annuity.

67. A reversionary life insured acquires, on the death of a policy owner, an interest in the Annuity for no consideration and will therefore, pursuant to table item 4 of subsection 118-300(1) of the ITAA 1997, disregard any capital gain or capital loss they make under section 104-25 of the ITAA 1997 from the receipt of the withdrawal value from Challenger upon commutation of the Annuity.

68. A nominated beneficiary referred to in subparagraph 4(c) or (d) of this Ruling or the trustee of a deceased estate referred to in subparagraph 4(e) or (f) of this Ruling acquires, on the death of a policy owner, or the death of a reversionary life insured, as applicable, an interest in the Annuity for no consideration and will therefore, pursuant to table item 4 of subsection 118-300(1) of the ITAA 1997, disregard any capital gain or capital loss they make under section 104-25 of the ITAA 1997 from the receipt of the withdrawal value from Challenger upon the relevant death.

Annuity purchased using a roll-over superannuation benefit

69. Paragraphs 70 to 78 of this Ruling apply exclusively to Annuities purchased by a policy owner using the whole or part of a roll-over superannuation benefit.

70. As per paragraphs 32 and 33 of this Ruling, subsection 27H(4) defines an annuity to encompass an annuity on ordinary concepts, subject to it not being either a qualifying security for the purposes of Division 16E or a superannuation income stream within the meaning of the ITAA 1997.

71. As per paragraph 39 of this Ruling, a superannuation income stream is defined for the purposes of the ITAA 1997 in subsection 307-70.02(1) of the ITAR (1997 Act) 2021 to mean, in relation to an annuity commenced after 19 September 2007, either:

- •

- an income stream that is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR, or

- •

- a deferred superannuation income stream that is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR because the contract for the provision of the income stream meets the standards of subregulation 1.06A(2) of the SISR.

72. Of the requirements that must be met for a benefit provided by a life insurance company to be taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR, the relevant ones in respect of the Annuity are that:

- •

- it arises under a contract that meets the standards of subregulation 1.06A(2) of the SISR and does not permit the capital supporting the annuity to be added to by way of contribution or rollover after the annuity has commenced, and

- •

- where it is purchased on or after 1 July 2007, it is done so with the whole or part of a roll-over superannuation benefit as defined in section 306-10 of the ITAA 1997.

73. As each Annuity purchased with the whole or part of a roll-over superannuation benefit is assumed (at subparagraph 9(e) of this Ruling) to be an annuity that meets the standards of subregulation 1.06A(2) of the SISR, and a policy owner is unable to add to the initial investment amount once it has commenced, such Annuities will be annuities for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR, and therefore constitute a superannuation income stream as defined in subsection 307-70.02(1) of the ITAR (1997 Act) 2021. As a superannuation income stream, each Annuity will not be an annuity as defined in subsection 27H(4).

Division 230 of the ITAA 1997 – taxation of financial arrangements

74. Division 230 of the ITAA 1997 does not apply to any gains or losses derived from an Annuity purchased by a policy owner using the whole or part of a roll-over superannuation benefit for the same reasons it does not apply to any gains or losses derived from an Annuity purchased by a policy owner without using the whole or part of a roll-over superannuation benefit, as set out at paragraphs 42 to 46 of this Ruling.

Division 301 of the ITAA 1997 – assessability of regular payments and withdrawal value upon commutation

75. A 'superannuation benefit' is defined in subsection 307-5(1) of the ITAA 1997 to include a payment to an annuitant either from a superannuation annuity or arising from the commutation of a superannuation annuity, because they are the annuitant.

76. A 'superannuation annuity' is defined for the purposes of the ITAA 1997 in section 995-1.05 of the ITAR (1997 Act) 2021 to mean, in relation to an annuity commenced after 19 September 2007, either:

- •

- an income stream that is issued by a life insurance company or registered organisation and is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR, or

- •

- a deferred superannuation income stream that is taken to be an annuity for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR because the contract for the provision of the income stream meets the standards of subregulation 1.06A(2) of the SISR.

77. As each Annuity purchased with the whole or part of a roll-over superannuation benefit is assumed (at subparagraph 9(e) of this Ruling) to be an annuity that meets the standards of subregulation 1.06A(2) of the SISR, and a policy owner is unable to add to the initial investment amount once it has commenced, such Annuities will be annuities for the purposes of the SISA in accordance with subregulation 1.05(1) of the SISR and therefore constitute a superannuation annuity as defined in section 995-1.05 of the ITAR (1997 Act) 2021. Regular payments and the payment of a withdrawal value from Challenger to a policy owner or a reversionary life insured upon commutation of the Annuity will constitute a superannuation benefit as defined in subsection 307-5(1) of the ITAA 1997.

78. Section 301-10 of the ITAA 1997 provides that a superannuation benefit received by an individual 60 years or over is not assessable income and is not exempt income. It follows that regular payments and the payment of a withdrawal value upon commutation of the Annuity to a policy owner or a reversionary life insured, as applicable, will not be assessable income or exempt income where they are 60 years or over at the time of receipt of such payments.

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Footnotes

There are limited circumstances where a policy owner under 60 years old may be eligible to purchase an Annuity using a roll-over superannuation benefit.

For the purposes of this Ruling, it is assumed at subparagraph 9(g) of this Ruling that no portion of the amount invested to purchase the Annuity is deductible.

Subject to certain limited circumstances entitling such purchase at a younger age.

Except when exercising a cooling-off right.

Subject to certain limited circumstances entitling such purchase at a younger age.

Except when exercising a cooling-off right.

Subject to certain limited circumstances entitling such purchase at a younger age.

Each of these indexes are described in the PDS.

Except when exercising a cooling-off right.

The term 'income stream' is defined at paragraph 5 of Taxation Ruling TR 2013/5 Income tax: when a superannuation income stream commences and ceases in the context of a superannuation income stream payable by a superannuation fund trustee to a member as '... a series of periodic payments that relate to each other over an identifiable period of time'.

Where an annuity provides for a residuary life annuitant, the relevant number for the purposes of the formula in subsection 27H(2) is the life expectation factor of whichever annuitant (that is, the original or residuary annuitant) has the longer life expectancy (see paragraph 27 of Taxation Ruling IT 2157 Income tax: assessment of annuities eligible termination payments - commutation of annuities - Commonwealth Superannuation Act). This represents the period for which the annuity may reasonably be expected to be payable.

For the purposes of the definition of 'life expectation factor' in subsection 27H(4) and with respect to annuities first commencing to be payable on or after 1 July 1993, section 7 of the Income Tax Assessment (1936 Act) Regulation 2015 prescribes the Australian Life Tables that are most recently published before the year in which the annuity first commences to be payable.

References

ATO references:

NO 1-11G23VGL

Related Rulings/Determinations:

IT 2157

IT 2480

TR 2013/5

Legislative References:

ITAA 1936 27H

ITAA 1936 27H(1)

ITAA 1936 27H(1)(a)

ITAA 1936 27H(2)

ITAA 1936 27H(3)

ITAA 1936 27H(3A)

ITAA 1936 27H(4)

ITAA 1936 95(2)

ITAA 1936 101A(1)

ITAA 1936 Div 16E

ITAA 1936 159GP(1)

ITAA 1936 Pt IVA

ITAA 1997 Div 54

ITAA 1997 104-25

ITAA 1997 104-25(1)(b)

ITAA 1997 108-5(1)

ITAA 1997 118-300

ITAA 1997 118-300(1)

ITAA 1997 Div 230

ITAA 1997 230-15(1)

ITAA 1997 230-20(4)

ITAA 1997 230-45(1)

ITAA 1997 230-45(2)

ITAA 1997 Subdiv 230-H

ITAA 1997 230-460

ITAA 1997 230-460(1)

ITAA 1997 230-460(5)

ITAA 1997 Div 301

ITAA 1997 301-10

ITAA 1997 306-10

ITAA 1997 307-5(1)

ITAA 1997 307-70(2)

ITAA 1997 995-1(1)

ITA(1997)R 2021 307-70.02

ITA(1997)R 2021 307-70.02(1)

ITA(1997)R 2021 995-1.05

ITA(1936)R 2015 7

IT(TP)A 1997

SISA 1993

SISR 1994 1.05(1)

SISR 1994 1.06A(2)

SISR 1994 Sch 1

Life Insurance Act 1995 9(1)(c)